Orsted deal with US utility sets up offshore growth surge

Orsted's new partnership with US utility Eversource will improve offshore wind permitting and local industry links and lower development costs, the Danish developer told New Energy Update.

Related Articles

On February 8, Orsted divested 50% of offshore wind development assets in Rhode Island, Connecticut, New York and Massachusetts to New England utility Eversouce.

The transaction builds on an existing joint venture by Orsted and Eversource to develop the Massachusetts Bay State Wind project and underlines Orsted's ambitious U.S. growth strategy.

In October, Orsted acquired 100% of U.S. group Deepwater Wind, raising its U.S. development pipeline to almost 9 GW. The world's leading offshore developer, Orsted plans to increase its installed capacity from 5.6 GW to 15 GW by 2025.

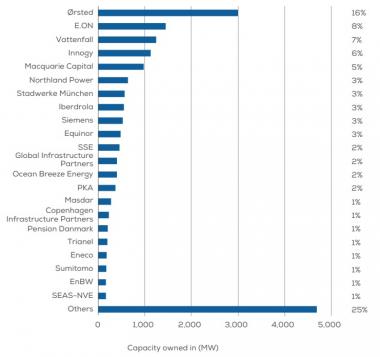

Owners' share of installed offshore capacity

(Click image to enlarge)

Source: WindEurope, February 2019

The joint venture enables Orsted and Eversource to "harvest synergies across the different New England projects," Martin Neubert, Executive Vice President and CEO of Offshore at Orsted, said in a statement.

The partners will jointly develop the 704 MW Revolution Wind project, which will deliver 400 MW to Rhode Island and 304 MW to Connecticut, as well as the adjacent 130 MW South Fork project off Long Island.

The Revolution Wind and South Fork projects will be developed in parallel, providing procurement, construction and operational savings. The South Fork project is expected to be commissioned by the end of 2022 while the Revolution Wind project is scheduled to be brought online in 2023, subject to permitting and final investment decisions.

The partnership also includes the Massachusetts North and Massachusetts South lease areas, which could potentially host over 1 GW of capacity.

The joint venture will lower development and operational costs and provide "unmatched permitting expertise" in the north-east region, Lauren Burm, head of public affairs at Orsted North America, told New Energy Update.

The partners’ Massachusetts Bay State Wind project is the only offshore wind project to have been designated a FAST-41 project by the Department of Interior (DOI) and the Department of Energy (DOE), Burm noted.

The FAST-41 process aims to improve the consultation process with government agencies and provide greater accountability through the "publication of project-specific timetables with completion dates for all federal environmental reviews and authorizations," according to the Federal Energy Regulatory Commission (FERC).

The FAST-41 status will improve coordination with federal authorities and provide more transparency and predictability to the permitting process, Burm said.

Orsted also recently created a non-binding partnership with the U.S. Responsible Offshore Development Alliance (RODA), a group representing commercial fishermen's rights.

"We are optimistic that our work with [Orsted] will set a standard ensuring that fishermen have direct input into wind farm designs and ensuring that their concerns are fully embraced by developers,” Peter Hughes, RODA Chairman and Director of Sustainability at Atlantic Capes Fisheries, said in a statement.

Atlantic alliances

Several European offshore wind developers have now joined with U.S. groups to increase their development potential.

European partners can lower project costs by bringing years of construction and operations experience while U.S. companies can aid permitting and bolster domestic industry credentials. Joint ventures also lower developers’ capital requirements and improve lending terms.

German utility EnBW has created a joint venture with U.S. group Trident Winds to develop a 1 GW floating wind project in California. EnBW may partner with companies to develop projects on the East Coast, where the company recently set up offices, Frank Mastiaux, CEO of EnBW, told Reuters last month.

Portuguese utility EDPR has partnered with Principle Power, Redwood Coast Energy Authority (RCEA), Aker Solutions, to develop a 200 MW project in northern California.

Oil and gas groups Shell and Equinor are also looking to grab a share of the U.S. offshore wind market. In December, Shell formed joint ventures with EDPR and France’s EDF to develop projects in Massachusetts and New Jersey.

