‘Big four’ turbine suppliers install 53% of global market; Pattern, Invenergy sign analytics deals

Our pick of the latest wind power news you need to know.

Related Articles

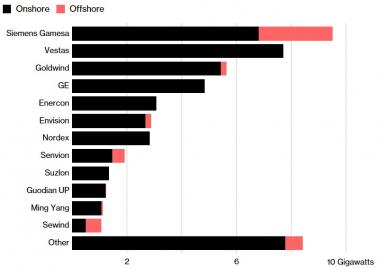

"Big four" turbine suppliers install over half of market in 2017

The four largest manufacturers of onshore wind turbines supplied 53% of the global wind market in 2017, further consolidating their market share ahead of smaller players, Bloomberg New Energy Finance (BNEF) said in a report published February 26.

Aggressive price competition continues to spur consolidation of the wind turbine market and new installed capacity fell 12% in 2017 to 47 GW, mainly due to a slowdown in China, BNEF said. New installations are expected to rebound to 55 GW in 2018 "as the Chinese market returns to growth and Latin America continues its expansion," BNEF said.

Denmark's Vestas remained the world's largest turbine supplier, commissioning 7.7 GW of new onshore capacity equivalent to 16% of the global market, BNEF data shows.

Siemens Gamesa, formed in 2016 from the merger of Germany's Siemens and Spain's Gamesa, commissioned 6.8 GW of new wind capacity in 2017. This raised Siemens Gamesa's market share to 15%, up from 11% in 2016 (combined), allowing the company to leapfrog GE and Goldwind in the global rankings. Including offshore turbines, Siemens Gamesa became the largest supplier with a total of 9.5 GW.

China's Goldwind commissioned 5.4 GW of new capacity for a share of 11%, retaining its position as third-largest supplier. GE commissioned 4.9 GW, representing 10% of the global market, which saw it slip from second-largest supplier to fourth-largest.

“We’ve seen a wave of mergers in the wind turbine manufacturing industry in the last few years, including the Siemens-Gamesa deal and Nordex’s takeover of Acciona Windpower," Albert Cheung, Head of Analysis at BNEF, said in a note.

"With a large number of small players outside the Big Four, it would be no surprise to see further consolidation,” Cheung said.

Top turbine manufacturers in 2017

(Click image to enlarge)

Source: Bloomberg New Energy Finance (BNEF)

In 2017, a number of small- and medium-size turbine vendors were either required (China Creative Wind Power), filed for insolvency (FWT Energy and Seawind), entered into receivership (Vergnet) or withdrew from the wind industry (Daewoo and JSW), FTI consulting noted in a separate report.

"In addition, to gain a new strategic positioning, Siemens Gamesa decided to discontinue Adwen turbines, Enercon took over Lagerwey (technology and emerging market opportunity) and most recently Vestas brought Utopus Insights (data analytics)," the consultancy said.

According to BNEF, Germany’s Enercon was the fifth-place manufacturer in 2017, commissioning 3.1 GW. Six other turbine makers from Europe and China commissioned between 1 GW and 3 GW.

In terms of geographical spread, more than 90% of Goldwind's turbines were commissioned in China, while General Electric remained stronger in the Americas than other global regions, BNEF said.

Vestas and Siemens Gamesa both commissioned significant capacity across the three main regions of Europe Middle East and Africa (EMEA), the Americas and Asia-Oceania.

Almost all of Enercon's capacity was commissioned in Europe.

Onshore wind turbine capacities continue to rise, and seven turbine manufacturers have now launched 4 MW models, according to FTI consulting. These include, Enercon, Vestas, Nordex Acciona, GE, Siemens Gamesa, Goldwind and Envsion.

In the offshore wind market, Siemens Gamesa remained the dominant global supplier, commissioning 2.7 GW of projects, BNEF said. Other suppliers such as China's Sewind, internationally-owned MHI Vestas and Germany's Senvion commissioned around 0.5 GW each.

Uptake to supply analytics to Pattern Energy

U.S. analytics supplier Uptake has signed an agreement with Pattern Energy to pilot predictive analytics software at its 200 MW Logan's Gap Wind facility in Comanche County, Texas, Uptake said February 22.

Since 2016, Chicago-based Uptake has been piloting its wind predictive analytics software with MidAmerican Energy Company, an operator of 4.3 GW of U.S. wind capacity. Both companies are owned by Berkshire Hathaway Energy (BHE).

Uptake plans to complete installation across MidAmerican's entire wind fleet by April, Uptake directors told a New Energy Update webinar in October.

Many wind operators are now using predictive analytics products to optimize maintenance activities and analytics suppliers are expanding system capabilities to tackle the upcoming challenges faced by wind owners.

“Pattern Energy has been impressed with the value Uptake has brought to wind fleets and major companies in other industries,” Ben Rice, a senior engineering manager for Pattern Energy, said.

In just three years, Uptake has expanded into multiple sectors such as mining, oil and gas, rail, aviation, construction and manufacturing.

In the wind sector, the company is developing new functionalities which will increase the sophistication of the system and allow operators to respond to a range of market conditions.

The gradual removal of tax credits for new wind farms and expiry of credits for older turbines will expose more plants to wholesale market prices. In order to minimize costs, wind fleet operators must shape their O&M strategies around wholesale market drivers, as well as system performance.

NarrativeWave signs analytics contract with Invergy

Analytics supplier NarrativeWave is to deliver wind farm software to Invergy, the U.S.'s largest privately-held renewable energy company, under a new three-year deal, the companies announced February 21.

Invenergy currently operates around 8 GW of wind, solar and gas-fired power capacity.

Following a 60-day pilot, Invenergy has agreed to use NarrativeWave’s software to optimize its fleet of wind turbines and other renewable energy assets.

The pilot involved "empowering mechanical, electrical, and turbine performance subject matter experts (SMEs) to rapidly build analytic models and deploy them across a fleet of turbines without the need for data scientists," the companies said in a statement.

In some cases, the new processes reduced return-to-service times by over 50%, the firms said.

NarrativeWave is already active in the Energy, Aerospace, Manufacturing, Oil & Gas, Mining, Transportation, and Heavy Equipment sectors.

New Energy Update