US grid reliability reforms offer wider role for flexible wind farms

As federal authorities prepare new market rules to stabilize grid reliability and wholesale prices, wind technology enhancements must focus on flexibility and forecasting to ensure long-term value.

Related Articles

An increasing focus on U.S. grid stability and the gradual removal of wind power subsidies are creating fresh challenges for U.S. wind farm developers and technology suppliers.

Developers installed 2 GW of utility-scale wind capacity in the first quarter of 2017, representing the highest first-quarter deployment rate since 2009 and raising total installed capacity to over 84 GW. Some 26 GW of new wind projects are currently under development as larger, higher efficiency turbines lower the cost of wind energy and spur demand from utilities, corporate clients and government institutions.

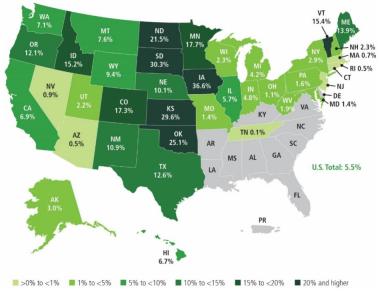

Wind power share of generation by state in 2016

(Click image to enlarge)

Source: American Wind Energy Association (AWEA).

Utility-scale wind is now cost-competitive with fossil-fired output in many regions and the scheduled removal of Production Tax Credits (PTCs) by 2020 will require wind farms to become more integrated with wholesale markets and grid services. Technological advancements will help support wind project returns, but operators will also need to optimize output within wholesale market mechanisms and, in some cases, provide response measures to support grid stability.

In June 2016, the Federal Energy Regulatory Commission (FERC) issued an order which eliminated wind power exemptions from reactive power requirements. In November 2016, the FERC proposed changes to require new large and small generators to install, maintain and operate equipment capable of providing primary frequency response as a condition of interconnection. Last month, FERC called for supplemental market comment on its proposals, specifically on the cost of primary frequency response capabilities for small generating facilities and the role of electric storage resources. The comment period ends September 14.

In parallel, President Trump's administration is studying new initiatives to improve grid stability and market pricing mechanisms in the light of rising renewable energy capacity and low gas prices.

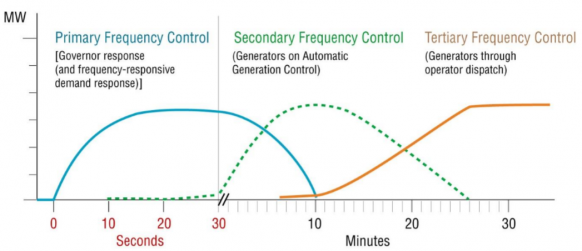

In a new Electricity Market and Reliability report commissioned by Energy Secretary Rick Perry, the Department of Energy (DOE) highlighted that recent technology advancements have enabled wind developers to provide the full spectrum of reliability services including synthetic inertial control, primary frequency control, and automatic generation control.

"To meet the needs of the future Bulk Power System, maintaining sufficient Essential Reliability Services will include a mix of market approaches, technology enhancements, and reliability rules or other regulatory rule changes," the DOE said in its report, reiterating previous comments by the North American Electric Reliability Corporation (NERC).

The DOE called for accelerated implementation of Essential Reliability Services (ERS) mechanisms to create "fuel-neutral markets and/or regulatory mechanisms that compensate grid participants for services that are necessary to support reliable grid operations."

Control mechanisms to restore frequency

(Click image to enlarge)

Source: Lawrence Berkeley National Laboratory.

Some state-level grid transmission operators are already introducing pilot grid projects to incentivise flexibility for wind farms and other renewable energy assets.

The New York’s Independent System Operator (NYISO) is planning to amend market rules to open the state’s energy, ancillary services, and capacity markets to wind, storage and other distributed energy resources.

California has commenced trials to pool distributed wind energy resources to meet the minimum 500 kW threshold to participate in the wholesale market. Meanwhile, Californian storage operators submit a ‘state of charge’ bid parameter for the day-ahead market.

“This will open new market opportunities for distributed energy resource products and services, which will be instrumental to grid reliability in an emerging era of renewable power,” Steve Berberich, President and Chief Executive Officer of the California Independent System Operator (CAISO), said in a statement.

Site settings

Original equipment manufacturers (OEMs) are introducing new technologies to respond to rising flexibility requirements.

“Recently, manufacturers have designed electronic controls for newer model wind turbines that can provide automatic generation control, primary frequency response and synthetic inertia,” the DOE said in its market reliability report.

Turbine suppliers are developing increasingly-sophisticated control systems for utility-scale projects to benefit from growing datasets and analytics capability.

In one example, Chinese turbine supplier Goldwind has introduced a control system which collates wind conditions and load data across a windfarm site and adjusts individual turbine settings to boost overall site production. The control system allows operators to adjust the machine’s output to optimize available wind and maximize potential overall output across the site, while maintaining systems within design limits.

“We can increase the output in response to the site conditions that we have,” Reinhard Sander, Vice President of Engineering at Goldwind Americas, told New Energy Update.

“That could mean as much as 3 to 5% increase in output for the whole of the wind farm,” he said.

GE's Digital Wind Farm platform also offers micro-site functionality through condition-based controls which can, according to the company, increase output by up to 5%.

Improved forecasting algorithms are also enabling more accurate forward scheduling of wind power output. The Electric Reliability Council of Texas (ERCOT) improved the mean absolute error in its day-ahead wind power forecasts from 8% in December 2012 to 5.3% in December 2016, aided by specialist expertise from companies such as AWS Truepower.

Forward wholesale pricing structures could also change under proposals set out in the DOE’s market reliability report.

DOE recommended the Federal Energy Regulatory Commission (FERC) and transmission service operators move forward with efforts to reform energy price formation in wholesale electricity markets to mitigate negative price formation.

The DOE also called for new research into "under-recognized contributions from baseload power plants," by using fuel-neutral metrics to compare the contribution to the grid of different generation types.

Adaptability

As U.S. power markets evolve, technology developers are faced with the challenge of developing new products which adapt to evolving grid codes. This is particularly important for suppliers operating in global markets with different requirements, Sander noted.

“Flexibility is very important as far as grid codes are concerned,” he said.

The DOE’s market reliability report proposed new research and development (R&D) projects into "21st-century" grid reliability and resilience tools to enhance system reliability and resilience.

New technologies should be developed to support Bulk Power System (BPS) reliability in the context of rising renewable energy capacity, it said.

R&D should focus on innovations in sensors and controls, storage technology, and advanced power electronics, to increase the flexibility of grid operations, the report said.

"The Grid Modernization Initiative should also consider additional applications of high-performance computing for grid-modelling to advance grid resilience," it said.

As data analytics raises grid efficiency and power plant performance, wind power systems will need to provide greater market flexibility while fulfilling cost reduction targets to ensure assets can compete over the long term.

By David Appleyard