Global wind investments rise 33% as US activity soars; UK commission favors renewables over nuclear

Our pick of the latest wind power news you need to know.

Related Articles

Global wind investments rise 33% in H1 to $57.2 billion

Global wind investments rose by 33% to $57.2 billion, boosted by large project financings of U.S. onshore and European offshore projects, BNEF said in a statement July 9.

"The headline deals included $1.5 billion for the 731.5 MW Borssele 3 and 4 offshore wind farm in Dutch waters, $1 billion for the 478 MW Hale County onshore wind project in Texas, and $627 million for the 120 MW Formosa 1 Miaoli project [Taiwan]," it said.

U.S. wind investments in H1 hiked 121% to $17.5 billion as developers rushed to finish projects in time to qualify for federal tax credits, BNEF said.

U.S. wind developers signed 3.6 GW of power purchase agreements (PPAs) in the first quarter of 2018, the highest level recorded to date, the American Wind Energy Association (AWEA) said in May.

Agreements with utilities accounted for 2.6 GW of this PPA activity, while corporate customers signed over 1 GW of contracts, AWEA said.

The U.S. wind industry reported 5.5 GW of new project activity in the first quarter, AWEA said.

Some 1.4 GW of projects started construction and a further 4.2 GW entered the advanced development phase, the industry group said.

"There are now over 33,000 MW of wind power either under construction or in advanced development, a 40% increase over this time last year and the highest level since AWEA began tracking both categories in 2016," it said.

In January, the U.S. Energy Information Administration (EIA) predicted installed wind capacity will rise by 8.3 GW in 2018 and push annual wind generation above hydroelectric output for the first time. Installed wind capacity is expected to rise by a further 8.0 GW in 2019, EIA said.

While global wind investments rose in H1, global solar investments fell by 19% to $71.6 billion. Solar investment was dented by lower capital costs per MW and a cooling off of China's solar boom, BNEF said.

Equity raised by specialist smart energy firms rose by 64% year-on-year to $5.2 billion, boosted by investments in storage and electric vehicles, it said.

"A mixed picture for global clean energy investment in 2018 is emerging, with dollar investment in solar under pressure while commitments to wind power and energy smart technologies such as electric vehicles and batteries are running above last year’s levels," BNEF said.

Sempra sells 2.6 GW US wind, solar assets in strategic shift

Sempra Energy is to sell 2.6 GW of U.S. wind and solar assets, along with natural gas storage and infrastructure, in the first phase of a portfolio optimization project, the California-based utility said June 28.

"Renewable energy is a vital part of the energy landscape and we have developed a great platform, but we have determined that our U.S. solar and wind generation businesses would be more valuable to another owner," Jeffrey Martin, CEO of Sempra Energy, said.

"Our strategy is to continue building a leading energy company operating best-in-class utilities and developing contracted energy infrastructure in some of the largest economies in the Americas, with a focus centered on North America," Martin said.

The announcement follows a year-long strategic review and comes amid pressure from activist investor Elliott Management Corp. and Bluescape Resources Co, which own a combined 4.9% stake in the company.

Sempra Renewables assets and investments include wholly-owned facilities and joint-venture and tax-equity investments with a total generating capacity of approximately 2.6 GW. The company also has ownership interests and investments in nine solar projects in Nevada, Arizona and California and wind projects in eight states stretching from Hawaii to Pennsylvania.

Sempra will record impairment charges of between $1.47 billion and $1.55 billion following the sale. This equates to impairments of $870 million-$925 million after tax and non-controlling interests.

"This is just the first phase of our portfolio optimization, which we expect to continue in the coming months," Martin said.

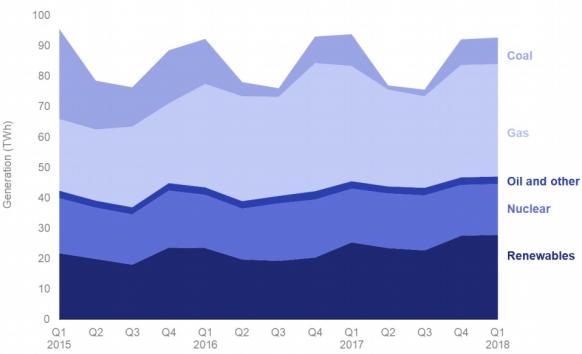

UK government commission favors wind, solar over nuclear

The UK government should increase support for wind and solar projects and aim to increase the share of renewable energy from 30% of generation capacity to at least 50% by 2030, the National Infrastructure Commission (NIC) said in its first National Infrastructure Assessment (NIA).

