Dubai CSP suppliers tested on durability for longest-ever PPA

Suppliers to ACWA Power's 950 MW Noor Energy 1 plant are using enhanced strength and design features to ensure reliability throughout the 35-year power purchase agreement (PPA), the companies told New Energy Update.

Related Articles

A flurry of recent supply contracts for ACWA Power's 950 MW Noor Energy 1 CSP-PV plant in Dubai signals accelerating activity on the world's largest CSP construction project.

The $4.4 billion Noor Energy 1 project includes three 200 MW parabolic trough systems supplied by Spain’s Abengoa, a 100 MW central tower plant which uses BrightSource control systems, a CMI molten salt receiver and Rioglass heliostats, and 250 MW of PV capacity.

China's Shanghai Electric Corporation (SEC) is the lead EPC Contractor for the project, which will host 15 hours of molten salt CSP storage capacity and be brought online in phases in 2020-2022.

Last month, Spain's Lointek signed a contract to supply the integrated steam generation system and oil salt thermal storage system for the 700 MW CSP plant section. Lointek will engineer, manufacture, install and commission the power island under a turnkey contract.

In January, Germany's Siemens announced it would supply four steam turbine generators and auxiliary equipment for the parabolic trough and tower plants.

Denmark's Aalborg CSP has also signed a contract to supply its header-and-coil steam generation technology for the 600 MW parabolic trough section.

The Dubai Electricity and Water Authority (DEWA) awarded the Noor Energy 1 project at a record low tariff of $73/MWh.

Economies of scale, an optimized combination of technology and a record long 35-year power purchase agreement (PPA) helped lower project costs, project partners said.

The 35-year PPA is over 10 years longer than typical arrangements, spreading the initial investment across a longer period and reducing the annual cost of capital.

To meet the longer contracted term, SEC has placed extra demands on suppliers to demonstrate technology durability, the companies told New Energy Update.

Longer lifespan

Until the Noor Energy 1 deal, the average length of PPAs for active CSP projects was 23.8 years, with the longest reported at 25 years, according to New Energy Update's Global CSP Tracker.

Suppliers to Noor Energy 1 had to demonstrate long-term durability levels conform with Shanghai Electric's project reliability and insurance requirements.

“To support the lifetime of 35 years, all suppliers had to confirm and calculate fatigue requirements,” Svante Bundgaard, CEO of Aalborg CSP, told New Energy Update.

Abengoa will incorporate recent structural enhancements on its parabolic trough technology to ensure long-term durability, Ana Cristina Gonzalez de Una, Director of business development, Energy at Abengoa, said. Abengoa will supply technology similar to the recently-commissioned 100 MW Xina project in South Africa and 50 MW CSP element of the Waad Al Shamal ISCC plant in Saudi Arabia.

“The most evident enhancement is an increase in the thickness of the galvanised steel structure of the collector,” Gonzalez de Una said.

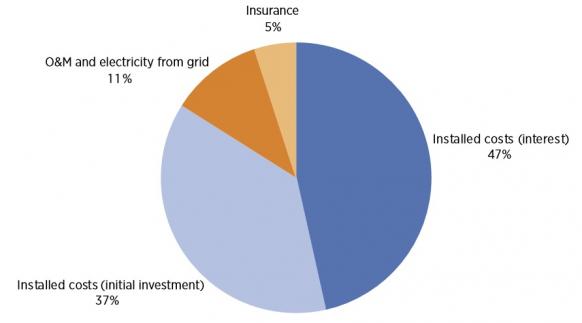

Levelized cost of parabolic trough plants

(Click image to enlarge)

Source: International Renewable Energy Agency's ‘Power to Change’ report (2016).

The output profile of CSP plants requires generation system components to accommodate frequent system starts and stops.

"Given the nature of CSP operations, it is essential that the steam turbines used in these plants be highly efficient and offer rapid start-up times," Siemens said in a statement in January.

Aalborg's header-and-coil steam generation system meets the long-term reliability requirements as it absorbs thermal dynamic stress, avoiding leaks and reducing downtimes, Bundgaard said.

The 100% welded coil design is based on steam boiler technology already proven in conventional power plants, he said.

Showcase project

SEC is one of China's top five power generators and has a total installed capacity of over 107 GW, including 5 GW of solar power and 10 GW of wind.

The Noor Energy 1 project is SEC's first CSP project outside of China. Back in 2014, Shanghai Electric and BrightSource formed a joint venture (JV) for the construction of utility-scale CSP plants in China and the partners have worked together to optimize the design and installation of the plant.

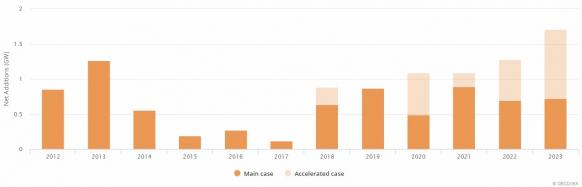

China is forecast to install 1.9 GW of new CSP plants by 2023, almost half of new global capacity, the International Energy Agency (IEA) said in a report in October.

Forecast global CSP installations

(Click image to enlarge)

Source: International Energy Agency (IEA), October 2018.

SEC has imposed a collaborative approach to cost optimisation for Noor Energy 1, suppliers told New Energy Update.

“SEC has worked very hard to reduce cost by optimization with key suppliers asking for inputs and ideas,” Bundgaard said.

“This open and cooperative approach has secured them many cost reductions both in terms of direct capex, efficiencies and installation schedule," he said.

“SEC is a massive group with vast experience in power plants and manufacturing which brings value to the project and to the cooperation between the two companies," Gonzalez de Una said.

Supplier magnet

The 700MW CSP capacity of the project is almost double the capacity of the 392 MW Ivanpah plant in California, the world’s largest CSP plant currently in operation.

Project partners are using economies of scale and low-cost Chinese manufacturing learnings to drive down costs.

“The large scale of the project helps to reduce component prices because there are more suppliers interested in entering the industry," Gonzalez de Una said.

The large project also presents opportunities for innovative manufacturing and automation processes, she said.

Site logistics is one of the greatest challenges for suppliers, Gonzalez de Una said. The company estimates more than 30 containers per day will arrive at the site, requiring optimized planning of storage, transportation and port facilities.

“Everything needs to be perfectly synchronized,” she said.

Logistics challenges have been heightened by an accelerated construction schedule.

Under a revised plan, the first parabolic trough plant and the central tower unit are scheduled to be completed before the Expo 2020 Dubai takes place in October 2020, six months earlier than the previously-announced target.

By Kerry Chamberlain