Coronavirus threatens 35,000 US wind jobs; Lockdowns cut power demand, shift loads

Our pick of the latest wind power news you need to know.

Related Articles

US wind industry calls for coronavirus aid to limit job cuts

US wind, solar and hydro industry groups have called on Congress to extend tax credit deadlines for renewable energy projects to prevent mass job losses from the coronavirus pandemic.

On March 25, the U.S. Senate reached a deal on a $2 trillion coronavirus aid package to rescue the economy, the third introduced by the Trump administration. Details of the package were not yet published at 12:00 GMT.

Supply chain delays following the COVID-19 outbreak is putting 25 GW of wind projects at risk, representing $43 billion of investments, the American Wind Energy Association (AWEA) said in a statement March 19. This is jeopardizing 35,000 jobs across wind manufacturing, installation and servicing, it said.

Before the virus outbreak, the US was forecast to install a record 18.5 GW of wind capacity in 2020 as developers raced to meet end-of-year deadlines for production tax credits (PTCs), data from the U.S. Energy Information Administration (EIA) showed. Most of this capacity was scheduled to be installed in the fourth quarter and installation activity was expected to remain strong in 2021, EIA said.

Deadlines for construction start and safe harbor of wind turbine components should be extended by two years while renewable tax credits should be made available for direct pay due to a reduced availability of tax equity, AWEA said.

"Decisive government action in the short term can do much to soften the virus’ effects," it said.

Germany loosens installation deadlines, retains 2020 tender dates

Onshore wind developers in Germany will be allowed to apply for extensions to construction deadlines following the supply chain disruption caused by the coronavirus pandemic, Germany's energy regulator Bundesnetzagentur (BNetzA) said March 23.

To avoid penalties, developers will be required to submit applications by email, stating the reasons for the delay, BNetzA said.

Power industry group VDMA welcomed the move. Import interruptions have impacted Germany's renewable energy supply chains, delaying some projects, VDMA said.

For the moment, the dates of future renewable energy tenders will remain unchanged, BNetzA said.

Some 900 MW of onshore wind capacity is scheduled to be tendered June 1, followed by 300 MW in July, 400 MW in September, 900 MW in October and 400 MW in December.

BNetzA will inform the tender winners but will not publish the results online or enforce implementation deadlines until after the impact of the coronavirus has softened, the agency said.

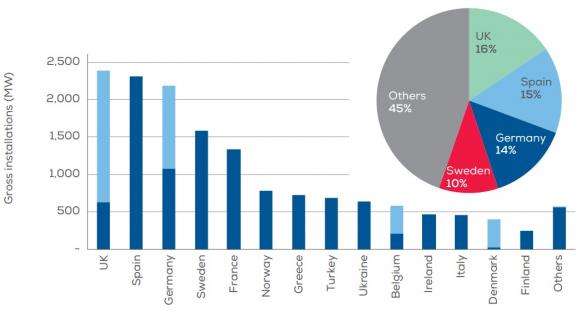

Spain installed 2.3 GW of onshore wind in 2019, the highest in Europe. Most of the projects now underway in Spain are not subject to strict completion deadlines, AEE, the Spanish wind industry association, noted in a statement March 20.

AEE would monitor the situation and work with its members, the group said. In addition to supply chain disruption, coronavirus restrictions could delay administrative procedures such as grid connections, it said.

New European wind capacity in 2019 by country

(Click image to enlarge)

Source: WindEurope, February 2020

Even before the virus spread in the West, China's coronavirus lockdown was impacting the global wind energy supply chain, industry group WindEurope said March 16.

"With COVID-19 we are likely to see delays in the development of new wind farm projects which could cause developers to miss the deployment deadlines in countries’ auction systems and face financial penalties," the industry group said.

"Governments should be flexible on how they apply their rules. And if ongoing auctions are undersubscribed because developers can’t bid in time, governments should award what they can and auction the non-awarded volumes at a later stage,” it said.

Coronavirus slices power demand, shifts load patterns

The escalating coronavirus pandemic has sliced power demand in Europe and the US, pushing down prices and altering daily demand patterns, data from grid operators show.