The UK government should agree to only one more nuclear plant following the 3.2 GW Hinkley Point C project before 2025, the NIC said in its report.

"In the longer term, an energy system based on low cost renewables and the technologies required to balance them may prove cheaper than building further nuclear plants, as the cost of these technologies is far more likely to fall, and at a faster rate," the NIC said in a statement.

A move to an electricity system mainly powered by renewable energy sources would present the "lowest cost outcome" for consumers, the council said.

UK power generation by fuel type

(Click image to enlarge)

Source: UK Government Department for Business, Energy and Industrial Strategy (BEIS)

The NIC recommends the UK government prioritizes support for wind and solar projects over other technologies and urged the government to set dates and budgets for future renewable energy auctions.

Established by the UK government in 2017, the NIC provides impartial, expert advice on major long-term infrastructure challenges.

The NIC must deliver an NIA every five years, covering sectors such as energy, transport, digital, water, waste and flood defences.

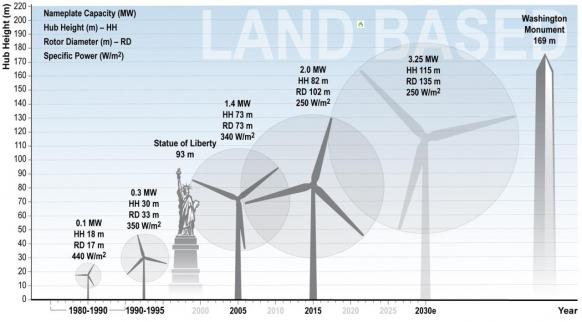

Vestas partners with Maersk to cut wind logistics, installation costs

Vestas and Maersk Supply Service have formed a partnership to develop logistics and installation technologies to reduce the cost of onshore and offshore wind, the companies announced June 28.

The new partnership will develop solutions to lower the cost of transporting and installing turbines as they increase in size and they are installed in more remote locations.

The first joint project is a new installation crane which will allow project partners to use "lower cost assets in the logistics value chain," the companies said in a joint statement.

The "Vertical Installer" crane is being developed in cooperation with MHI Vestas Offshore Wind, and has received 47 million Danish krone ($7.4 million) of funding from the Danish government for a period of three years.

Forecast US onshore turbine sizes (average)

(Click image to enlarge)

Source: Berkeley Laboratories, 2017

Equinor, Masdar complete first offshore wind battery

Norway's Equinor (formerly Statoil) and Abu Dhabi's Masdar have installed the world's first offshore wind battery storage facility in Scotland, the companies announced June 27.

The 1.2 MW Batwind storage facility aims to mitigate peaks and troughs in production from the operational 30 MW Hywind Scotland floating offshore wind farm, owned by Equinor and Masdar.

The battery facility has been installed at an onshore substation and the operators will gather data on weather, market prices and consumption patterns to create an "intelligent and optimized storage system," the partners said.

The Batwind project will allow the company to analyze multiple strategies for monetizing energy storage dispatchability and assess when the increased capital expenditure (capex) required to integrate battery storage becomes commercially attractive, Hilde Strom, Batwind Project Manager, Equinor, told New Energy Update in November 2017.

Potential business models include the capture of wind overshoots to sell excess generation on the wholesale market at later periods, reduction of balancing costs by self-regulation of power supply, capture of wholesale power price peaks through arbitrage, as well as system services such as frequency regulation, she said.

“We may not be able to test all these value drivers, but this is the aim,” Strom said.

Denmark's Orsted has also been developing battery storage for offshore wind farms.

Orsted aims to use a battery in conjunction with its Burbo Bank wind farm to provide frequency response services to the UK power grid.

New Energy Update