Falling prices boost UK solar outlook but land, offtake risks remain

Plummeting solar costs have reignited UK market activity but growth rates will depend on land rents, grid upgrades and long-term offtake demand, leading solar developers said.

Related Articles

Falling solar technology costs and rising energy prices have reignited development activity in the UK solar market, following three straight years of decline, the Solar Trade Association (STA) said in a report published in December.

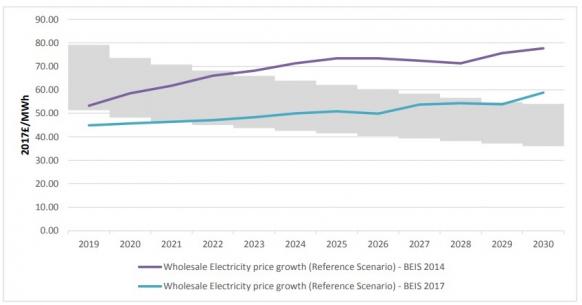

Utility-scale solar costs are estimated at between 50 and 60 pounds per MWh ($64.8-$77.8/MWh) in 2019, far below the STA's previous prediction of 80 pounds/MWh, made in 2014.

Solar plants are now highly competitive with combined cycle gas turbine (CCGT) plants and onshore wind projects, STA said.

Falling panel prices have been the main driver of cost reductions, but innovations in balance of system and operations and maintenance (O&M) practices have also played a role. Plant lifespans are also increasing with some developers now predicting 40 years of operations.

Developers expect further cost reductions to unlock new project opportunities in the coming years.

"Solar PV growth in the UK will be driven by continued cost reduction of solar panels as well as a reduction in balance of system costs” Wolf Dietrich, General Manager at developer Solarcentury, told New Energy Update.

A further 10 to 20% reduction in costs would "make a lot more projects feasible in the UK," Dietrich said.

By 2030, solar costs could fall to as low as 40 pounds/MWh, undercutting wholesale prices and making solar the U.K.'s cheapest energy source, STA said in its report.

Forecast UK solar costs vs power prices

(Click image to enlarge)

Source: Solar Trade Association

To meet these cost forecasts, solar developers will have to overcome grid connection and land availability challenges and secure a share of the emerging corporate PPA market.

Site obstacles

Grid availability and connection costs remain a critical issue for many solar developers in the UK.

Grid costs vary widely but STA predicts costs for a 10 MW PV plant in South England could rise from a baseline assumption of 50,000 pounds/MWp in 2018 to 58,000 pounds/MWp in 2025.

"Continued distribution network congestion will drive increases in grid connection costs, but we factor in some mitigation of this effect in future as a result of increased availability of more flexible network connection options," STA said in its report.

District Network Operators (DNOs) must continue to deploy technology and, where necessary perform grid upgrades, to update the UK's "outdated" network infrastructure,” David Peill, Commercial Director at British Solar Renewables, told New Energy Update.

"Western Power Distribution (WPD), Scottish & Southern Energy (SSE) and UK Power Networks (UKPN) in particular have made significant steps with active network management trials, whereby new generation is subject to restriction during times of peak generation but otherwise can connect and export," he said.

The U.K.'s relatively high population density also creates land cost and permitting challenges.

Landowners often expect unrealistic lease rates, given the removal of solar subsidies and increasing price competition in the UK power market, Dietrich said.

In the past, higher subsidies for solar projects meant that farmers could often secure annual rents of 1,000-1,200 pounds per acre, Dietrich said. In the current market, solar projects might only become feasible at rents of around 600 pounds/acre and this is still a favorable price compared with crop production margins, he said.

Economic consequences from Britain's exit from the European Union (Brexit) could also impact UK land prices.

Operations focus

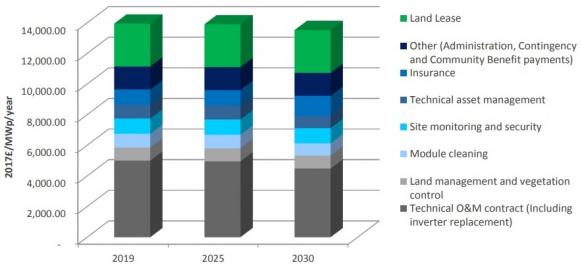

Further falls in capex will increase the share of operational expenditure in project costs.

UK market participants predict only marginal reductions in operations and maintenance (O&M) costs in the coming years.

“These [O&M] costs have already dropped considerably, we don’t see a lot of margin for further reductions that would have a significant impact on project feasibility,” Dietrich said.

Rising insurance costs could inflate O&M costs going forward, STA said in its report. This would be offset by falling O&M contract costs, it said.

Forecast UK solar opex by category

(Click image to enlarge)

Source: Solar Trade Association

Wholesale hedge

Growing renewables capacity will reduce the ability for solar operators to capture wholesale market prices during high wind and solar periods, STA warned in its report.

Without access to a contract for difference (CFD) price floor, solar developers will need to procure bankable long-term power purchase agreements to secure revenues.

“Investors are getting more comfortable with subsidy-free projects...but only where the income is provided by a fixed term corporate PPA from a bankable organisation," Peill said.

The global corporate renewable PPA market is growing fast as companies capitalize on falling costs to meet growing sustainable development objectives.

Corporate renewable energy purchases in Europe, Middle East and Africa (EMEA) rose 109% in 2018 to 2.3 GW, BloombergNEF (BNEF) said in a recent report.

European Union directives and growing demand from heavy industry is set to accelerate PPA activity in Europe. However, UK PPA growth remains "extremely slow" due to current corporate carbon reduction mechanisms, STA warned in its report.

The UK government should extend exemptions from national Climate Change Levy (CCL) charges to corporate solar PPAs to incentivize contract procurement, STA said.

"This will help to build up experience in the PPA model among both developers and corporates, further enabling future cost reductions," it said.

By Beatrice Bedeschi