Floating wind developers focus on lean multiples as competition mounts

Floating wind developers are cutting design weight, maximizing onshore build capability and gaining lender support, but the jump to commercial arrays will require state-level measures, industry experts said.

Related Articles

On October 5, Shell, Innogy and Stiesdal Offshore Technologies (SOT) signed a cooperation agreement to build a demonstration floating wind project using SOT’s modular ‘TetraSpar’ foundation concept.

The three companies will invest a total of 18 million euros ($20.5 million) towards the construction of a demonstration plant at the Metcentre site in Norway.

Increasing competition between floating wind technologies is spurring design advancements as developers look to drive down costs.

Fixed-bottom offshore wind costs have plummeted but floating wind developers are chasing the much larger deepwater market. An estimated 80% of offshore wind resource, some 4 TW of capacity, is in water depths of over 60 meters, where fixed bottom designs are not suitable, according to industry group WindEurope.

Advances in floating wind technology are attracting support from multilateral lenders.

On October 19, the European Investment Bank (EIB) awarded a 60 million-euro loan to WindFloat Atlantic, a 25 MW project off Portugal's coast.

WindFloat Atlantic is being developed by WindPlus, a consortium owned by renewable developer EDP Renovaveis, oil and gas group Repsol and technology developer Principle Power. The project will also obtain a 29.9 million-euro loan from the EU's NER300 low-carbon energy demonstration program, and up to 6 million euros through the Portuguese Carbon Fund.

Gaining lender support represents a key step for the project, Kevin Banister, Head of Development at Principle Power, told New Energy Update.

“We've crossed some of the major hurdles...There is debt in the project, which is a demonstration of how lenders have been convinced that the performance will be as expected," he said.

However, developers will require regulatory and infrastructure support to bridge the gap from small-scale projects to competitive large-scale arrays.

WindEurope group last month called for “urgent" action from policymakers to remove development hurdles for floating wind.

The European Union (EU) should coordinate national schedules for floating offshore wind deployment to optimize supply chain buildout, provide funding instruments for low-cost financing and support research and development (R&D), WindEurope said in a policy statement.

"Europe should capitalize its first mover advantage. Floating offshore wind needs urgent action from the EU and Member States to maximize the local economic benefits of a nascent supply chain," it said.

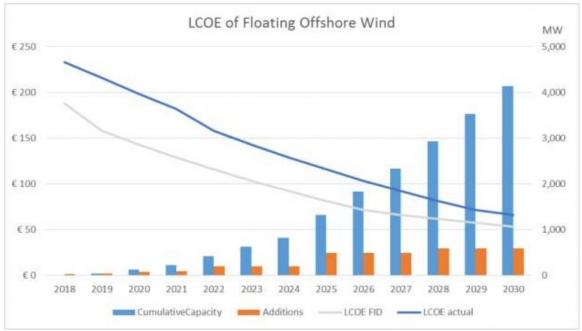

With appropriate support, floating offshore wind costs could drop to 80 to 100 euros per MWh for projects financed by 2025, and fall to 40 to 60 euros/MWh by 2030, WindEurope said.

Europe floating wind cost forecast

(Click image to enlarge)

Source: WindEurope's Floating Offshore Wind Energy: a Policy Blueprint for Europe (October 2018)

International effort

Shell's investment in the TetraSpar technology is the latest in a sequence of floating wind investments from oil and gas groups. Experts in offshore platform operations, oil and gas companies bring decades of vessel, supply chain and logistics learnings.

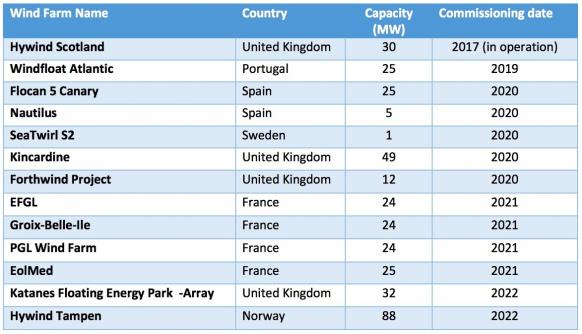

In October 2017, Norwegian oil and gas operator Statoil brought online the world's first commercial-scale floating plant in Scottish waters. The 30 MW Hywind Scotland floating wind consists of five 6 MW Siemens direct drive turbines deployed in water depths of 95 to 120 meters.

A further 12 pre-commercial floating offshore wind projects are scheduled to be commissioned in Europe by 2022, for a total capacity of 334 MW.

