Offshore wind opex set to fall 40% by 2030 as suppliers dig deep

Supply chain and services innovations are set to slash operational expenditure (opex) with the greatest impact expected in projects in deeper waters further offshore, industry experts told New Energy Update.

Related Articles

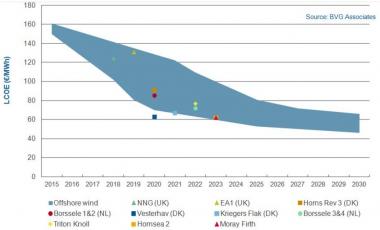

Dramatic price reductions in European offshore wind power prices are helping to secure a long-term future for offshore wind technology.

In a highly competitive power market, offshore wind developers are finding new ways to reduce construction risks and increase operations and maintenance (O&M) efficiency.

Improved technology and installation experience have slashed capital expenditure (capex) and experts predict similar reductions in opex as suppliers respond to growing demand for larger, more efficient projects.

By 2030, European offshore O&M costs could fall to around 55,000 euros per MW-year ($65,000/MW-year), down from current levels of 80,000 to 100,000 euros/MW-year, Giles Hundleby, Director at BVG Associates, told New Energy Update.

BVG Associates has factored the latest UK offshore tender prices into its forecasts and expects opex and capex to fall by similar amounts. Combined with higher capacity factors, opex and capex savings could account for 50 to 60% of LCOE reductions, Hundleby said.

“The remaining 40% [comes] from cost of capital benefit and supply-chain advancement,” he said.

European offshore LCOE by commissioning date

(Click image to enlarge)

Turbine boost

A key driver of cost reductions will be rising turbine capacity and efficiency, which will impact both capex and opex. Earlier this year, Dong Energy was the first developer to use 8 MW turbines on its Burbo Bank Extension wind farm off the coast of Liverpool and the developer has predicted turbines of capacity 13 to 15 MW will be on the market by 2024.

Larger turbines require less resources per MW for installation and operations, requiring fewer Balance of Plant (BoP) components such as foundations and cables and incurring less maintenance trips per MW. This reduces the outlay for vessels and personnel during construction and operations.

In a report in 2016, analysts from BVG and KIC InnoEnergy forecasted an increase in turbine rating from 4 MW to 10 MW between 2014 and 2030 could reduce the levelized cost of energy (LCOE) by almost 20%, before improvements in other areas such as blade aerodynamics and control.

Larger project sizes, longer supplier pipelines and sharing of learnings between sites will also positively impact OPEX costs in the coming years, Hundleby said.

“Improvements in OPEX will come from resource sharing over a bigger number of projects, including being able to consolidate and rationalize spare parts and stock-holding and making more efficient usage of vessels and crew across sites,” he said.

Deeper impact

Experts predict projects in further offshore will yield the greatest reductions in opex by 2030.

Rising installation experience and O&M innovations are reducing the risk premium associated with deeper waters and longer transfer times.

Installation learnings and supply-side innovations such as Service Operation Vessels (SOVs) are allowing companies to operate safely in higher wave heights and optimize maintenance resources.

New vessels will provide a boost for projects further offshore as suppliers respond to market demand, Barbara Zuiderwijk, offshore wind expert at Green Giraffe financial advisors, told New Energy Update.

“Given the more specialized vessels coming to the market, the O&M price difference between projects closer and further away from shore will become less significant,” Zuiderwijk said.

In the latest European offshore wind tenders, the lowest priced projects were on average 57.2 km from shore. This compares with an average 44 km from shore for projects online or under construction in 2016.

Investor comfort with projects further offshore is demonstrated by Dong Energy's 1.4 GW Hornsea Project Two (Hornsea 2) which will be built 89 km off the coast of Yorkshire, England and online by 2023. The UK government awarded the project in September at a record-low price of 57.50 pounds/MWh, half the price of the lowest contracts awarded in the last UK offshore wind tender in February 2015. DPR and Engie were also awarded a contract at 57.50 pounds/MWh for their 950 MW Moray Offshore Windfarm (East) project in Scotland, located much closer to shore than Hornsea 2, as the below table shows.

Distance from shore of latest offshore projects

Source: New Energy Update

Dong Energy anticipates dramatic improvements in construction and operations efficiency for Hornsea 2 compared with its adjacent Hornsea 1 project, allocated in 2014 and currently under construction.

Dong Energy has noted Hornsea 2 will benefit from a growing and competitive supply chain and the use of the company's O&M hub at Grimsby, England, which also serves other Dong Energy offshore wind farms on the UK east coast. The Hornsea 1 project, due online in 2020, has also provided learnings on specific site conditions and installation practices and enables Dong Energy to synergize supply chain logistics.

BVG Associates expect near-term growth will spur fresh efficiency gains from the offshore supply chain.

“If you can go to the supply-chain with requests for a significant portfolio of projects then you can help them drive down costs by either finding ways of doing things more efficiently or investing in better tools and equipment,” Hundleby said.

Post-2020 push

From 2020, more turbines will have exceeded initial warranty periods and this should accelerate supply chain efficiency and O&M competition.

Contractual terms will evolve to allow further O&M cost reductions, Barbara Zuiderwijk, offshore wind expert at Green Giraffe financial advisors, told New Energy Update.

“The contract scope will become less extensive as the competitive pricing required in the tenders will no longer allow for the ‘gold-plated character’ that we have seen in earlier contracts,” Zuiderwijk said.

“At the same time as the industry is maturing risk mark-ups can be taken out, which could lead to a decrease in scope but mostly to a decrease in price,” she said.

The growing involvement of oil and gas majors in offshore wind projects should also generate cost savings as they apply decades of expertise in offshore installation and logistics.

Advancements in analytics and plant monitoring technologies will also reduce opex by driving predictive and preventive maintenance. Experts also predict weather forecasting improvements and more efficient blade inspections through the use of new technology such as drones.

"It is the sum of these incremental gains that we are seeing developers and service providers pursuing that will contribute to improvements in OPEX,” Hundleby said.

By Kerry Chamberlain