Giant Oregon wind-solar plant to use 4-hour battery for peak shifting

The 380 MW Wheatridge facility will use battery storage to shift solar supply to evening peak periods as local utility Portland General Electric (PGE) prepares for further solar buildout, PGE told New Energy Update.

Related Articles

Last month, Portland General Electric (PGE) and NextEra Energy Resources agreed to a build 380 MW wind-solar-storage plant in Oregon.

The Wheatridge Renewable Energy Facility will be the largest 'hybrid' renewable plant in the U.S., incorporating 300 MW of wind capacity, 50 MW of PV solar and 30 MW of battery storage. GE Renewable Energy will supply 120 wind turbines while the solar and battery storage technology is yet to be announced.

Due online in 2020-2021, the new facility will increase PGE's contracted wind capacity to over 1 GW and hike its solar capacity from the current level of 13 MW.

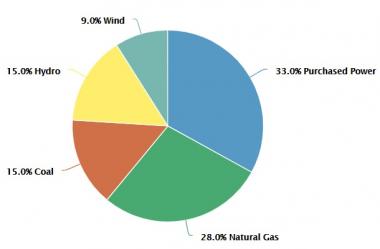

PGE's current power supply mix

(Click image to enlarge)

Source: Portland General Electric

The battery section will provide four hours of storage capacity at full discharge and will charge from the solar array only, Steve Corson, spokesman for PGE told New Energy Update.

The battery will maximize output from the facility and help PGE cover evening demand peaks, Corson said.

Customer load typically peaks in the morning and evening and the battery is expected to be "particularly useful” during the evening peak period as solar generation drops, he said.

PGE predicts further solar development in the region and plans to submit a multi-year integrated resource plan to the Oregon Public Utility Commission this summer.

Oregon's renewable portfolio standard requires PGE to procure 50% of customer needs from renewable resources by 2040 and this will require "very significant additions to our renewable portfolio," PGE said.

Coupling gains

PGE will own 100 MW of the wind project and NextEra will own the balance of the project and sell its output to PGE under 30-year power purchase agreements.

The split ownership and PPA structure will allow the two companies to “share project risks and benefits,” PGE said.

The wind farm section of the Wheatridge project is due online by December 2020 and will qualify for 100% of the federal production tax credit (PTC). The solar and battery plants are scheduled to be built in 2021 and will qualify for the federal investment tax credit (ITC).

Solar developers are moving into the solar plus storage market to take advantage of falling battery prices, cost savings and revenue gains from coupling PV and battery technologies.

As solar capacity rises, solar plus storage becomes a more attractive solution to cover evening peak demand. PV plus storage projects are spreading from Southwest U.S. markets into more eastern states, replacing retiring coal-fired generation in a direct threat to gas plant developers.

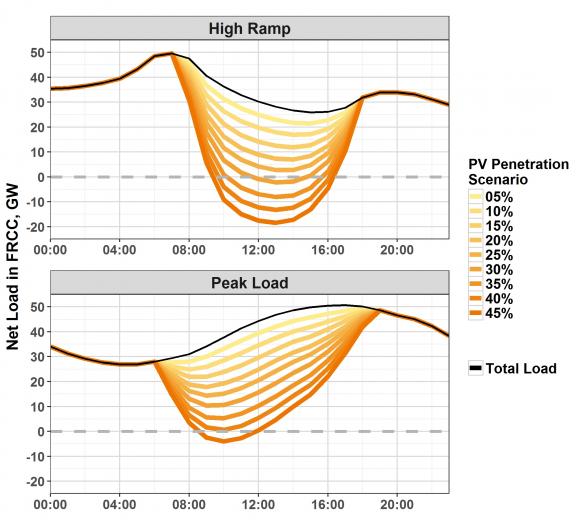

Florida is rapidly expanding its solar capacity and will require greater energy shifting resources to mitigate the ‘duck curve’ effect on prices already experienced in California.

Supply and demand-side energy shifting measures will become more important in Florida when PV penetration reaches levels of 15% to 20%, researchers at the National Renewable Energy Laboratory (NREL) said in a recent study.

Florida PV impact on net load ('Duck curve')

(Click image to enlarge)

Source: National Renewable Energy Laboratory, 2018

Developers predict falling balance of system costs and engineering improvements will create new opportunities for solar plus storage.

Coupling PV and storage increases revenue by utilizing otherwise clipped energy, while also reducing costs through system synergies such as sharing of components.

However, the benefits of coupled systems compared with separate systems can depend on inverter loading and tracking systems, NREL noted in a 2017 report.

For example, shared inverter systems on coupled plants can decrease revenue by restricting storage operation during high solar periods, it said.

Solar plus storage projects are also subjected to higher interest rates than stand-alone storage projects due to the relative lack of operational experience.

As more projects are deployed, financing costs should fall, helping projects to become competitive without government subsidies.

The Wheatridge project will clearly benefit from economies of scale on installation and operations costs.

Labor costs represent a significant share of project costs and the combined technology types should provide synergies. Once operational, the plant will employ around 10 full-time staff.

Dispatch strategy

NextEra and PGE will need to optimize battery dispatch and charge profiles to minimize lifetime costs.

Dispatch decisions impact system degradation, future upgrade revenues and maintenance windows for coupled systems.

Elements affecting lithium-ion battery degradation include level of charge, and depth of charge-discharge cycles and temperature.

Lithium-ion batteries typically require maintenance and augmentation every 6 to 10 years, which would equate to several major maintenance projects during the 30-year PPA contract. The shorter life spans of batteries mean that solar plus storage operators can take advantage of falling battery costs and wider system improvements to maximize returns over the lifetime of the project.

“We would expect to optimize the storage facility’s dispatch to times when the energy is most beneficial to PGE customers while ensuring the activity is not overly degrading to the batteries,” Corson said.

By Beatrice Bedeschi