Equinor cuts floating wind costs by 40% in design revamp

Equinor will use new installation techniques, concrete substructures and a shared mooring design to slice costs at its ground-breaking Hywind Tampen floating wind project in Norway, Halvor Hoen Hersleth, Operations Manager at Hywind Tampen, told the Offshore and Floating Wind Europe 2019 conference.

Related Articles

Hywind Tampen, the world's first floating wind farm to supply oil and gas facilities, is set to spur cost reductions across the floating wind sector.

Developed by Equinor, Norway's state-owned oil and gas group, the 88 MW Hywind Tampen facility will be located 140 km from shore in water depths of 260 to 300 meters. Due online in 2022, the facility will supply 35% of the power needs of five platforms on the Snorre A and B and Gullfaks A, B and C licenses.

In October, Equinor and oil field partners agreed to build the project at a total cost of NOK5 billion ($545 million). Norwegian state fund Enova has agreed to fund NOK2.3 billion and Norway's NOX fund will provide NOK 566 million. Norway is increasing its support for floating wind, aiming to turn oil and gas expertise into renewable trade exports.

Hywind Tampen follows Equinor's 30 MW Hywind Scotland floating wind project in the UK, the world's first commercial-scale floating wind farm. Operational since October 2017, Hywind Scotland has collected over two years of operational data on five 6 MW Siemens direct drive turbines in water depths of 95 to 120 m.

Floating wind developers must reduce costs to become competitive and secure larger commercial projects. The cost of bottom-fixed offshore wind farms has plummeted and floating wind developers must demonstrate cost reductions and stable operations to lure investors.

Equinor will implement new installation methods and substructure designs to lower the cost of the Hywind Tampen project, Hersleth told the conference on November 12.

Equinor aims to reduce the cost of Hywind Tampen by 40% compared with Hywind Scotland, Hersleth said.

"We are now moving onto the cost reduction phase...Hywind Tampen is the next step in that journey," he said.

New methods

Floating wind developers are targeting deeper water sites, typically at depths of over 60 meters, where bottom-fixed designs are unsuitable. These deepwater sites could host some 4 TW of global offshore wind capacity, according to industry association WindEurope.

Developers are continuing to refine their designs and installation processes to reduce costs. For the early projects, developers are focusing on leaner designs that can be rapidly assembled and installed and towed to site for connection.

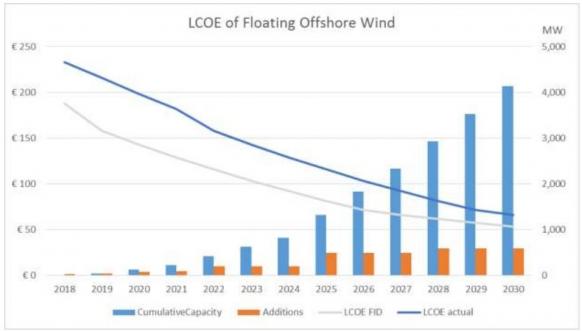

Europe floating wind cost forecast

(Click image to enlarge)

Source: WindEurope's Floating Offshore Wind Energy: a Policy Blueprint for Europe (October 2018)

In October, Equinor signed NOK 3.3 billion of supply contracts for Hywind Tampen. Germany's Siemens Gamesa will supply 11 of its 8 MW direct drive turbines while Norway's Kvaerner will design and build the substructures and lead onshore assembly, inshore marine operations and site connection. UK group JDR Cable Systems will supply the electrical cables and Norway's Subsea 7 will install the cables and connect up the wind facility to the oil platforms.

For Hywind Tampen, Equinor has "completely changed" the installation method used on Hywind Scotland, Hersleth told attendees.

On Hywind Scotland, Equinor used a large Saipem 7000 crane vessel to lift the fully-assembled turbines onto the substructures, in one action. The Saipem 7000 measures more than 200 meters in length and is equipped with two cranes capable of lifting up to 14,000 tons.

For Hywind Tampen, the partners will use a land-based ring crane to perform turbine installation, which offers an attractive day rate compared with the vessel-based method, Hersleth said.

"We will be stacking the tower one piece at a time, similar to what you do when you assemble onshore turbines," he said.

Equinor has also switched to a concrete substructure, Hersleth said.

"They are cheaper than the steel substructures we used on Hywind Scotland, and they also remove some of the complexity when it comes to the inshore marine operations," he said.

Hywind Tampen will also feature a simplified mooring system which uses shared suction anchors, reducing the number of anchors from 33 to 19.

Remote operations

Equinor will operate the Hywind Tampen facility and Siemens Gamesa has signed a five-year service agreement.

The floating structure will require a slightly larger subsea inspection scope than bottom-fixed projects and the remote location of Hywind Tampen brings some additional project challenges.

"You are looking at a mean significant wave height of 2.8 (m) which makes accessing the turbines extremely challenging," Hersleth said.

To mitigate safety risks, Equinor will use a walk to work (W2W) vessel to perform operations and maintenance, he said. W2W vessels use active heave compensated gangways to provide safer transfer to the offshore platform and Equinor will share the vessel with oil and gas operations.

A Service Operations Vessel (SOV) will be used for corrective maintenance of the wind farm and planned annual services, Hersleth said.

For major component replacement, the turbine will be towed to shore. Floating wind developers have yet to develop a cost-efficient on-site method for major component repairs.

The Hywind Tampen project was restricted to 11 turbines to avoid large modifications of the existing electrical infrastructure at the platforms, Hersleth said.

Gas plants will be integrated with the wind power system to provide backup power at short notice, for example when wind curtailments are triggered by hurricanes, he said.

Deeper savings

Small utility-scale projects like Hywind Tampen are allowing developers to improve designs and installation practices and increase investor confidence in floating wind technology.

In addition to oil and gas facilities, small-scale opportunities could include onshore industrial power supply, electrification of fishing and hydrogen production, Hersleth told the conference.

These applications could help developers secure projects, but much larger facilities will be required to implement deeper cost savings, Hersleth said.

Commercial projects of capacity 200 to 250 MW could be brought online by 2025 and these could reduce costs by a further 30%, he said. Equinor is reportedly planning to build a 200 MW floating wind farm off Spain's Canary Islands by around 2024.

"We generally believe that we need bigger, commercial projects-- 250 MW onwards," Hersleth said.

"It is only then we can properly show to everyone that we will be able to reduce the levelized cost of energy in a similar manner to what you see in the bottom-fixed industry," he said.

New Energy Update