AI turbine wake controls cut output losses by up to 10%

Sites with low wind velocity, changeable wind direction and high temperatures could see the greatest revenue gains from machine-learning turbine controls, Jim Kiles, CEO of wind AI supplier Vayu, told New Energy Update.

Related Articles

As wind power margins fall and assets become increasingly exposed to wholesale power markets, advanced wake control strategies could give operators a competitive edge.

Last month, technology group Emerson and data optimization specialist Vayu launched a commercial wind turbine control solution to reduce wake losses and boost revenues.

The joint project combines Emerson’s Ovation distributed control system with Vayu’s cloud-based machine learning analytics to provide reactive turbine yaw control.

Coordinated yaw adjustments on upstream turbines allow operators to steer low-energy wind away from downstream units, increasing overall output. The Emerson controller system is able to communicate data between the turbine sensors and the analytics system every one to two seconds, allowing turbines to respond to changing site conditions.

Vayu already has data optimization contracts in place at six commercial wind farms. The new control solution can be applied to any wind turbine type and could increase output by as much as 10% at some sites, Kiles told New Energy Update.

Wind farms with turbines in close proximity would benefit the most from this technology and these represent “about two thirds of wind farms in the U.S. and Canada," Kiles said.

Research base

A number of public-private initiatives have tested the impact of wake control on wind farm revenues.

In 2017-2018, the National Renewable Energy Laboratory (NREL), power group NextEra and Ystrategies, a minority shareholder in Vayu, tested yaw control strategies using NREL-developed modeling and optimization software.

Field tests allowed the researchers to test and validate its simulations under a wide variety of environmental conditions seen at a wind farm site over the course of a year.

Other research projects include the Department of Energy's Atmosphere to Electrons (A2e) program, which analyzed plant dynamics and turbine optimization in the context of surrounding weather activity.

NREL also led an international effort with Delft University in the Netherlands to develop an open source software that models wind wakes and wind speed deficits according to yaw settings. The ‘Flow Redirection and Induction in Steady State’ (FLORIS) program can be used in conjunction with control solutions to maximize total output of wind farms.

For many of the current wind farm layouts, wake control strategies could boost output by around 2 to 3%, Paul Veers, Chief Engineer at NREL’s National Wind Technology Center (NWTC), told New Energy Update. Less favorable layouts could see greater gains.

“Full plant control is in its infancy – very few commercial plants now use it, but it is of high interest throughout the industry,” he said.

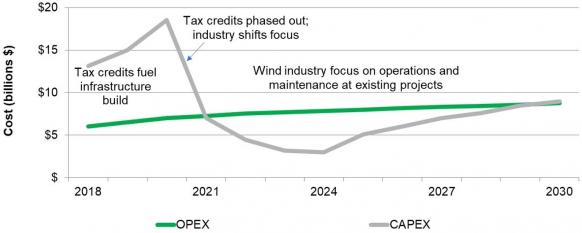

Forecast North American wind opex vs capex

(Click image to enlarge)

Source: IHS Markit, September 2018.

Research shows that offshore wind farms suffer greater wind wake losses than onshore assets, Veers noted.

"Offshore plants tend to be more tightly spaced than land-based plants…There is large financial incentive to minimize the amount of undersea infrastructure,” he said.

In Europe, the UKs’ Carbon Trust has been leading cross-industry trials of offshore wake control strategies through its Wind Farm Control Trials (WFCT) project.

Launched as part of the Carbon Trust’s Offshore Wind Accelerator program, the WFCT project will be the first to demonstrate the gains from wake control strategies at a full-scale offshore wind farm.

Early data indicated pitch and yaw-based control strategies could increase energy yield by as much as 3.5%, according to the Carbon Trust.

Full results from the WCFT are expected this year.

Early adopters

Since wind farms are set up to maximize prevailing wind directions, the Emerson-Vayu solution will be particularly effective when wind blows from other directions, Kiles noted.

Modelling showed the solution is most effective at sites with low to middle wind velocities, from 3 meters/second up to 9.5 meters/second, he said.

Regions that experience high temperatures will be key target markets.

Higher temperatures raise power demand from air-conditioning units and typically coincide with lower wind levels, Kiles noted.

This raises electricity prices in these areas, opening up significant revenue opportunities.

"Being able to produce additional energy at those times is particularly valuable,” he said.

Repowering assets

Emerson and Vayu are looking to capitalize on a surge of repowering activity in the U.S. wind market. Repowering has hiked in recent years as operators capitalize on rising turbine efficiencies and tax credit windows to increase asset returns.

For example, GE Renewable Energy has repowered 4 GW of onshore wind capacity at 2,500 turbines since 2017, and expects to repower a further 3 GW by the end of 2020, the company said last month.

Wake control solutions can help developers optimize turbine repowering strategies and maximize production tax credits [PTCs] in the coming years, Kiles said.

Since 2016, the PTC for wind projects drops by 20% each year and equates to $11.4/MWh for projects started in 2019.

To qualify for PTCs, repowering projects must invest at least 80% of the fair market value (FMV) of the asset. Operators must invest 5% of the total repowering plan by the end of 2019 to gain the current tax credit level.

Some operators may choose to include wake control solutions in early repowering spending and make "later plan modifications to include turbine upgrades within the four-year completion window,” Kiles said.

Forward data

Going forward, AI-based analytics and pattern analysis could allow operators to use real-time data to predict future site wind directions and speed, Veers said.

Such additional controllability could equip wind turbines to provide ramping, reserve and frequency control services, according to market needs, he said.

Such predictive strategies will be supported by improving sensor and analytics capabilities which are set to transform operations and maintenance (O&M) practices.

GE aims to use advanced sensors and automation to develop prognostics for all failure modes and new turbine units offering full "self-diagnosing" abilities could be available "very soon," Denver Bane, Onshore Wind Services Strategy Leader at GE Renewable Energy, told the Wind Operations Dallas 2019 conference in April.

"In the next one to five years you are going to see turbines coming online with more sensors and capabilities in that regard than ever before and we are going to have better analytics and machine learning to make sense of that data stream," he said.

By Beatrice Bedeschi