Europe strengthens renewable PPA support as industrials enter market

European Union directives, growing demand from heavy industry, and global contract innovations should see growth in corporate PPAs rise towards U.S. levels in the coming years.

Related Articles

Last month, leading global technology and industrial companies became steering group members of Europe's RE-Source Platform in a bid to accelerate growth in corporate solar and wind purchases.

Falling solar and wind prices and green energy initiatives have boosted demand for corporate renewable power purchase agreements (PPAs), but in some European countries regulatory barriers have hampered growth.

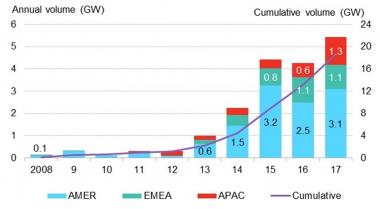

Around 1 GW of corporate renewable PPAs were signed in Europe in 2017, compared with 2.7 GW in the U.S., according to Bloomberg New Energy Finance (BNEF). U.S. volumes will be far higher this year.

Global corporate renewable PPA volumes

(Click image to enlarge)

Source: Bloomberg New Energy Finance (BNEF)

The RE-Source Platform aims to improve Europe's regulatory frameworks for corporate renewable PPAs by implementing common initiatives at European Union (EU) level and increasing the information available to stakeholders.

Thus far, most European renewable PPA activity has been concentrated in northern Europe, making France, Germany, Spain and Ireland priority markets for regulation change, Bruce Douglas, Chief Operating Officer of industry group SolarPower Europe, told New Energy Update.

These countries host large corporates “ready to switch” to renewables and significant potential for new projects, Douglas said.

As demand grows, global renewable energy initiatives and pioneering contract negotiations by technology giants are opening up renewables projects to a wider range of offtakers.

In Europe, a new Renewable Energy Directive (RED II) will help remove barriers to entry while increased standardization of contracts could further accelerate growth.

New rules

The RED II directive, agreed by EU members on June 14, includes a binding EU-wide 32% renewables target for 2030 and commitments to better long-term planning for public support, a simplified permitting process and an enabling framework for self-consumption, including corporate renewable energy sourcing.

"Crucially, European countries will be required under this legislation to identify and remove existing administrative barriers to the development of corporate renewable PPAs," Douglas said.

The new directive also strengthens the role of guarantees of origin in tracking renewable energy, supporting renewable PPAs by providing traceability, Douglas noted.

Further forward, market design proposals currently under negotiation by EU members should boost growth by improving renewable developers’ access to forward markets, ancillary services and new customers.

Industrial demand

Globally, technology groups have pioneered new corporate PPA structures, but demand from other industries is growing fast.

Last month, the European Chemical Industry Council (Cefic) signed a Memorandum of Understanding (MoU) to collaborate on the RE-Source Platform.

"Corporate sourcing of renewable electricity can offer an attractive solution for chemical companies to secure clean and affordable energy with a longer time horizon," Marco Mensink, Cefic Director General said in a statement.

Energy-intensive companies are keen to lock in long-term power supplies at competitive rates.

Earlier this month, Norwegian aluminium giant Norsk Hydro signed a 29-year wind PPA with a subsidiary of Macquarie Group for a new 235 MW onshore wind farm in Sweden.

The contract is believed to be the world’s longest corporate wind PPA, Norsk Hydro said in a statement July 19. The contract secures baseload supply of 0.3 TWh per year for the period 2021 to 2031 and 0.55 TWh/year for the period from 2031 to 2050. In total, the wind farm is expected to generate around 0.8 TWh/year.

"This project is the latest to utilize a new investment model – developing new projects by working with companies who want to buy renewable energy directly," Mark Dooley, Global Head of Green Energy for Macquarie Capital and the Green Investment Group said in a statement.

Energy-intensive groups will require contract frameworks to be simple, flexible and transparent and provide "consistency and certainty" at a European level, Douglas said.

"In Europe, a basic regulatory framework for corporate renewable PPAs should be set up to ensure facilitated PPAs negotiations,” he said.

Virtual contracts

In the U.S., Virtual PPAs have been the most commonly used contract type, through which the purchaser becomes a virtual power buyer. A long-term strike price is agreed and during operations payments are made between counterparties to account for the differences between the strike price and the wholesale price.

Another option is a sleeved PPA, where the buyer negotiates its own PPA agreement with a project and a simultaneous arrangement with a utility who acts as the buyer’s agent.

"We are seeing innovation in risk management solutions to meet these evolving needs," Mark Porter, Manager at the Rocky Mountain Institute’s Business Renewables Centre (BRC), told New Energy Update.

"Some of these, for example the price collar, are written into the PPA contract, while others, such as the proxy revenue swap, sit alongside the PPA to provide the non-utility buyer with overall the risk protection it needs," he said.

Multi-buyer PPAs are also on the rise as falling renewables costs attract smaller companies to the table.

Energy-hungry tech groups such as Facebook and Microsoft are acting as "anchors" for renewable PPAs, lowering risk for smaller counterparties.

In one example, Microsoft recently signed a 315 MW solar PPA for SPower’s 500 MW Pleinmont project in the U.S. state of Virginia.

The contract is expected to attract smaller firms to purchase power from the project. Microsoft's strong credit rating will support project financing and allow the remaining production from the project to be sold at a “lower rate," Brian Janous, Microsoft's General Manager of Energy, told New Energy Update in April.

US corporate renewable energy deals

(Click image to enlarge)

Source: Business Renewables Center (BRC)

Wider deployment of aggregated purchases is required to attract more smaller offtakers, Lori Bird, Principal Energy Analyst and Member of the Market and Policy Analysis Group at the National Renewable Energy Laboratory (NREL), said.

Companies also want more flexibility on contract durations with some calling for shorter durations of “around 10-12 years,” Bird said.

“Many buyers are pushing developer counterparts for shorter term contracts,” Porter said.

“We've seen this push run into the (typical) 10-year financing period acting as a minimum term limit,” he said.

Faster negotiations

Standardization of PPA contracts could help simplify negotiations and reduce costs, Douglas said.

PPA negotiations must address areas such as price risk, curtailment risk or balancing responsibility and negotiations can take up to "up to 18 months," Douglas said.

Standardization of contracts could streamline negotiations, lower soft costs and attract more small and medium-sized enterprises into the renewable PPA space, Douglas said. For developers, simpler and shorter PPA negotiations would expedite investment decisions and help to accelerate new installations, he said.

Standardization could initially focus on areas such as financing terms, contract durations, operations and metering and interconnection arrangements, Douglas said.

Meanwhile, the efficient implementation of RED II will require efforts at all levels of government. National level implementation is due to start in 2021 and could potentially face "consistency and interpretation issues" between EU member states, Douglas said.

"The deadline of end 2018 for final national plans will give significant clarity to what each member state is planning," he said.

New Energy Update