US announces Atlantic, Pacific offshore lease sales; UK power utility goes 100% wind

Our pick of the latest wind power news you need to know.

Related Articles

US advances offshore lease sales on Atlantic, Pacific coasts

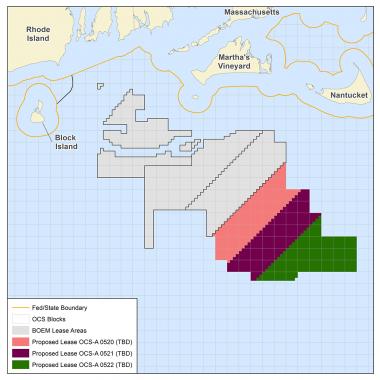

The U.S. Bureau of Ocean Energy Management (BOEM) is to hold a tender December 13 for the Massachusetts Wind Energy Area which could host around 4.1 GW of offshore wind capacity, the Department of Interior (DOI) announced October 18.

The BOEM will also prepare an Environmental Impact Statement for the construction and operations plan for the South Fork Wind Project offshore Rhode Island and will publish a call for expressions of interest to build offshore wind plants off central and northern California, the DOI said.

The BOEM has already awarded 13 commercial wind energy leases off the Atlantic coast.

In April, the BOEM launched a lease sale proposal for the Massachusetts Wind Energy Area and opened a 60-day public comment period.

Some 19 companies have qualified to participate in the Massachusetts auction, the DOI said in its latest statement.

“I'm very bullish on offshore wind," U.S. Secretary of the Interior Ryan Zinke, said.

“The Massachusetts sale has a lot of potential for both energy and economic activity,” he said.

Back in December 2016 and January 2017, Statoil Wind and PNE Wind submitted separate unsolicited requests for lease areas OCS-A 0502 and OCS-A 0503 which lie within the Massachusetts Wind Energy Area. Since the two parties nominated the same areas, BOEM plans to proceed with the competitive leasing process. BOEM must award leases competitively, unless it determines there is no competitive interest.

Massachusetts offshore wind lease areas

(Click image to enlarge)

Source: BOEM, October 2018.

The BOEM has also published a notice of intent to prepare an environmental impact statement for Deepwater wind's 90 MW South Fork Wind Project. Earlier this month, leading global offshore wind developer Orsted acquired 100% of Deepwater Wind from owner D.E. Shaw Group at a price of $510 million. Orsted will merge Deepwater Wind's 3.3 GW U.S. offshore wind portfolio with its own 5.5 GW of potential projects, creating the largest U.S. offshore wind pipeline of any developer, it said.

The South Fork project would be situated in Deepwater’s previously-allocated Massachusetts lease site and would send power to Long Island. The Long Island Power Authority (LIPA) approved the power purchase agreement (PPA) for the project in 2017. Deepwater plans to begin construction of the plant in 2021 and start commercial operations in 2022.

Bloomberg New Energy Finance (BNEF) predicts 2.7 GW of offshore wind will be installed in the U.S. by 2025, rising to 6.2 GW by 2030, Tom Harries, Associate at BNEF, told a conference in June.

Massachusetts projects will dominate activity in the early 2020s, while New York State and New Jersey will drive growth in the mid-to late 2020s, according to BNEF.

In a key advancement for Pacific Coast development, the U.S. Bureau of Energy Management (BOEM) has also called for developers to submit information on nominations for offshore wind leases in three designated areas off the California coast.

"This is the first step towards offering a location for wind leasing," the DOI said.

The three zones are situated off Morro Bay and Diabolo Canyon in central California and Humbolt Bay in Northern California, representing a total area of 687,823 acres.

California's deep offshore waters favor floating offshore wind projects and several developers have been developing large-scale facilities in these areas.

MHI Vestas enters US offshore wind with EDF Nautilus deal

EDF Renewables North America has selected MHI Vestas Offshore Wind as the preferred turbine supplier for its 25 MW Nautilus offshore wind project.

The Nautilus project is set to become the first offshore wind project in New Jersey waters and could be online by 2020.

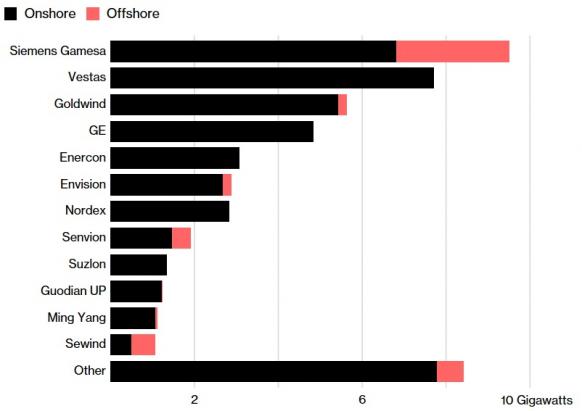

MHI Vestas will supply three 8.3 MW turbines to the project, representing the company's first major contract in the U.S. offshore sector. MHI Vestas has already partnered with EDF Renewables on European offshore projects. Vestas, which owns 50% of MHI Vestas, was the leading global onshore turbine supplier in 2017, installing almost 8 GW of wind capacity.

Top global turbine suppliers in 2017

Source: Bloomberg New Energy Finance (BNEF).

The Nautilus project is fully permitted and is awaiting approval of an offshore renewable energy credit (OREC) agreement from the New Jersey board of Public utilities.

ScottishPower becomes first UK power utility to generate 100% from wind

ScottishPower has agreed to sell its remaining 2.6 GW gas and hydroelectric power plant fleet to Drax to become the first vertically integrated UK power group to produce 100% of its electricity from wind energy.

ScottishPower has agreed to sell eight plants to Drax for a cash price of 702 million pounds ($913.7 million). The transaction will help ScottishPower fund 5.2 billion pounds of planned investments in renewables and smart grids over a four-year period.

ScottishPower currently has 2.7 GW of wind power capacity operating or under construction in the UK and a 3 GW development pipeline consisting almost entirely of offshore wind projects.

ScottishPower and Vattenfall are joint-owners of the 714 MW East Anglia One windfarm under construction off the east coast of England.

ScottishPower will look to secure further UK offshore wind projects when the government holds its next lease rounds, the company said.

The UK government plans to hold offshore wind tenders every two years from May 2019 in a bid to install up to 2 GW of new capacity per year.

The sale of ScottishPower's conventional power assets forms part of growth and carbon reduction plans laid out by Spain's Iberdola, the owner of ScottishPower.

In February, Iberdola announced a 3 billion-euro ($3.4-billion) "global asset rotation plan" which will help the group reduce emissions by 30% by 2020 and 50% by 2030, compared with 2007 levels.

New Energy Update