The closure of factories and offices has reduced business power demand and this has not been offset by residential demand. In most countries, restrictions on movement will tighten in the coming days and weeks, further impacting power demand and asset operations.

In Germany, a manufacturing powerhouse, industrial demand could fall by up to 20% this year due to the coronavirus crisis, reducing power prices by almost 5%, Enervis energy consultancy said March 16.

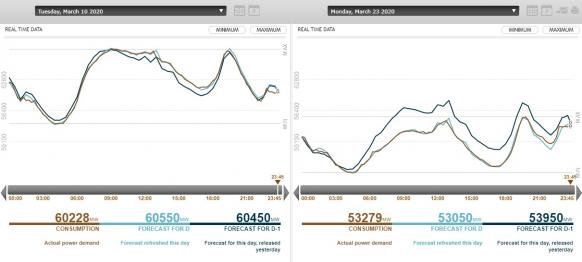

In France, national power demand has fallen 15% since self-distancing measures were put in place, national grid operator RTE said March 19. On March 17, France ordered people to stay at home unless they had to perform essential duties, after the closure of bars, restaurants and non-essential shops failed to limit congregations. On March 23, France enforced perimeter limits on civilians.

This is new territory for demand forecasters, RTE said.

"There is no reference scenario that allows us to predict day-ahead demand as accurately as usual...RTE forecasters are having to adjust their forecasts in real-time," it said.

French power demand is rising more gradually than normal during the morning, hitting a lunchtime peak around 13:00 local time, then falling more sharply than usual in the afternoon ahead of the evening peak period, the grid operator said.

French power demand before, after lockdown

(Click image to enlarge)

Source: RTE (France's national grid operator)

In Italy, where coronavirus fatalities have soared, power demand fell by up to 9% following a nationwide quarantine March 13, according to S&P Global Platts Analytics.

In the U.S. ISO New England region, early changes in behaviour following the coronavirus outbreak had reduced power demand by 3 to 5% compared with normal levels, ISO New England said March 20.

"Our forecasters are seeing load patterns that resemble those of snow days, when schools are closed and many are home during the day. These patterns include a slower than normal ramp of usage in the morning, and increased energy use in the afternoon," the ISO said.

"Though the pandemic is affecting energy usage, weather conditions remain the primary drivers of system demand," the operator noted.

"We will continuously monitor these ever-changing trends in load patterns, and make the appropriate adjustments to calculate an accurate load forecast," it said.

In other news:

Oil group Total enters floating wind market

Oil and gas giant Total has entered the floating wind market by acquiring 80% in Simply Blue Energy's 96 MW Erebus floating windfarm project in Wales, UK, Total said in a statement March 20.

The Erebus project will use Principle Power semisubmersible floating wind technology and is due online in the mid-2020s.

The project will be sited in water depths of 70 m in the Celtic Sea. The new development company, Blue Gem Wind, has submitted an application for the site to the UK Crown Estate, Simply Blue said.

"This site and others that are planned to follow will be developed for deployment of Principle Power’s WindFloat technology with the turbines being chosen during the development process," Simply Blue said.

Total joins a growing group of oil and gas companies backing floating wind technology. Norway's Equinor, UK-Dutch group Shell and Spain's Repsol have all invested in floating wind projects, bringing financial power and offshore expertise to early-stage deployment.

Total's announcement came as oil groups cut capital and operational spending following a slump in oil prices. On March 18, the price of Brent crude fell below $25/barrell, its lowest level for 17 years, due to a supply-led price war and ongoing coronavirus effects.

"Floating offshore wind is an extremely promising and technical segment where Total brings its extensive expertise in offshore operations & maintenance," Patrick Pouyanne, Chairman & CEO of Total, said.

"Total has the appropriate skills to meet the technological and financial requirements that determine the success of future floating offshore developments,” Pouyanne said.

New Energy Update

This article was amended March 26 to correct the value of the US coronavirus aid package to $2 trillion.