Global PV costs fall 13% in 2019; Bifacial offers higher returns at over 93% of sites

Our pick of the latest solar news you need to know.

Related Articles

Global PV costs fall by 13% as module pressure continues

The global average levelized cost of energy (LCOE) of new solar plants fell by 13% in 2019 to $68/MWh, the International Renewable Energy Agency (IRENA) said in its latest annual Renewable Power Generation Cost report.

The average installed cost of utility-scale PV fell by 18% last year to $995/kW, the agency said.

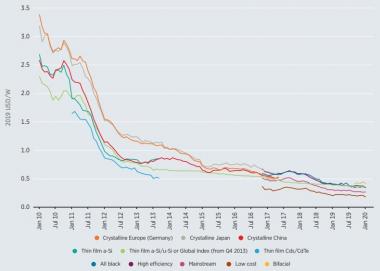

The cost of mainstream module technology fell by 14% in 2019 to $0.27/W. Prices in December 2019 ranged from $0.21/W for low-cost modules to $0.38/W for all-black modules, it said.

PV prices will continue to fall at learning rates of over 23% in the coming years, due to improvements in wafer and cell performance, advances in bifacial cells and improved layouts, according to the latest annual Photovoltaic Roadmap (ITRPV), published by German engineering industry group VDMA last month. This implies selling prices will fall by over 23% for every doubling in cumulative PV shipments.

Data for bifacial modules has become available as more developers opt for this technology, IRENA said.

Bifacial module costs were 56% higher than mainstream mono facial modules in 2019 and 18% higher than the most expensive options, it said.

PV module prices by technology, supplier country

(Click image to enlarge)

Source: IRENA's 'Renewable Power Generation Costs 2019' report.

In recent months, bifacial module costs per Watt have been "within a close range of the higher performing monofacial options," IRENA said.

"This may support expectations of increased bifacial technology adoption in the market, given its potential for increased yield per Watt, compared to monofacial technologies," it said.

Bifacial systems are lowest cost option at over 93% of sites: study

Single-axis tracker bifacial plants are the lowest-cost option for 93.1% of global solar sites on a levelized basis, according to a new study by the Solar Energy Research Institute of Singapore (SERIS), published in the journal 'Joule.'

The researchers estimated the irradiance on both side of modules for different system designs. Performance calculations were validated against actual field data and extrapolated over a 25-year lifetime.

Single-axis tracker bifacial systems can increase energy yield by 35% and reduce the levelized cost of energy (LCOE) by 16% compared with conventional monofacial systems, the study said.

"Although dual-axis tracker installations achieved the highest energy production, due to their current high costs, they only reached the lowest LCOE values for locations very close to the poles," it said.

A regional sensitivity analysis showed that factors such as weather and local cost parameters can favor non-bifacial single-axis designs, the researchers noted.

For example, land cost and shading risks were not covered in the study.

US PV life expectancy rises to 32.5 years

The average life expectancy of US utility-scale PV projects rose to 32.5 years in 2019, according to a survey of project developers and consultants by the Lawrence Berkeley National Laboratory (Berkeley Lab).

Module manufacturers now typically offer warranties of 25 or 30 years. Many plant owners expect lifespans over 35 years, while very few anticipate lifespans below 30 years, the survey showed.

Life expectations also outstrip long-term power purchase agreements (PPAs), extending the "merchant tail" period exposed to power price risks, Berkeley Lab noted.

Current life expectation of US PV plants

Source: Survey by Berkeley Lab, December 2019

Estimated lifetime operational expenditure (opex) was $17,000/MW/year in 2019, compared with $35,000/MW/yr in 2007, the survey showed. The latest opex estimates range between $13,000 and $25,000/MW/yr.

Operations and maintenance (O&M) costs have fallen significantly in recent years and were estimated at between $5,000 and $8,000/MW/yr in 2019, the laboratory said.

India's Adani wins world's largest solar build program

India has awarded Adani Green Energy Limited (AGEL) 8 GW of new solar projects, the world's largest ever solar development award, AGEL said in a statement June 9.

The projects will require $6 billion of investments and will be built over a period of five years. AGEL has also committed to build 2 GW of new solar cell and module manufacturing capacity in India by 2022, the company said.

The Adani group has launched a major clean energy investment drive and the new projects will double AGEL's renewable energy capacity. The group aims to install 25 GW of renewable power capacity by 2025 and become the world's largest solar power company.

In February, French oil major Total acquired a 50% stake in AGEL's solar business for around $500 million.

Total and Adani Green Energy Limited (AGEL) would create a 50/50 joint venture into which AGEL will transfer its solar assets, consisting of 2.1 GW of operational capacity and 475 MW of capacity under development, the French group said.

India aims to increase its installed renewable energy capacity from 81 GW in 2019 to 225 GW by 2022, which includes 50 GW of large-scale hydroelectric capacity.

New Energy Update