Focus on wind repairs could lead to lasting COVID-19 impact

Europe's wind operators are prioritizing reactive maintenance due to COVID-19 restrictions and sustained distancing measures could hurt future asset performance, experts told New Energy Update.

Related Articles

As COVID-19 restrictions disrupt supply chains and worker availability, wind operators are adapting processes to maximize asset availability.

National lockdowns have delayed new projects but existing wind farms must continue to operate to ensure security of supply. Factory closures have sliced power demand, increasing the share of wind power in the generation mix.

In most of Europe, only "essential" employees are allowed to work. This has prompted wind operators to focus on reactive turbine repairs and reduce scheduled, preventative maintenance activities.

Operators may be removing some items from servicing checklists and relying more on supervisory control and data acquisition (SCADA) data to monitor performance to save man hours, Robin Redfern, Partner at consultants Everoze Partners, told New Energy Update. Safety-critical inspections would remain a high priority, while asset-critical items such as lubrication checks would be favored over cleaning and inspection of peripheral components, Redfern said.

In Spain, where strict lockdowns stopped wind power manufacturing and severely curbed outside work, O&M workers have concentrated on corrective tasks and postponing many preventative maintenance tasks, Alberto Cena, Technical Advisor at the Spanish Wind Energy Association (AEE), said.

Key activities have included the replacement of Insulated Gate and Bipolar Transistors (IGBTs), electric switchgears and gearbox dismantling, typically requiring cranes, Cena said.

Vattenfall, an operator of onshore and offshore wind farms, has identified its key workers necessary “to maintain essential turbine operations and critical functions,” a spokesperson for the company told New Energy Update. Otherwise, staff have been working from home using remote technology to limit disruption.

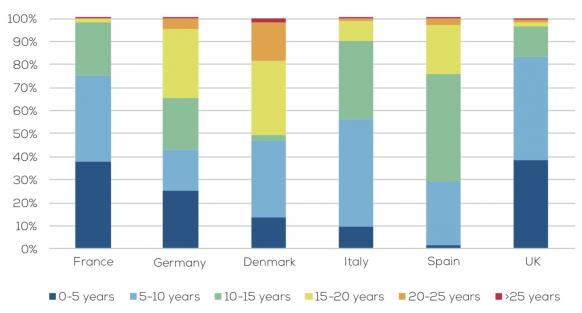

Wind turbine ages by country

(Click image to enlarge)

Source: WindEurope, August 2018.

Location and family responsibilities are also limiting the supply of workers, Frederick Keil, press officer for BWE, the German Wind Energy Association, said.

School closures have prevented some employees from leaving home while travel restrictions have curbed the transfer of staff across longer distances, Keil said.

With remote working at an all-time high, wind operators with advanced analytics and remote capabilities could have an advantage.

Operators are having to optimize their limited resources and new measures that balance safety against costs could have a lasting impact if waves of lockdowns or self-distancing are implemented in the coming years.

Safety first

UK health and safety group SafetyOn has published guidance for wind site workers to allow safe working practices during the pandemic. Many of these could be prolonged long after the crisis as a new normal of self-distancing sets in.

Employers should carry out risk assessments for local service teams and "strictly" limit the number of staff working together, the guidelines said.

When multiple teams are on site, working hours should be staggered and workers must be nominated tooling times and restricted to defined workspaces, it said.

“Persons should not share vehicles, where suitable distancing cannot be achieved," it said.

Service teams should avoid visiting service centres and equipment stores where possible, the guidelines said.

If required, tools and material collection should take place outdoors, it said.

According to SafetyOn, cleaning becomes part of the job. The first and last person to arrive at a turbine or substation should disinfect all frequently-touched surfaces, such as door handles and handrails, it said.

The stricter guidelines will increase costs and operators will need to find ways to become more efficient with on-site staff.

“Scheduled maintenance is typically covered under a fixed price arrangement," Redfern noted.

"Therefore, I expect any additional costs due to extra staffing or subsequent catch-up effort will either need to be swallowed by service providers or claimed through force majeure arrangements,” he said.

Spares supply

On April 20, leading turbine supplier Vestas announced it will lay off 400 employees by stopping technology projects and prioritizing deliveries in 2020 due to the COVID-19 pandemic.

Earlier this month, Vestas suspended its 2020 financial outlook due to ongoing coronavirus disruptions. Factory closures and travel restrictions have impacted Vestas' manufacturing, supply chain and installation activities, the company said.

"We’re in a period of high uncertainty and by making a strategic decision on our product portfolio and reduce complexity, we sustain our competitiveness in the future and ensure we can adjust quickly to COVID-19 challenges," Henrik Andersen, President and CEO of Vestas, said in a statement.

In Europe, wind factory closures have been confined to Spain and Italy, the two countries hardest-hit by the COVID outbreak. In Spain, Siemens Gamesa, Vestas, Nordex and GE Renewable Energy recently reopened 15 manufacturing facilities after a strict two-week lockdown was loosened April 13. Three factories in Italy owned by smaller suppliers remained closed as at April 22.

Vestas factories in China have returned to normal operation and the company will use this capacity where possible to mitigate challenges in other parts of the world, the company said.

Offshore exposure

Offshore O&M often involves larger teams to reduce vessel trips and this creates greater staffing challenges, Redfern said.

In northern Europe, the scheduled maintenance season has just begun, leaving operators little time to test new procedures.

Scheduled maintenance might typically include around four technicians, working in parallel and spread out across the tower, yaw deck, nacelle and other areas, Redfern said.

“Clearly this may be more problematic in the current climate due to social distancing requirements, so I wouldn’t be surprised if the team sizes reduce temporarily, whilst the number of days on each turbine may potentially increase accordingly," he said.

Leading offshore operator Orsted has split up its on-site teams to reduce the potential for infection and is allowing as many workers as possible to work from home, the company said March 25.

Orsted's installed offshore asset base remained fully operational at "normal availability rates" and construction projects were progressing according to plan, Henrik Poulsen, CEO, said.

"There is a risk that key suppliers get delayed and that our own personnel are constrained by the travel restrictions put in place in many countries, but so far we have been able to find solutions to the challenges," he said.

Prolonged international travel restrictions could hamper the manning of O&M vessels, Poulsen warned.

“This may over time impact the availability of our wind farms but we see no Covid-19 related impact on availability so far,” he said.

Long battle

Experts predict that many parts of Europe and the US will require lockdowns of varying severity for months and a second major COVID-19 spike in the winter would cause further pain.

Prolonged factory shutdowns and worker restrictions would make it harder for operators to avoid profit-sapping downtimes and higher costs, experts warn. Operators would be forced to delay more maintenance activities.

“The postponement of preventive maintenance could affect future operation of the plants if faults are not detected in advance," Cena noted.

Scheduled retrofits-- upgrading of minor components-- could also be delayed, depriving operators of the performance benefits of improved components, Redfern said.

Implementation of larger repowering projects would likely mirror the new build market, where project progress currently depends on regional lockdowns and supply chain availability, he added.

"I would expect the same to be true of repowering, especially if contractors are already mobilized for the work," he said.

Reporting by Neil Ford

Editing by Robin Sayles