Pan-European contract template unlocks financing for solar, wind

A new standard European power contract will bring proven credit risk measures to corporate power purchase agreements (PPAs), accelerating growth in multi-offtaker projects and spurring PPA activity across Europe, Jan Haizmann, Chair of the European Federation of Energy Traders (EFET) Legal Committee, told New Energy Update.

Related Articles

Last month, the European Federation of Energy Traders (EFET) launched a new standard corporate power purchase agreement (CPPA) aimed at reducing transaction costs and accelerating contract negotiations for power projects.

The new Europe-wide contract comes amid growing demand for renewable energy from the corporate sector, driven by falling solar and wind costs and rising carbon-reduction targets.

Launched in cooperation with the RE-Source renewable energy platform, the CPPA supports the EU's Renewable Energy Directive (RED II) to remove barriers to renewable energy projects. Agreed by EU member states in June 2018, RED II includes commitments to simplify permitting and support corporate renewable energy sourcing.

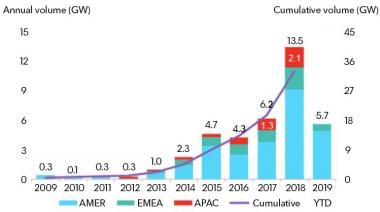

Corporate renewable PPA deals in Europe Middle East and Africa (EMEA) doubled to 2.3 GW in 2018, BloombergNEF data shows, but activity continues to lag behind the U.S. market and is not spread evenly across Europe.

Global corporate renewable PPA volumes

(Click image to enlarge)

Source: BNEF, June 2019.

The new standard contract includes flexible terms that can be used by offtakers of any size or risk profile, unlocking financing for a wider range of companies and markets, Haizmann told New Energy Update.

The CPPA brings standard EFET credit clauses to the PPA market, providing proven methods to mitigate counterparty risk, Haizmann said.

"The EFET credit clauses have been tested multiple times and this strong track record should create trust in the PPA market”, he said.

Banking support

The CPPA provides a level playing field for buyers and sellers and is the result of three years of consultation between power industry groups and financial institutions.

The contract can be used for physical or financial PPAs and uses a "proven Election Sheet approach" which allows the terms to be tailored to counterparty needs, EFET said in a statement.

The contract includes terms on Credit Support, Termination, Force Majeure, Construction Delays and Capacity Shortfalls and this should "reduce complexity around transactions and increase the likelihood of banks financing deals," Chris Hewett, Chief Executive of the UK's Solar Trade Association, told New Energy Update.

Contract termination is a key risk area for counterparties and clauses in the contract allow for early termination if credit conditions deteriorate.

These clauses can be adjusted to the size of the counterparty and the type of risk, Haizmann said.

“Banks seek in particular adequate protection of their interests in termination scenarios. This general acceptance by the institutions involved should shorten negotiations with them," he said.

Other industry initiatives are underway to support growth in solar and wind PPAs.

Energy advisory and certification group DNV GL recently launched a new web-based platform to streamline procurement of renewable PPAs.

The platform screens and benchmarks projects based on DNV GL’s scoring methodology and provides best practices, guidelines and standardized contracts to share lessons learned.

Market spread

In February, solar investment group WElink signed a 708 MW solar PPA in Iberia with power supplier Audax Renovables, the largest ever private solar PPA signed in Europe.

The 20-year contract will source energy from WElink's 219 MW Solara4 and 46 MW Ourika plants in Portugal, and other new projects to be developed by the group in Spain and Portugal.

To minimize credit and counterparty risks, corporates need to work with the same contracts in multiple jurisdictions, whether they are buyers or sellers, Haizmann said.

“Of essential importance in this context are clauses on force majeure, change of law and termination because of non-delivery or insolvency”, he said.

Markets with higher PPA market liquidity, such as the UK, Italy, Spain and the Nordic countries, will benefit the most from the standard CPPA contract, Haizmann said.

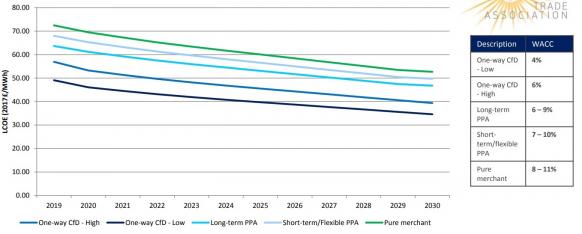

Estimated cost of capital for UK solar by contract type

(Click image to enlarge)

Source: UK Solar Trade Association, December 2018.

Until recently, European renewable PPA activity has mainly been concentrated in northern Europe. However, growing demand and improvements to regulatory frameworks in France, Germany and Spain should see PPA activity spread across Western Europe.

Last week, Wood Mackenzie Power & Renewables raised its Europe PV installation outlook, forecasting annual installations at around 20 GW for the next three years, rising to 25 GW by 2022.

Germany will remain Europe’s largest PV market, installing 21 GW between 2019 and 2024. Spain will come a close second, with almost 20 GW of mostly utility-scale capacity expected," Wood Mackenzie said.

The CPPA also increases the prospects of cross-border PPAs, Hewett said.

Club contracts

The CPPA can also accommodate increasingly-complex PPA structures being used in the solar and wind sectors, such as multi-offtaker arrangements and layered structures with multiple contract durations, Haizmann said.

Growing demand from smaller corporate offtakers has spurred multi-layered PPA structures and new risk aggregator models, experts told the PV Operations Europe 2019 conference in February.

Tech giants have spearheaded growth and innovation in renewable PPAs, helping to attract industrial players and smaller, higher-risk offtakers.

In one example, Microsoft's 315 MW solar PPA for SPower’s 500 MW Pleinmont project in the US allowed the developer to sell power to other counterparties at a “lower rate," Brian Janous, Microsoft's General Manager of Energy, told New Energy Update in 2018.

The CPPA could support growth in ‘mini-utility’ and ‘club’ PPAs which are well-suited to the UK market, Hewett said.

"To make the economics stack-up for post-subsidy solar parks in the UK, we’ve seen the average project size increase considerably... [Small and medium-sized enterprises] that group together could share risk and increase their bargaining power," he said.

Going forward, experts predict greater PPA flexibility and new aggregator roles will widen the market to partial merchant models and higher risk offtakers.

"There is money out there that is also willing to work on a PPA basis with companies that are not investment-grade," Ulrika Wising, Head of Solar and Storage at Macquarie Group investment bank, told the conference in February.

Demand from these companies will see the emergence of new market players which aggregate these deals and manage risk on a portfolio basis, Patrick Hinze, Senior Project Manager at Munich RE insurance group, told attendees.

"Maybe even combined with some portfolio hedging solutions...I think we will see new players there," he said.

By Neil Ford