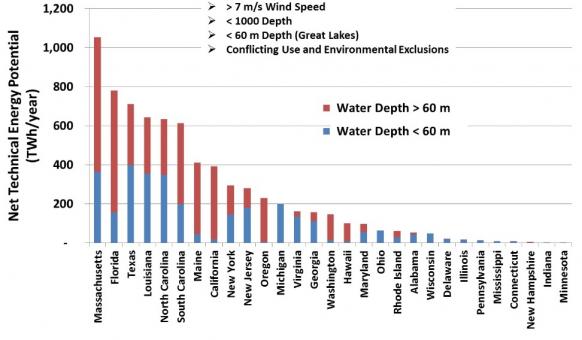

Technical offshore wind capacity by state

(Click image to enlarge)

Source: US Department of Energy (DOE), 2016.

Going forward, Orsted will develop projects through joint ventures or independently, depending on project requirements, Burm said.

Orsted plans global gross investments of 200 billion Danish krone ($30.3 billion) in 2019-2025, of which 75%-85% will be on offshore projects, the company said in December. Orsted predicts a 10% return on capital invested over the period.

Vessel growth

A key challenge for the US offshore wind industry is the development of an efficient supply chain network and port infrastructure that can accommodate growing turbine capacities, Stephanie McClellan, Director of the Special Initiative on Offshore Wind at the University of Delaware, told New Energy Update.

Last year, GE Renewable Energy launched the 12 MW Haliade-X offshore wind turbine, - equivalent to double the average turbine capacity installed in 2017. Commercially available from 2021, the turbine has a height of 260 metres and uses blades of length 107 m.

Vessel suppliers and wind companies are collaborating to build new vessels and convert existing assets to bring the latest turbines to the U.S. market.

The U.S. Jones Act requires freight shipped within U.S. waters to be transported only by vessels built, owned and operated by U.S. citizens. The offshore supply chain has established there is sufficient market volume to build Jones Act-compliant vessels, McClellan said.

Last year, Florida-based Aeolus Energy Group announced it plans to build a U.S.-flagged vessel fleet to serve the offshore wind sector, expecting to generate 4,000 jobs in the next couple of years.

Seacor subsidiary Falcon Global and Norway's Fred Olsen Wind Carrier have also agreed to jointly supply vessels and marine installation crews to the U.S. offshore wind market. Fred Olsen Windcarrier is one of Europe's most experienced offshore wind installation groups and has installed more than 300 turbines to date.

Other vessel construction projects are underway and the wider supply chain is establishing U.S. bases.

In November, UK-based cable supplier JDR Cable Systems and U.S. group McAllister Towing agreed to develop a new U.S. East Coast offshore wind subsea power cable delivery and service base on McAllister quayside property.

Port boosters

The U.S. can use years of offshore infrastructure learnings in Europe to accelerate cost reductions in the coming years.

In the UK, Europe's largest offshore wind power market, leading operators Orsted and Vattenfall are making large investments in port-side facilities and expanding remote vessel capabilities to optimize growing portfolios.

Orsted will soon complete the construction of the U.K.'s largest offshore wind operations and maintenance (O&M) hub at Grimsby Royal Dock in north-east England.

Orsted’s East Coast Hub will initially support the company’s 210 MW Westermost Rough, 573 MW Race Bank and 1.2 GW Hornsea 1 wind farms, employing over 400 staff on a long-term basis. The company has pledged to spend some 6 billion pounds ($7.8 billion) in the wider Humber area by 2019.

Last year, Swedish group Vattenfall signed an agreement with infrastructure group Peel ports to reserve an area of Great Yarmouth Harbour in eastern England for a new offshore wind operations base.

The base will serve Vattenfall’s planned 1.8 GW Norfolk Vanguard and 1.8 GW Norfolk Boreas projects, set for government approval in 2019 and 2020.

Key benefits of large onshore operations hubs include the sharing between projects of onshore infrastructure, labor resources and spare parts warehouses, Fernando Sevilla Montoya, Senior Engineer, Renewables Projects Offshore, N&B at DNV GL, told New Energy Update in November.

The pooling of resources at centralized facilities can accelerate the sourcing of vessels and strategic components and support optimized framework agreements with vessel operators, Montoya said.

“Together with better communication and sharing of lessons learnt between projects, this could entail significant reductions in costs and resources required,” he said.

By Neil Ford