Wind operators forecast revenue-driven maintenance in push for yield

Evolving risk priorities and growing operational experience are propelling the wind power industry towards revenue-based maintenance contracts, operators told the Wind O&M Dallas 2018 conference on April 17.

Related Articles

The continuing drive towards lower wind costs has accelerated competition in operations and maintenance (O&M) markets and spurred innovations in O&M contracting.

A recent trend in developed wind power markets is the transfer of production risk to O&M providers, to better align the long-term economic interests of owners and service companies.

An increasing number of owners are switching from time-based availability guarantees to performance-based guarantees. Some owners are advancing on to energy-based guarantees where the service provider also takes on wind resource risk.

Earlier this month, EDP Renovaveis (EDPR) implemented its first energy availability-based wind service contracts. Based on technical energy availability (TEA), the new contracts will cover five EDPR wind farms in Portugal, representing a total capacity of 250 MW.

As the wind market matures, the removal or expiry of wind subsidies and the introduction of competitive wind power tenders will see more wind farms exposed to wholesale market risks.

The wind industry is potentially heading towards revenue-based service guarantees where the service provider takes on performance, resource and market risk, Nicholas Rossel, Head of Business Development - O&M Mexico at EDF Renewables, told the conference in Dallas.

"We are not there yet…Ultimately this will likely involve interplay between different entities, not just service providers but different types of vendors that come together to offer this," he said.

Wind power deployment has reached a sufficient level for the industry to move towards revenue-based guarantees, Aday Magec, Technical Manager at Elawan, told attendees.

"We have a lot of operational data...we should move forward...With the existing PPA [power purchase agreement] prices, that is the only way that owners and operators can go in the future," he said.

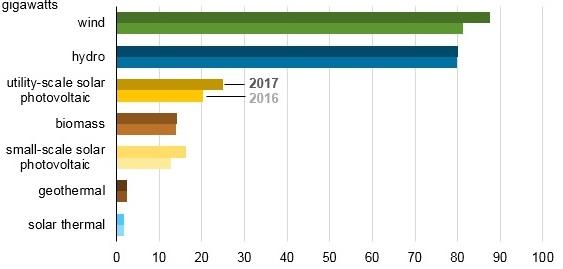

US installed renewable energy capacity by type

Source: Energy Information Administration (EIA).

Transferring risk

Despite technology gains and growing project experience, the North American wind industry faces rising O&M costs in the coming years. The average turbine age in North America will rise from 5.5 years in 2015 to 7 years in 2020 and 11 years in 2025, according to the 2017 IHS Markit Wind O&M Benchmarking in North America report, published in December 2017. O&M costs are forecast to rise from $45,000-$50,000/MW per year for turbines aged between five and 10 years, to around $50,000-$60,000/MW per year for turbines aged between 10 and 15 years, it said.

Wind asset risks can be grouped together into categories such as market/regulation, wind resources, performance value and performance degradation.

Different types of wind asset owners will mitigate these risks in different ways, according to operational strategies and spending power, Rossel told the conference.

"The first step in understanding this is looking at the different risks drivers and understanding where you stand in terms of your ability to take these on," he said.

The transfer of production risk requires significant fleet analysis. EDPR decided to implement its first energy availability contracts following almost 10 years of studies, drawing from in-depth, granular cost assessments and five years of SCADA data, Pedro Alves, EDPR's Transversal Activities Manager, told the Wind O&M EU 2018 conference in February.

The implementation of energy availability terms in services contracts incentivises providers to focus on energy losses and be more flexible in the distribution of their resources, Alves said. EDPRs contracts apply penalties if the service provider falls below energy availability targets.

“The KPI we chose for this contract this year is 98% energy availability,” Alves said

Energy-based guarantees also improve budgeting by reducing the variability of cash flows and provide benefits project finance structures, particularly in emerging markets, Rossel told the U.S. conference.

"You can look to improve your position with lenders with different types of guarantees. That can either be at the beginning of your project with the initial project finance or potentially with refinancing later down the road," he said.

Owners can weigh up their risk tolerance against their spending power to decide the type of performance guarantees they should put in place for their assets, Rossel said.

"If you have...low risk tolerance and high spend, then you may be interested in ultimately a revenue guarantee for your project and guaranteeing the dollars at the meter," he said.

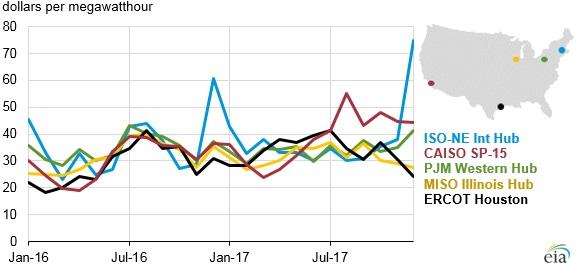

US monthly average wholesale power prices in 2016-17

Boosting yield

Many operators now see time-based availability as an out-of-date concept.

Time availability percentages can sometimes be several percentage points above asset yield, when the opposite should be true, Jason Allen, Chief Operations Officer at Leeward Renewable Energy, told the conference.

"I want to see yield at 98%-- that means [the technicians] are out there taking advantage of the low wind periods, taking the turbines down doing work," he said.

In the end, the performance metrics must translate to increased bottom line for the business. Allen said.

"If I lose 1% of yield that's about $2 to $2.5 million of revenue," he said.

Closer alignment of technician deployment with yield data is a key way to drive up performance and squeeze extra revenue out of assets, Allen noted.

"It's amazing when you give them the right incentives and the right reinforcement what a group of technicians can do," he said.

New Energy Update