Solar O&M groups expand storage operations in quest for growth

Operations and maintenance (O&M) contracts are evolving to include the complex market requirements of the growing solar plus storage market, experts told New Energy Update.

Related Articles

As market competition pressures the margins of solar plants, O&M providers are expanding energy storage capabilities.

In Europe and the U.S., falling storage costs and rising solar renewable energy penetration are improving the economics of solar plus storage.

A recent request for proposals (RFP) by Colorado's Xcel Energy recently yielded 87 bids for 59 solar plus storage projects at a record-low median bid price of $36/MWh, competitive with many fossil-fuel power plants.

Following rapid drops in battery prices, developers predict lower balance of system costs and engineering improvements will create new storage coupling opportunities. Solar plus storage projects currently represent more than 40% of the global pipeline for grid-scale energy storage, IHS Markit said in a report published in April.

O&M contracts are evolving to reflect the additional skills required for solar plus storage projects, industry experts told New Energy Update.

“Initially, solar plus storage O&M will likely be split into separate solar and storage contracts, as the assets likely belongs to different SPVs [special purpose vehicles],” Carlos Javier Sarasa Maestro,

Technical director at New Energy Capital, a solar investment and asset management company, said.

The O&M parameters will depend on market applications, Sarasa Maestro said.

“For time-shifting (services), they will look similar to solar while for fast frequency response they will be aligned to the life-cycle of batteries," he said.

As more solar O&M providers expand into the storage space, service contracts may be incorporated into a single solar plus storage arrangement.

For example, British Solar Renewables (BSR) has been developing storage maintenance capabilities. Last year, BSR EPC built a 50 MW/50MWh storage facility in Hertfordshire, UK and the company recently completed 18 months of energy storage operations at a facility in Somerset.

Going forward it will be "easier to wrap all services under one single contract,” Matthew Harnack, director, BSR O&M, told New Energy Update.

Revenue streams

For solar plus storage plants, O&M providers must understand complex technologies and market applications and work with a wide range of companies.

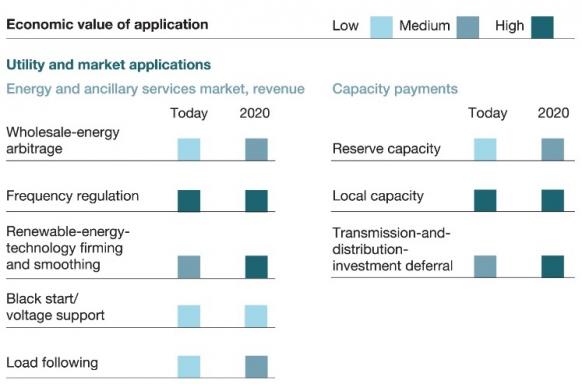

Economic outlook for utility-scale storage applications

(Click image to enlarge)

Source: McKinsey&Company, July 2017.

O&M companies need to collaborate with owners and aggregators of demand-side response services to clarify responsibilities over performance monitoring, Harnack said.

Aggregators may not have the expertise to monitor all the metrics that might identify performance issues, such as temperature, current and voltage, and respond to these remotely, he said.

Solar peak shifting and frequency response contracts are two key market applications for solar plus storage plants. In U.S. and Europe, grid operators are developing new regulatory frameworks to accommodate rising use of storage and demand management technology.

In Europe, merchant solar plant owners may be overvaluing equity returns and owners should consider storage coupling to boost economics, Pietro Radoia, Solar Analyst at BNEF, told the PV Operations Europe 2018 conference in February.

At higher price assumptions, investors have forecast an internal rate of return (IRR) for UK merchant solar projects of 14% in 2025, while BNEF estimates equity IRR UK at around 2 to 3%, Radoia said.

"Investors can reach 12% IRR in the UK if they combine merchant projects with a battery which provides frequency regulation services today," he said.

Last September, solar developer Anesco launched the U.K.'s first subsidy-free solar-plus-storage facility. The 10 MW Clayhill plant in southern England uses solar panels and five battery storage units supplied by China's BYD. Huawei supplied 1,500 Volt inverters, the first deployment of these in Europe.

Future proofing

Operators will be looking to transfer solar O&M learnings into storage maintenance plans. Solar companies are continuing to invest in data analytics and spare parts optimization in a bid to optimize production. Preventative maintenance, along with an increased focus on plant availability and revenue, is increasing the efficiency of O&M contracts.

Solar operators and service providers must become more market-focused by optimizing electricity market arrangements while continuing to improve O&M efficiency, Renaud Chevallaz-Perrier, Director of Operations at RES France, said in February.

Spare parts and local labor strategies can have a significant impact on costs and operators must prepare for the wider deployment of energy storage, Chevallaz-Perrier said.

"We have to be creative with new technology like storage, how we can mix that with the PV," he said.

By Beatrice Bedeschi