South Africa wind developers eye fresh bids to meet short-term deficit

South Africa's proposed renewables plan overestimates coal-fired capacity in the coming years and the wind industry must prepare cost-competitive projects for potential procurement announcements, wind developers told the Africa New Energy 2018 conference.

Related Articles

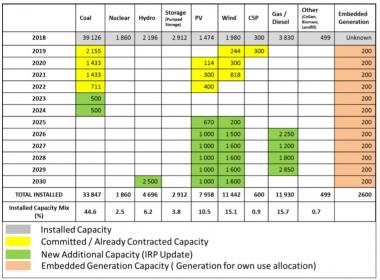

In August, South Africa published its draft 2018 Integrated Resource Plan (IRP), calling for 8.1 GW of new wind capacity and 5.7 GW of new PV between 2025 and 2030.

Wind companies broadly welcome the IRP’s “least-cost” approach but warn the proposed three-year gap between committed projects and the IRP’s planned buildout from 2025 will damage industry growth.

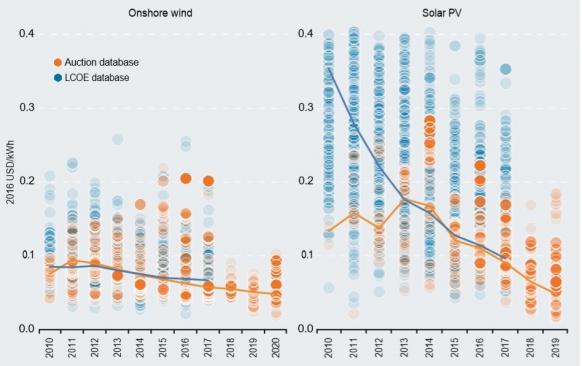

Global wind costs are continuing to fall and the IRP includes inaccurate markets assumptions which support coal-fired generation, the South African Wind Energy Association (SAWEA) said in a document sent to the government in October.

Taking into account falling renewables costs, current data on Eskom’s coal fleet efficiency, and the effects of a proposed carbon tax, “very different investment choices would be made," SAWEA said.

South Africa's draft generation build plan (IRP)

(Click image to enlarge)

Source: South African government's draft Integrated Resource Plan (August 2018).

The IRP includes overly-generous assumptions on future coal plant availability and cost, James Cumming, Principal, African Clean Energy Developments, told the conference on November 27.

"Eskom is able to deliver availability at around the 70% mark for the existing fleet...To think that will increase to 80% by 2020 is probably overoptimistic," Cumming said.

The IRP also appears to underestimate the cost of retrofitting coal plants to improve availability, he said.

Many wind developers believe current generation capacity will be insufficient to provide the short term power needs of South Africa, and this will prompt the government to procure capacity ahead of the IRP plan.

"We don't believe this [procurement] gap is going to survive...because of the fundamentals," Kilian Hagemann, Managing Director of G7 Renewable Energies, said.

Coal plant availability will not reach the levels set out in the IRP in the next five years and renewables represent a cost-effective solution to fill the supply gap, Hagemann said

"We strongly believe there is going to be wind procurement in the next year or two," he said.

Developers should be prepared for potential short term energy plans which will require rapid sourcing of local content providers, Davin Chown, Director of Genesis Eco-Energy, told attendees.

Chown expects "some interesting curveballs thrown at this industry in the next three to four months that are going to have to try and address this particular gap," he said.

IRP impact

In response to the IRP plan, SAWEA sent the government data on the negative socio-economic and economic effects of a wind procurement gap.

The proposed three-year gap in procurement will be particularly damaging to the development of local industry, Hagemann told the conference.

A delay to wind projects since the last procurement round in 2014 forced the mothballing of DCS group’s Coega wind tower manufacturing facility in 2016, he noted.

"These stops in procurement are toxic for the very thing that government wants to create-- that is jobs, local content," Hagemann said.

A procurement gap would also lead to higher costs for future wind projects, Cumming said.

"We hinder efficient local content delivery, skills retention, a highly competitive market...we will see developers and IPPs [independent power producers] focus elsewhere," he said.

"At the end of the day, you are undermining the idea of a least-cost path," Cumming said.

Forecast global wind, solar costs in 2020

(Click image to enlarge)

Source: IRENA's "Renewable power generation costs in 2017" report.

Project queue

If an "emergency" procurement plan is launched ahead of the IRP, wind developers could respond rapidly, due to a legacy of projects from previous rounds.

"We believe there are about 35 to 40 bid-ready projects that could be submitted into the next round. That would probably grow to 55 projects for a round that would take place in Q3 [2019]," Cumming said.

"Within 24 months, on average, you could see 2.5 GW deployed, in an ideal world," he said.

SAWEA recommends new projects meet local content targets of 45%-65% set out in the latest REIPPPP criteria. Local content shares rose to around 46% in the latest bidding round in 2014, following the installation of new tower manufacturing facilities.

Further gains in local content shares will likely come from incremental gains from smaller component manufacturing rather than new factories for larger parts, Hagemann said.

Blades are unlikely to be manufactured in South Africa anytime soon, as facilities use specialized, design-specific moulds and turbine suppliers would require a stable pipeline of projects to justify the large investments involved, he noted.

Suppliers are instead looking to localize other components such as the nacelle housing and components within the nacelle, Hagemann said.

"There might be a few other components where you incrementally get a couple of percent here and a couple of percent there to get to 50%, 55%, maybe 60% [local content share] in the next couple of years," he said.

Manufacturing hubs

Industrial development zones (IDZs) will continue to be crucial for local content development, Hagemann said.

IDZs provide tax, infrastructure and transport benefits for industries which add value to the South African economy.

South Africa's two operational wind tower factories are located in IDZs and these zones will continue to play a "critical role" for new manufacturing facilities, Hagemann said.

The IDZ support must benefit local initiatives as well as international investors to ensure locally-grown businesses can compete, Chown noted.

To encourage support for wind development going forward, project partners will need to demonstrate and quantify the socio-economic impact of their projects, he said.

"That's one of the big issues that government is still taking us to task on," Chown said.

New Energy Update