Pre-commercial floating wind projects due online by 2022

(Click image to enlarge)

Source: WindEurope's Floating Offshore Wind Energy: a Policy Blueprint for Europe (October 2018).

Japan and the U.S. West Coast are seen as two other significant markets for floating wind projects.

Last month, California unveiled its first offshore wind lease zones, calling for developers to submit information on nominations for commercial offshore wind leases in three designated deepwater areas off the California coast.

The three zones are situated off Morro Bay and Diabolo Canyon in central California and Humbolt Bay in Northern California, representing a total area of 687,823 acres.

California should look to install some 7 GW of offshore wind power, equivalent to 13% of the state’s electricity demand, Alla Weinstein, CEO of Castle Wind, developer of a 1 GW floating wind project off California’s central coast, told New Energy Update.

This capacity “is achievable and would increase opportunities for the [wider] U.S. offshore wind market,” Weinstein said.

New designs

SOT’s TetraSpar technology uses a modular concept with a tubular steel main structure with a suspended keel, to allow industrialized deployment.

The TetraSpar partners predict the concept will provide "leaner manufacturing, assembly and installation processes with lower material costs" than other floating concepts. The demonstration project will use a 3.6 MW Siemens Gamesa Renewable Energy (SGRE) direct drive offshore wind turbine and is due to be deployed in 2019 in water depths of some 200 m.

"These are exciting times. The floating offshore wind market is evolving but until now, floating foundations have been stubbornly expensive. This demonstration project will give us a better understanding of how the cost can be driven down," Hans Bunting, Chief Operating Officer Renewables of Innogy, said in a statement.

Growing expertise

Principle Power is continuing to improve its Windfloat design to prepare for large-scale commercial deployment.

Key design optimizations include lower steel requirements per MW installed, to minimize weight and materials costs, Banister told New Energy Update.

Rising turbine capacities are cutting offshore wind costs and floating developers will need to accommodate growing turbine dimensions to maximize efficiency gains.

The WindFloat Atlantic project will use the latest 8.4 MW MHI Vestas turbines, around four times the capacity used at WindFloat's prototype project five years ago, but will require only a "marginal” extra amount of steel, Banister said.

Onshore assembly and tow-to-shore operations and maintenance (O&M) methods will help to avoid the high cost of heavy lift offshore vessels, he added.

Principle Power's design has been proposed for a 150 MW-200 MW floating windfarm off California's northern coast. The project is being developed by a public-private consortium made up of Redwood Coast Energy Authority (RCEA), EDPR North America, Principle Power, Aker Solutions, H. T. Harvey & Associates and Herrera Environmental Consultants.

“One of the key reasons Principle Power’s WindFloat technology is a great fit is that we can bring components into the harbor, do fabrication and assembly in the harbor, and then tow the units out with conventional tugboats for final deployment,” Matthew Marshall, executive director of consortium partner Redwood Coast Energy Authority (RCEA), told New Energy Update.

In other industry innovations, Vestas and marine logistics group Maersk are jointly developing a "Vertical Installer" crane system to lower installation and logistics costs and remove the need for seabed-based jack-up vessels.

Vestas and Maersk are mainly targeting fixed bottom offshore turbines, but the solution could also be used for floating offshore wind farms, the companies said.

Barge designs

France-based floating wind developer Ideol has been working to improve industrialization and commercial development of its barge-type floating wind design.

Ideol recently connected to the grid France's first floating wind turbine and aims to build Japan's first commercial-scale floating project with partner Acacia Renewables. In September, the company was awarded a 2.5 million-euro grant from the EU to optimize installation and O&M and help strengthen commercial development.

Plant designs need to remain compact while being able to accommodate rising turbine capacities in the coming years, Geschier told New Energy Update last year.

“This not only has a massive impact on the materials’ cost but also on the cost of construction, launching, yard logistics and installation,” Geschier said.

Ideol has also been working with STX Europe Offshore Energy on a new modular substation design compatible with floating and fixed-bottom technologies.

Infrastructure gaps

The 2030 costs targets set by WindEurope will require significant infrastructure spending to support onshore industrialization.

The limitations of Europe's port infrastructure and insufficient vessel capacity could prove a significant hurdle to floating wind growth.

Only a few ports in Scotland, Norway and Spain are currently suitable for the development and operation of floating offshore wind farms, a study by LOC Renewables, WavEC and Cathie Associates for the U.K.'s Carbon Trust, said in September.

Quayside construction of large-scale floating wind farms requires ports to have large areas for component set down and production lines, and an area for wet storage of assembled units, the report said.

Without a plan to develop a network of equipped ports, floating offshore projects could suffer higher costs and longer project lead times, it warned.

New Energy Update