South Africa urged to plug gap in renewables build to retain industry

South Africa's new draft power generation plan revitalizes wind and solar development but a gap until the first installations in 2025 could dent cost-cutting industrial growth, sector experts told New Energy Update.

Related Articles

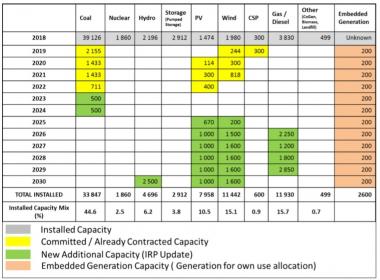

South Africa published August 28 its draft 2018 Integrated Resource Plan (IRP), calling for 8.1 GW of new wind capacity and 5.7 GW of new PV solar between 2025 and 2030.

Under the plan, which is open for public commentary for 60 days, wind and solar capacity would rise to 15.1% and 10.5% respectively by 2030, while the share of coal-fired capacity would plummet from over 80% to 44.6%. The IRP allocates 670 MW of PV and 200 MW of new wind capacity in 2025, rising to 1 GW of PV and 1.6 GW of wind per year from 2026 onwards.

Wind and solar companies broadly welcome the long-term objectives of the plan but warn the proposed gap between committed projects expected online by 2022 and the IRP’s planned buildout from 2025 could damage the renewables industry.

“With such a gap in procurement there could be a disinvestment in local manufacturing, local services and associated losses of the very jobs that the government is trying to create,” Kilian Hagemann, Managing Director at wind power developer G7 Renewable Energies, said.

Less investment in local manufacturing would mean fewer options for developers to meet local content requirements, potentially raising project costs.

South Africa's draft generation build plan (IRP)

Source: South African government's draft Integrated Resource Plan (August 2018).

Developers have already suffered delays following earlier renewable energy bidding rounds. In April, the government approved 27 power projects initially procured two years ago for a combined capacity of 2.3 GW.

“Spreading out the annual procurement of solar and wind over several years helps create a consistent annual demand for local industry to plan, but it should start sooner than 2025,” Chris Ahlfeldt, energy specialist at consulting firm Blue Horizon, said.

The energy ministry’s plans for the next renewable bid windows indicate that the new buildout dates maybe earlier than set out in the draft plan. The government plans to launch the next bidding window in November, energy minister Jeff Radebe said in June.

Chris Clarke, investment manager at Inspired Evolution, estimates the government will procure around 1.8 GW of PV, wind and gas projects in the next bid window.

“It is a bit of a mystery what is going to happen but our sense is that they will probably bring forward some of the allocations,” he said.

Coal blocks

The draft IRP plan proposes 1 GW of new coal-fired coal capacity in 2023-2024, on top of the 5.7 GW of committed new coal-fired capacity expected online in 2019-2022.

The construction of new coal-fired plants is not required under a least cost scenario and shows South Africa lacks ambition in meeting its Paris climate agreement to decarbonize electricity generation by 2050, Ahlfeldt said.

A recent study by the Energy Research Centre at the University of Cape Town said South Africa should shift funds spent on coal subsidies for state power company Eskom towards support for diversifying coal-centric communities.

The South African government's capacity to continue to prop up Eskom is limited, the study warned.

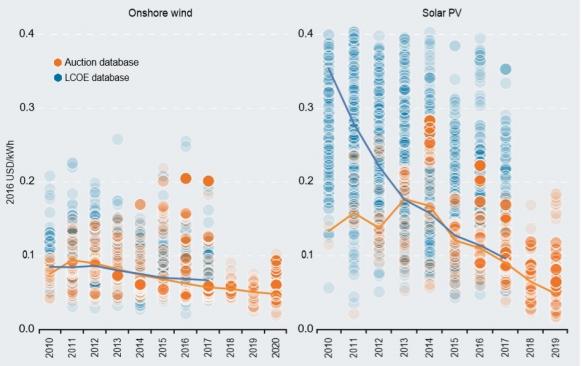

Global solar and wind prices have fallen dramatically since the last IRP was created in 2011 and replacement of coal plants with renewables could significantly boost South African industry amid a struggling economy.

The South Africa Reserve Bank (SARB) recently lowered its 2018 national growth forecast from 1.2% to 0.7% and forecasts growth of 1.9% and 2.0% in 2019 and 2020.

Forecast global wind, solar costs in 2020

(Click image to enlarge)

Source: IRENA's "Renewable power generation costs in 2017" report.

Low economic growth, improved energy efficiency and fuel switching to liquefied petroleum gas (LPG) for cooking and heating, has meant electricity demand is relatively unchanged since 2007, the latest IRP noted.

“It is a bit of a fine balance...if consumption continues to reduce it doesn't make sense to add new generation capacity in the grid," Theuns Elhers, head of project finance at ABSA Capital, said.

"But (investment in renewables) could also be used by the government as a good tool to attract investment to start stimulating growth again,” he said.

Flexible limits

The draft IRP establishes annual build limits for solar PV and wind through 2030.

Industry participants want some flexibility in these limits to accommodate future cost trends.

“It is probably better to have more flexibility to choose the appropriate mix," Elhers said.

"The cost of solar PV is reducing at a faster pace compared to wind energy, so it would make economic sense to have more PV compared to wind,” he said.

By Anna Flavia Rochas