Solar O&M firms seek energy storage, warehouse gains in hunt for value

Solar asset management specialists are investing in analytics, centralized spare parts warehousing and integrated energy storage to boost long-term plant efficiency, leading executives told the PV O&M USA conference on November 2.

Related Articles

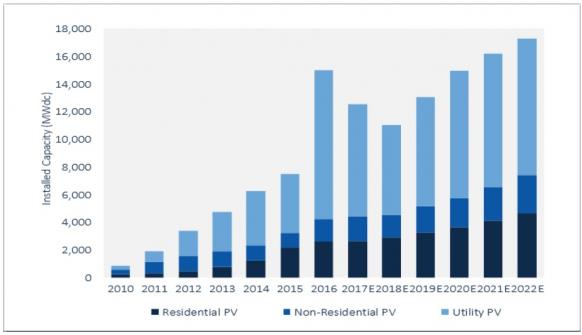

Rapid growth and intense competition in the U.S. utility scale PV sector have sliced costs and raised the importance of operations and maintenance (O&M) efficiency.

After soaring growth in 2016, policy shifts are expected to dent growth in the coming years, but industry participants still expect significant opportunities across all market segments.

Falling costs have seen solar spread into an increasing number of states and this brings fresh challenges for service providers.

Service providers will need to deliver more effective service at lower cost to a wider range of project geographies, technologies and regulatory environments, Laura Stern, President of Nautilus Solar, told the PV O&M USA conference on November 2.

"We used to be concentrated in a handful of states and it was easier to get a handle on the local technicians in that area, the regulatory environment," Stern said.

Service contracts will need to take into account the availability of local technicians and number of project stakeholders, as well as project size and finance structure, she said.

O&M providers must also respond to the demands of ageing PV fleets and provide more efficient services, post-warranty strategies and better contractual solutions for underperforming assets, Stern said.

Service providers will be increasingly required to align contract conditions with project economics to ensure maximum value, she said.

"Aligning service requirements to project economics has never been more important."

US solar growth forecast by market segment

(Click image to enlarge)

Source: GTM Research, September 2017.

Analytics ahead

Solar asset managers will be required to drive down costs through increased reliance on remote fault diagnosis and automation.

Stern predicts increasing investment in automation and equipment to "in-source additional scope," such as vegetation control, module cleaning and drone operations.

Service providers will need to ensure labor forces are appropriately sized and combined with advancing predictive maintenance capabilities to meet the cost expectations of owners, Larry Freeman, Business Development Manager at EDF Renewable Services, told the conference.

"We can leverage some of this big data to really look at the analytics...that's going to be a key trend that's going to drive this in the next few years," Freeman said.

EDF is planning to integrate its business processes to optimize its global analytics and machine learning capabilities, Freeman said. Growing datasets must be accompanied by actionable insights, he said.

"We firmly believe in the power of scale...EDF is working on that, at a global scale, to help integrate all these processes and help us be efficient," he said.

Standardization

A lack of public data on failure rates and systemic issues continues to inhibit the development of best practices for solar O&M, Stern told the conference.

"We don't get the benefit of building up a body of knowledge on how to address a lot of these issues...As a result there's a lot of starting from scratch," she said.

Inconsistencies in work scope descriptions are also curbing potential efficiency gains, Stern said.

For example, the implementation of 24-hour security might imply a locked facility, security camera monitoring, or guard attendance, she said.

In a bid to boost operational efficiency, EDF is shifting towards a more standardized approach to its O&M work practices, Freeman told the U.S. conference.

"We need to re-standardize the metrics and the processes," he said.

In Europe, the solar industry has worked together to build an industry-standard PV operations and maintenance contract and best practice guidelines. Standardized contracts should help cut primary and secondary market costs and lower barriers to entry, Vassilis Papaeconomou, Managing Director of Alectris and Chair of SolarPower Europe's Best Practices Task Force, told the PV Asset Management and O&M Europe 2017 conference in June.

A survey by Solarpowereurope found that 70% of industry participants said there was ‘significant’ or ‘much’ improvement needed in the quality of solar plant operations, in particular the monitoring of equipment and analytics, Papaeconomou said.

Supply chain consolidation

Increasing fleet sizes for owners and service operators are creating new opportunities for greater efficiency.

EDF is seeking more centralized spare parts distribution to optimize fleet-wide costs and allow it to provide owners with a more "holistic" performance guarantee, Freeman said.

"We are now considering moving all of our parts into one centralized location so we can share those, control those and capture the efficiencies there," he said.

By taking on certain supply chain risks, the service provider could enter into more "full wrap" O&M contracts and gain more control over performance and engineering, Freeman said.

This strategy is informed by EDF's experience in the wind sector, where plants involve a large number of moving parts and performance levels depend on fast spare parts access.

"We found that when [the parts] are out there, we can keep those, manage them and ship them far cheaply than we could pay someone elso to do it," Freeman said.

Solar plus storage

Service providers will also need to respond to continuing growth in energy storage deployment.

While the business models for PV plus solar are currently very site-specific, costs are falling fast and rising solar penetration will drive more widespread deployment in the coming years.

By 2020, the business case for PV coupled with energy storage in California could be more favorable than stand-alone PV, the U.S. National Renewable Energy Laboratory (NREL) said in a recent report.

To prepare for growth in energy storage, EDF is studying more holistic energy management services to best integrate the different parties involved in solar storage, including storage providers, EPC companies, and inverter suppliers, Freeman said.

"We are going to have to broaden our horizons…Is it going to be some of the battery companies which move out into the O&M world or is it going to be vice versa?...There's a lot of moving pieces there," he said.

New Energy Update