Wind turbine technology leaps set to slice maintenance costs

Self-diagnosing turbines, real-time output maximization and “crane less” maintenance will soon impact wind operations, cutting labour costs and increasing generation revenue, Denver Bane, Onshore Wind Services Strategy Leader at GE Renewable Energy, told the Wind Operations Dallas 2019 conference.

Related Articles

Intense competition in the wind market is spurring turbine developers to find new ways to improve performance and minimize costs.

As margins narrow, turbine suppliers are placing an increasing focus on operations and maintenance (O&M) efficiency while targeting a greater share of the services market.

Growing turbine capacities are raising plant efficiency but they are also putting greater pressure on major components and raising logistics challenges.

Wind operators are using economies of scale, improved spare parts strategies and the latest sensor and data analytics technologies to reduce O&M costs.

Turbine suppliers are continuing to improve designs to reduce maintenance requirements while maximizing up-tower capabilities to reduce logistics costs.

Crane less operations, automated turbines and robotics solutions will soon boost efficiency further, cutting outages and increasing energy production, Bane told the conference on April 16.

New solutions currently in development could reduce O&M labor hours and maintenance intervals to a third of today's levels, he said.

Preventing faults

Advances in sensors and analytics have allowed wind asset operators to implement predictive and preventative maintenance strategies and reduce unplanned outages.

New technologies such as thermal imaging blade inspection equipment are providing valuable insights, Bane told conference attendees.

Machine learning can be used to process the images and provide a report to customers within 24 to 48 hours which shows which blades have anomalies and provides recommended remedies, Bane said.

"This technology is incredible...it allows you to inspect blades that are actually running... With that thermal capability we can see subsurface and surface anomalies," he said.

Going forward, GE aims to use advanced sensors and automation to develop prognostics for all failure modes, Bane said.

"In the next one to five years you are going to see turbines coming online with more sensors and capabilities in that regard than ever before and we are going to have better analytics and machine learning to make sense of that data stream," he said.

In one example, GE blade subsidiary LM Windpower is developing a system which uses sensors to quantify blade deflection in real-time for improved turbine control and condition monitoring.

"We can identify loss factors like a mis-aligned blade for instance, and react quicker to that issue," Bane said.

By avoiding unplanned outages entirely, operators could reduce O&M costs by up to 10%, he said.

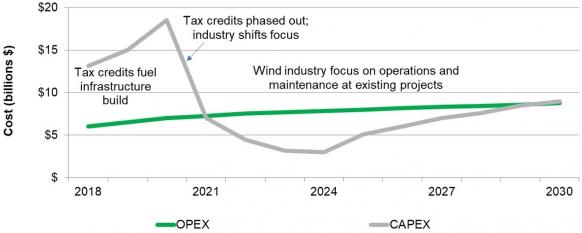

Forecast North American wind opex vs capex

(Click image to enlarge)

Source: IHS Markit, September 2018.

Crane less maintenance

Wind farm operators are continuing to reduce the need for land-based cranes for O&M activities.

By shifting from a replacement to a repair mindset, the reliance on cranes has fallen from 90% of failures, to around 50%, Bane said.

Companies such as GE can already replace gearboxes without using a ground-based crane. New turbines have better upper platform access for up tower repairs and tower integrated lifting capabilities, he said.

GE's latest turbine design includes a larger nacelle platform for better access and improved up-tower troubleshooting systems.

"In uptower repair capabilities, we are now designing for serviceability and investing in design for serviceability more than we ever have in the past," Bane said.

Going forward, operators should aim to be able to perform any major component exchange without procuring a crane, Bane told attendees.

"I think that will be a reality sooner rather than later," he said.

Improved planning and greater cost efficiency could see the cost of major component failure drop from a current estimated level of $100,000-$300,000 per event to $50,000-$150,000, Bane said.

Operators will also need to increase maintenance efficiency to maximize availability.

Maintenance windows provide opportunity to install upgraded parts and advanced data analytics will allow companies to perform activities based on value to the project, Bane said.

"We're going to implement value-based maintenance...You are going to see that across the industry here in the next one to five years," he said.

Self-diagnostics

Smarter turbines with greater monitoring capabilities will have a major impact on troubleshooting and repair efficiency.

New turbine units offering full "self-diagnosing" abilities could be available "very soon," Bane said.

"This will enable [technicians] to bring right parts, tools and skill sets the first time," he said.

Routine repair tasks must be automated where possible, and robots will be able to perform basic touch interactions as well as monitoring and analysis, Bane said.

"A lot of the aviation technology is spilling over into the wind turbine technology. You are going to start seeing robots in the cells, robots in blades...That's going to be here in the very near future," he said.

Augmented reality combined with handheld devices can provide detailed real-time repair guidance, accelerating complex repair tasks and increasing technicians' learning curves, Bane noted.

"Instead of taking five to 10 years for a technician to gain the experience that [he/she] needs, we could see technicians productive after one or two years using tools like these," he said.

Raising revenue

Operators are already using variable speed technology and other upgrades to improve wind turbine performance according to the condition of the turbine and market factors. Pad-specific performance analysis is also used to identify outlying turbine units.

Demand profiles and offtake needs can vary between owners and operators must work with suppliers to maximize revenues, Bane said.

Suppliers are best-placed to ensure assets are operating at design limits and are providing products which respond to increasing need for asset flexibility, he said.

In one example, GE plans to launch later this year "dynamic" uprate capabilities which allow uprating under certain conditions in real-time.

"In the future, continuous optimization to wind, weather, that's the goal," Bane said.

New Energy Update