Siemens Gamesa service terms for record PPA show growing risk comfort

Siemens Gamesa's 25-year service contract for Norsk Hydro's longest-ever wind purchase in Sweden highlights an increasing appetite for long-term performance risk in the highly competitive operations and maintenance (O&M) market.

Related Articles

In July, Norwegian aluminium company Norsk Hydro signed a 29-year wind purchase contract with Green Investment Group (GIG), a subsidiary of Macquarie, for a new 235 MW onshore wind farm in Overturingen, Sweden.

The contract is believed to be the world’s longest corporate wind power purchase agreement (PPA) and shows growing investor comfort in corporate PPA-backed projects. In 2017, GIG and Norsk Hydro partnered on the 650 MW Markbygden Ett onshore wind farm, Europe's largest onshore wind project. Including hydroelectric supply, Norsk hydro supplies over 100% of Norway power needs from renewable sources.

Global wind and solar procurement has soared as companies take advantage of falling costs to meet carbon reduction objectives. After a surge in U.S. PPA activity, European deals are on the rise with a growing interest from industrial groups.

The Overturingen wind farm is scheduled to be online by December 2019 and is expected to generate around 0.8 TWh/year. The PPA provides Norsk Hydro with 0.3 TWh/year of baseload supply for the period 2021 to 2031, rising to 0.55 TWh/year for the period from 2031 to 2050.

Siemens Gamesa will supply 56 of its 4.2 MW turbines and will also provide operations and maintenance (O&M) services through a 25-year service agreement which incorporates an energy yield-based availability guarantee.

The long tenor of the O&M contract shows how service providers are taking on a greater scope of performance risk to gain a share of the growing wind O&M market.

The wind O&M market is set to soar in the coming years as operators in Europe and North America look to optimize growing fleets and ageing turbines.

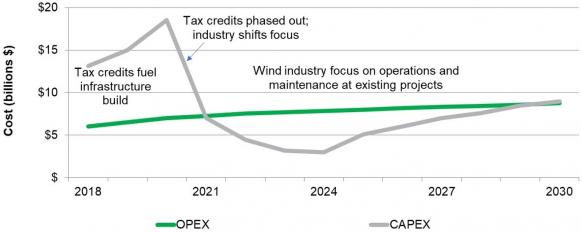

Annual investments in wind operations and maintenance (O&M) in U.S. and Canada will rise from a current level of $5 billion-$6 billion to $7.5 billion by 2021, eclipsing capex spending for the first time, IHS Markit said in a recent report.

North American wind opex vs capex

(Click image to enlarge)

Source: IHS Markit, September 2018.

In Europe, Middle East and Africa (EMEA), annual onshore wind O&M spending is estimated at around $5 billion in 2018, according to Bloomberg New Energy Finance (BNEF).

Competitive market

Original equipment manufacturers (OEMs) such as Siemens Gamesa are increasingly moving into the third-party servicing market, where they face competition from independent service providers (ISPs) and operators' in-house teams.

BNEF has estimated that 71% of the 300 GW of onshore wind capacity installed in EMEA at the start of 2018 was out of warranty, aged between six and 27 years old.

The long-term tenor of Siemens Gamesa’s O&M contract for Overturingen incurs a broad range of risks.

Siemens Gamesa will take on risks associated with technology performance, equipment costs, spare parts supply and labor supply, as well as wider economic uncertainties such as currency exchange rates, a company spokesperson said.

On the upside, innovations in component efficiency, spare parts strategies, and preventative maintenance are expected to create O&M savings going forward.

Advances in remote diagnostics and data analytics, for example, will reduce the number of man hours required for maintenance procedures, the spokesperson noted.

OEMs expect an increasing share of onshore wind revenue to come from O&M services and service providers are investing heavily in infrastructure and digital technology and innovative spare parts strategies, a recent survey by New Energy Update showed.

Long-term O&M contracts such as that at Overturingen will enable Siemens Gamesa to continue to invest in its service capabilities, the company spokesperson said.

"Long term contracts provide a stability for our service business," the spokesperson said.

Revenue risk

The removal and expiry of wind power tariffs and increasing exposure of projects to wholesale markets is placing increasing pressure on O&M efficiency.

The Overturingen PPA was signed at a “very attractive” long-term price for Norsk Hydro, aided by low interest rates and low financing costs, Tor-Ove Horstad, senior vice president and Head of Energy Commercial at Norsk Hydro, told New Energy Update.

Wind power capacity combines well with the storage capabilities of Norsk Hydro's hydroelectric portfolio, Horstad noted.

“They go hand in hand as a natural hedging," he said.

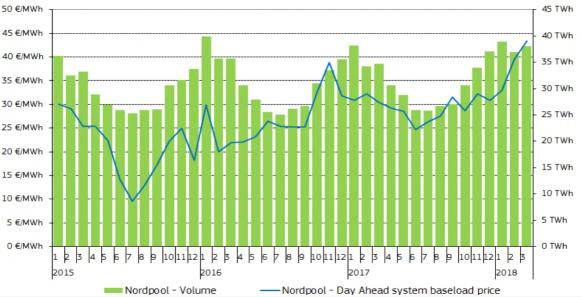

Centrica subsidiary Neas Energy is to provide balancing and power trading for the Overturingen wind farm under a 10-year deal, the company said in a statement.

The contract will include "physical balancing and trading of the power production on the Nordic electricity exchange as well as the offtake of El-certificates and Guarantees of Origin," Centrica said.

Average day-ahead power prices in northern Europe

(Click image to enlarge)

Source: European Commission's Q1 2018 electricity market report. Data source: Nordpool.

Many wind farm owners are now looking to transfer production risk to O&M providers, to better align the long-term economic interests of owners and service companies.

An increasing number of owners are switching from time-based availability guarantees to performance-based guarantees. Some owners are advancing on to energy-based guarantees where the service provider also takes on wind resource risk.

Evolving risk priorities and growing operational experience are propelling the wind power industry towards revenue-based maintenance contracts, operators told the Wind O&M Dallas 2018 conference in April.

Seeking contracts

Until now, most European renewable PPA activity has been concentrated in northern Europe, but new EU directives, growing demand from heavy industry, and global contract innovations will see activity spread south.

Recent wind deals include a 15-year PPA between Eolus Vind and aluminium producer Alcoa Norway to support a new 330 MW wind farm in Norway and a PPA signed by Global healthcare company Novo Nordisk and biological solutions group Novozymes to support Vattenfall's 600 MW Kriegers Flak offshore wind project in Denmark.

In July, Mercedes-Benz signed Europe’s first automotive industry PPA to support the 45 MW Taczalin wind farm in Poland, operational since 2013.

On a global basis, Norsk Hydro supplies 70% of its primary aluminium production power needs from renewable energy sources. Going forward, the group will continue to seek out new long-term renewable PPA deals, Horstad said.

“We are in the market…if the [tenor], counterparts and price are attractive," he said.

By Beatrice Bedeschi