Chile CSP pioneer signs PPA with Copec; Silicon storage to replace Aurora CSP project

Our pick of the latest solar thermal news you need to know.

Related Articles

Cerro Dominador signs PPA with Copec energy group

Cerro Dominador, Latin America's first CSP plant, has signed a five-year power purchase agreement (PPA) with Chilean fuel distributor Copec, Cerro Dominador, a subsidiary of EIG Global Energy Partners, said December 11.

Located on a 146-hectare site in the Atacama desert, the 110 MW Cerro Dominador plant will enter commercial operations this year. The plant features a 250 meter-high receiver tower and a record 17.5 hours of molten salt thermal energy storage capacity. When joined with an operational 100 MW PV plant, the facility will be able to supply power 24 hours a day. The project was awarded a 15-year power purchase agreement (PPA) in 2014 at a price of $114/MWh. Since then, global CSP costs have fallen dramatically and spurred interest from energy-intensive companies such as Chile's large mining community.

The new PPA with Copec will start in July 2020 and supply 50% of the group's energy needs, reducing its annual CO2 emissions by 19,850 tons. The contract will cover 72 service stations owned by Copec, almost all of Copec's electricity charging stations and eight of its 16 industrial plants in Chile.

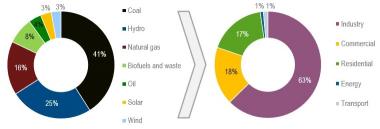

Chile power generation, consumption

(Click image to enlarge)

Source: International Energy Agency Chile energy policy report, 2018

In October, Cerro Dominador acquired the rights to SolarReserve's 450 MW Likana CSP project in northern Chile. Cerro Dominador is preparing to bid the Likana project into Chile's next power auction in June.

The price of the Likana project will set a new record for the CSP industry, undercutting prices set recently in the Middle East and North Africa (MENA), Fernando Gonzalez, CEO of Cerro Dominador, told the CSP Madrid 2019 conference in November.

Last year, Morocco allocated an 800 MW CSP-PV project at $71/MWh, beating an earlier record of $73/MWh set in Dubai. In a 2016 auction, SolarReserve reportedly bid $63/MWh for its 240 MW Copiapo CSP project in Chile, but was outbid by competing technologies.

Silicon storage developer buys SolarReserve Aurora project

Silicon storage developer 1414 Degrees has acquired SolarReserve's Aurora solar energy project near Port Augusta, South Australia, the company announced December 12.

U.S. developer SolarReserve failed to secure financing for its 150 MW Aurora CSP tower project despite backing from the South Australia government.

As a result, the South Australia government has issued a new request for proposals (RfP) for renewable energy capacity to cover 100% of government demand, equivalent to 500 GW/year. Shortlisted participants will enter a request for tender (RfT) in Q1 2020.

The newly-named SiliconAurora project will combine 1414 Degrees' silicon storage technology with solar PV generation.

“Our plan is to progressively increase the generation at the Aurora Project," Kevin Moriarty, Executive Chairman of 1414 Degrees, said in a statement.

"This will limit capital servicing requirements while our technology is proved at increasing scale to more than 1,000 MWh,” he said.

In 2017, the South Australia government awarded SolarReserve a 20-year power offtake agreement for Aurora CSP at a highly-competitive maximum price of A$78/MWh.

Under the arrangement, SolarReserve would take wholesale market (electricity pool) risk on the output over and above the government load profile and retain 75% of renewable energy certificates issued for the plant, it said.

Modular CSP plant developer Vast Solar also plans to submit a project proposal in the South Australia tender, Craig Wood, CEO of Vast Solar, told New Energy Update in November.

In the short term, Vast Solar sees Australia's mining sector as the greatest deployment opportunity and is currently in talks with several potential offtakers over a separate commercial CSP-PV facility.

The facility would feature 30 to 50 MW of CSP capacity and long duration energy storage capacity, Wood said.

“In terms of location, we are assessing several options in some of the highest DNI [direct normal irradiance] locations in Australia,” he said, implying northern or western regions.

New Energy Update