Offshore wind operators use scale, analytics to cut vessel trips

Operators are using multi-skilled teams, vessel enhancements and data analytics gains to reduce the number of crew transfers per turbine, industry experts told New Energy Update.

Related Articles

Falling offshore wind capex costs have placed increasing importance on operations and maintenance (O&M) efficiency.

O&M costs are currently estimated at around 70,000 to 80,000 pounds/MW/year on average, representing around 25 to 30% of total project costs. In the coming years, O&M costs are expected to fall dramatically as operators use technology advancements to optimize resources.

In the UK, Europe’s largest offshore wind market, improved forecasting and execution of offshore wind maintenance is reducing the number of crew transfers per turbine, the latest data shows.

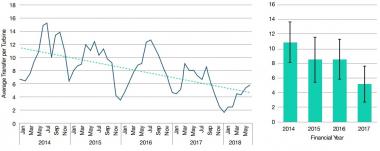

The average number of crew transfers per turbine in the UK fell by 50% between 2014 and 2018, to around six trips per year, according to a report by the U.K.'s Offshore Renewable Energy (ORE) Catapult and the Crown Estate.

UK annual offshore transfers per turbine

(Click image to enlarge)

Source: ORE's System Performance, Availability and Reliability Trend Analysis – 2017/18 Portfolio Review

The report collected data from 22 wind farms and 1,445 wind turbines, representing 77% of installed wind capacity in UK waters, under the System Performance, Availability and Reliability Trend Analysis (SPARTA) initiative.

The reduction in vessel trips looks set to continue. Operators are combining growing O&M experience with economies of scale and data analytics power to reduce logistics costs and boost plant availability.

Technology shift

Larger, higher efficiency turbines and improved component reliability are helping operators to reduce O&M costs.

Higher capacity turbines require less maintenance resources per MW, reducing the outlay for spare parts, vessels and personnel during operations. Growing turbine capacities could directly impact as much as 60% of offshore O&M costs, according to BloombergNEF (BNEF).

New technologies such as drones are allowing operators to perform more inspection activities remotely, reducing vessel requirements. Drones could cut offshore wind inspection costs by $1,000 per turbine per year, according to BNEF.

Annual offshore wind inspection costs per 3.6 MW turbine

Source: BloombergNEF (BNEF), Sterblue, VisualWorking

Operators and service companies are also using growing data analytics prowess to predict faults and improve maintenance scheduling.

"In the past 10 years we’ve developed our own monitoring system," Michael Splett, global head of O&M, offshore wind at Germany's EnBW, told New Energy Update.

The system incorporates SCADA data, such as temperature, pressure and current, along with vibration data from moving parts, Splett said.

"Thanks to the increasing amount of data, we can forecast whether interventions are required two to three weeks, or even one month in advance,” he said.

EnBW’s offshore wind assets in Germany include the operational Baltic 1 (48.3 MW) and Baltic 2 (288 MW) wind farms and the planned Hohe See (497 MW), Albatros (112 MW) and He Dreiht (900 MW) projects in the North Sea.

Advanced analytics

Wind companies are combining data from across their businesses-- including work management, inventory and asset integrity data-- with improved forecasting and logistics capabilities, Owen Murphy, Engineering Manager at ORE Catapult, told New Energy Update.

“We know of several innovators who are pushing into this area and we expect it to grow in focus and continue to gain traction in the coming years,” he said.

Improved forecasting capabilities are also helping operators optimize asset revenues by scheduling maintenance when wind forecasts are low.

“The next step is to combine this data with trading data,” Splett said.

EnBW's He Dreiht project will operate without a subsidized tariff, and the company will add trading data to forecasting capabilities to perform maintenance when electricity prices are low, he said

Mixed teams

Offshore operators are raising the productivity of crew missions by sending multi-skilled teams and maximizing the number of tasks per trip.

Multiple skill sets allow operators to perform unplanned maintenance alongside scheduled work, Friedrich von Storch, operations manager, offshore wind at EnBW, said.

"For example, we send foundations (technicians) as well as turbine technicians together,” he said.

“We also try to have as many synergies as possible…in the North Sea, we have developed a system in order to manage two wind farms at once,” von Storch said.

For example, EnBW will use combined service teams and storage facilities for its Hohe See and Albatros projects in the North Sea, he said.

Performing maintenance for a “cluster” of wind farms can significantly reduce costs. Owners of projects on the same UK coast could reduce O&M management and marine logistics costs by around 25%, according to BNEF. Directly adjacent projects could achieve 50% savings, it said.

New vessels

Improvements in vessel designs are also boosting productivity.

The cost of a CTV and fuel is around 2,000-4,000 pounds per day. These costs can soon mount if operators are using multiple vessels for the same site and a number of trips are abandoned.

CTVs are also growing in size, allowing larger teams and equipment stores per vessel. For new sites further offshore, operators are turning to larger, purpose-built service operation vessels (SOVs).

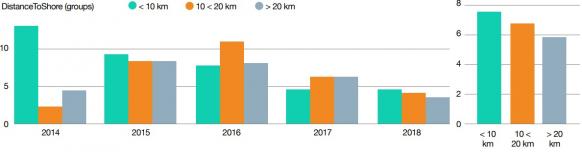

UK offshore transfers by distance from shore

(Click image to enlarge)

Source: ORE's System Performance, Availability and Reliability Trend Analysis – 2017/18 Portfolio Review

Last year, EnBW and Siemens signed a 10-year charter agreement with UK shipping company Bibby Marine Services for a new SOV. The 90-meter vessel will serve EnBW's Hohe See and Albatros projects from 2019 until 2029.

SOV's can operate in larger wave heights, house large numbers of technicians at sea for several weeks, offer larger storage space, and provide greater access to turbines. The vessel chartered by EnBW will host 20 Bibby vessel crew members and 40 wind turbine technicians.

In the UK, Orsted operates the 81m Edda Passat SOV out of its UK East Coast Hub to service its Race Bank project. Supplied by Norwegian shipping company Ostensjo Rederi and designed by Britain’s Rolls-Royce, the vessel spends up to 28 consecutive days out at sea, servicing six to eight turbines each day. The vessel holds 60 cabins and technicians work a two-week on, two-week off shift pattern.

Predictive power

Currently, offshore O&M costs are split fairly equally between planned and unplanned maintenance, but this will soon change.

Design improvements and operations learnings could see planned maintenance rise to 77% of O&M costs for projects installed in the next 5 to 10 years, according to ORE Catapult. This will give operators greater scope for optimizing logistics and maximizing revenues.

The number of crew transfers will continue to fall in the coming years as further efficiency gains combine with advancements in analytics and forecasting, and greater data sharing, Murphy said.

"Turbine manufacturers have made much of their plans to dramatically reduce the amount of offshore [O&M] visits,” he noted.

For example, the development of digital twins will help operators adapt and refine construction and predictive maintenance practices, Murphy said.

"Data from existing farms can be used to optimize the design of new farms and the insights from data and analytics can be readily shared to the benefit of all industry," he said.

By Beatrice Bedeschi