Europe tariffs could hike turbine prices by 18%; US bottleneck threatens 2019 wind installs

Our pick of the latest wind power news you need to know.

Related Articles

European steel tariffs could raise turbine prices by 18%: WindEurope

New steel import restrictions agreed by European Union (EU) members January 16 could raise turbine prices by 18%, industry group WindEurope said.

EU members agreed to enforce a steel import quota at 5% above recent import volumes in 2019, rising by 5% each year until 2021. Volumes above this quota level would be subject to a 25% import tariff.

The measures are a direct response to metals tariffs imposed by the U.S. earlier this year. EU steel producers feared the U.S. tariffs would flood Europe with steel products no longer being imported into the U.S.

Steel makes up over half of the material used in wind turbine manufacturing and the tariffs would significantly damage European competitiveness, WindEurope warned in a statement.

"[A quota of] 5% is very low: we expect demand for steel in offshore wind alone to rise by 36% in 2019," Giles Dickson, CEO of WindEurope, said.

"Tariffs could add 18% to the price of turbines...it would put European turbine manufacturers at a disadvantage to Chinese competitors that source domestic steel at much lower prices," he said.

US to install 11 GW new wind capacity in 2019, 8 GW in 2020

The U.S. is forecast to install 10.9 GW wind capacity in 2019-- the highest level since 2012-- representing around a third of all new capacity additions, the Energy Information Administration (EIA) said in its latest Short-Term Energy Outlook. The wind installation forecast represents a 3 GW increase on the 2019 projection set out in EIA's 2018 Annual Energy Outlook.

More than half of the new wind capacity additions will be located in Texas, Iowa, or Illinois and most of the capacity will come online towards the end of the year, EIA said.

US forecast utility-scale power additions in 2019

In 2020, some 8 GW of wind capacity is scheduled to come online, EIA said. This forecast is somewhat lower than Wood Mackenzie Power and Renewables’ latest prediction of 12.9 GW in 2020.

The share of total U.S. generation from wind is projected to increase from 7% in 2018 to 9% in 2020, EIA said.

Some 4.3 GW of utility-scale solar power is scheduled to be connected to the grid in 2019 with a further 6 GW expected in 2020, EIA said. Around half of the new capacity in 2019 will be situated in Texas, California or North Carolina, it said.

EIA also expects an additional 3.9 GW of small-scale solar PV capacity to enter service by the end of 2019.

US wind industry facing supply bottlenecks in 2019-2020 surge

U.S. supply chain bottlenecks in 2019 and 2020 could lead to project cancellations and postponements, threatening $2.1 billion of industry revenue, Wood Mackenzie Power and Renewables said in a report published January 9.

Wood Mackenzie predicts 23 GW of new wind capacity will be installed in the next two years as developers race to meet production tax credit (PTC) deadlines.

Wind installations peak in the fourth quarter of the year, resulting in peak transportation periods in the third quarter of the year.

Growing turbine sizes are requiring more specialized transportation measures and demand from other industries will limit available capacity, Wood Mackenzie warned

Wind companies should collaborate to levelize shipments over a longer period, it said.

"Although the large players in the wind industry are preparing for rapid growth in 2019-2020, many have not anticipated the magnitude of these supply chain constraints and the losses they can cause," the consultancy said.

Industry participants should work together to create additional specialized trailer capacity, ensure sufficient qualified drivers and optimize the use of dedicated railcars, Wood Mackenzie said.

Placing forward equipment inventory could help reduce supply bottlenecks, it said.

"Q1 shipments must be more than doubled to minimize under-utilization of transportation equipment and alleviate potential bottlenecks in the third and fourth quarters," Wood Mackenzie said.

Global offshore wind spending climbs 14% as China ramps up activity

Global offshore wind investments rose 14% in 2018 to $25.7 billion, Bloomberg New Energy Finance (BNEF) said in a report published January 16. Offshore wind projects included 13 projects in China for a total of $11.4 billion.

“The balance of activity in offshore is tilting. Countries such as the U.K. and Germany pioneered this industry and will remain important, but China is taking over as the biggest market and new locations such as Taiwan and the U.S. East Coast are seeing strong interest from developers,” BNEF said.

Onshore wind investments rose by 2% last year to $100.8 billion, BNEF said.

The largest wind projects financed included Enel Green Power's 706 MW South Africa portfolio at an estimated cost of $1.4 billion, and Xcel's 600 MW Rush Creek wind farm in the U.S., a $1-billion project.

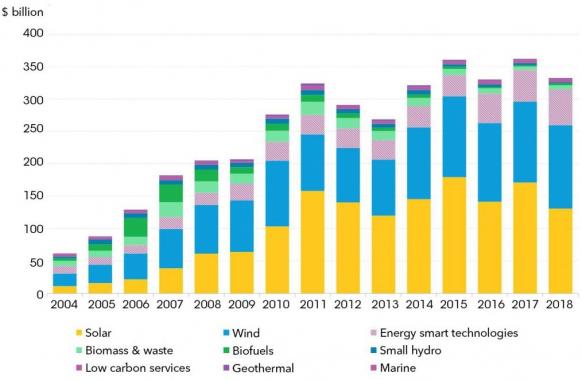

Global annual clean energy investments

(Click image to enlarge)

Source: Bloomberg New Energy Finance, January 2019.

Global solar investments fell 24% in 2018 to $130.8 billion as falling prices outweighed higher installation rates, BNEF said.

Chinese solar investment plunged 53% to $40.4 billion in 2018. China set new national limits on PV installations in May which dented new project installations in the second half of the year and exacerbated a global surplus of modules.

BNEF’s global PV cost benchmark fell 12% in 2018 as global manufacturers slashed selling prices in the face of a glut of modules.

“2018 was certainly a difficult year for many solar manufacturers, and for developers in China," Jenny Chase, Head of Solar Analysis at BNEF, said.

"However, we estimate that global PV installations increased from 99 GW in 2017 to approximately 109 GW in 2018, as other countries took advantage of the technology’s fiercely improved competitiveness,” Chase said.

New Energy Update