PV operators probe wider costs of inverter upgrades

Operators must factor in wider plant impacts, supply chain stability and ongoing technology advances when repowering inverters, experts told the PV Operations Europe 2020 conference.

Related Articles

As solar fleets age, operators are increasingly looking to repower their assets to improve competitiveness.

A key focus area for operators is the upgrade of inverters, the primary source of solar plant downtime.

Global demand for replacement inverters is forecast to grow by 40% in 2020 to 8.7 GW, over half of which will be in Europe Middle East and Africa (EMEA), research group IHS Markit said in a new report.

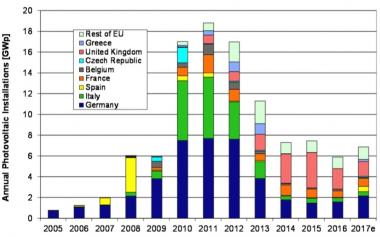

Europe annual PV installations by country

(Click image to enlarge)

Source: European Commission's PV Status Report 2017.

Inverters typically represent 5 to 10% of project costs and new designs can boost performance and provide additional reliability and maintenance benefits. Modern inverters offer improved access, higher voltage, monitoring, and autonomous control functionality. In some cases, operators may choose to switch from large central inverters to string inverter systems.

To minimize upgrade risks, operators must perform a health check of the full solar facility with future components in mind, experts told the conference on March 5.

Other key decision drivers should include parts availability, supplier stability and looming technological advances, the experts said.

Performance focus

UK asset management group Gresham House recently assessed inverter repowering options at four of its oldest PV sites, two of which use central inverters while two use string inverters, John O'Toole, Technical Director at Gresham House, said.

"We are focusing first on the central inverters because they have the biggest impact on downtime," he said.

US solar O&M costs by category (2018)

Source: U.S. National Renewable Energy Laboratory (NREL).

At one of the sites, Gresham House chose to replace two 500 kW central inverters with string inverters, largely due to extra cabling requirements for a new central inverter.

"That's probably what we are likely to do on the second site," O'Toole said. "It's a very site-specific question...The approach is slightly different for each due to layout and configuration changes."

Inverter replacements can require additional component upgrades, O'Toole noted.

To replace the central inverter with string inverters, Gresham house had to replace transformers and cabling at the original combiner boxes, he said.

Holistic view

Operators must conduct a comprehensive performance analysis of the solar facility when making repowering decisions, as new components can introduce new sensitivities, Nicola Waters, Managing Director at UK O&M group PSH Operations, told the conference. PSH performed around 45 MW of repowering projects last year.

Other key considerations include electrical configurations, permitting and grid requirements, physical access and requirements of manufacturers down the supply chain, Waters said.

In one example, PSH replaced a 1.25 MWp central inverter that was underperforming due to poor EPC design, with a 2.2 MWp inverter. PSH typically assumes a budget of 60,000-90,000 pounds per MW ($71,000-$107,000/MW) for a central-to-central inverter replacement and this particular project increased the performance ratio (PR) by around 4.1%.

Testing the existing solar field revealed cable faults that hadn't been identified through preventative maintenance, Waters said.

"Doing a full field test before...thinking about the future-- what systems are going to be in there in the future-- is so, so important," she said.

The careful planning of deliveries to avoid unnecessary costs for on-site staff, involvement of the monitoring company in the project and salvaging of unused equipment also aided efficiency, Waters said.

"It's worth trying to salvage any equipment…Think about where else you might be able to use it, can you recycle it, can you upcycle it even, that's becoming more important, especially as more manufacturers are using generic parts," she said.

Future supply

Market consolidation has also been a key driver of inverter decisions as operators favor suppliers with stable outlooks and supply chain access.

"Replacement inverters of old generation inverters may simply not be available anymore," IHS Markit said in its report.

To mitigate these risks, O&M providers are developing specialist in-house inverter expertise and warehousing inventories of spare parts, it said.

At one of its central inverter sites, Gresham House chose to implement optimization add-ons rather than repower, based on stronger inverter performance and the expectation of a stable supply chain for the next five or 10 years, O'Toole said.

"The string inverter sites have a supply chain which can basically maintain the existing fleet of inverters for some time, once that supply chain starts to dry up then I think we will quickly reconsider replacement of those inverters," he said.

Disruptive gains

Operators must also take into account ongoing advances in inverter technology when deciding the timing of repowering.

"Technology is improving very quickly, they are designing new central inverters which can be switched out and the parts can be replaced like you have a string inverter inside the central inverter," Waters said.

"It might be worth in some cases waiting for that technology to come through... If you are not desperate to get that uplift right now," she said.

Operators may also want to use new lease models that manufacturers are set to offer going forward.

These may suit "some cases, where big repowering is on the cards," Waters said.

Robin Sayles