Larger US wind farms gain cost advantage at 4 to 10 years, study shows

Larger wind projects can benefit from operations and maintenance (O&M) costs up to 60% lower than smaller facilities in the 4 to 10-year age period and economies of scale will become more widespread in the coming years, Mike McNulty, co-author of IHS Markit's new O&M cost report, told New Energy Update.

Related Articles

Falling wind power costs and increasing wholesale market exposure have placed increasing importance on operations and maintenance (O&M) efficiency. Operators are installing larger, higher efficiency turbines and driving up maintenance efficiency to lower costs over the full life of the project.

North American investment in wind O&M is set to soar in the coming years as fleet sizes grow and average turbine ages rise.

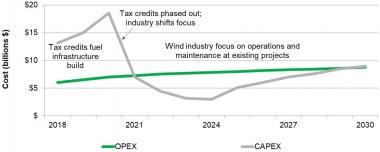

Annual investments in wind operations and maintenance (O&M) in U.S. and Canada will rise from a current level of $5 billion-$6 billion to $7.5 billion by 2021, eclipsing capex spending for the first time, IHS Markit said in a new report. The average wind turbine age will rise from seven years in 2018 to 14 years in 2030, it said.

North American wind opex vs capex

(Click image to enlarge)

Source: IHS Markit, September 2018.

IHS Markit’s analysis shows that growing project capacities are set to significantly impact O&M costs going forward.

Larger projects benefit from lower and more stable O&M costs than smaller facilities, most notably in the 4 to 10 year age period, McNulty told New Energy Update.

The rapid buildout of large-scale wind facilities in the U.S. Interior has been a key driver of lower costs and the benefits of scale are set to be compounded in the coming years.

The average capacity of U.S. wind farms rose from 34 MW in 2008-2017 to 72 MW in 2008-2017 and IHS Markit predicts capacities will double again in the next 10 years, McNulty said.

"Between 2018-2027 we expect the average project size for new projects to be greater than 150 MW….for the U.S. Interior we expect it to be over 200 MW," he said.

Big rewards

Installation and operations learnings have significantly reduced O&M costs during the first years of operations.

Year one O&M costs fell from an average of $46,000 per MW during 2008-2013, to $38,000 per MW from 2014 to 2017, IHS data shows.

As turbines age, O&M costs increase on average to as much as $58,000/MW annually. Direct costs rise sharply by the end of the first decade of operation, which is offset somewhat by declining indirect costs such as general site administration, business services, taxes and royalties, IHS Markit said. One quarter of turbine gearboxes and generators needed replacement within 10 years of operations, it noted.

It is around the middle of this first decade when economies of scale significantly reduce and stabilize O&M costs.

From years 4 to 10, O&M costs for projects greater than 100 MW of capacity are between 25% and 60% lower than similar-aged projects under 50 MW capacity, depending on site and project characteristics, McNulty told New Energy Update.

Larger projects are less impacted by single turbine failures and operators can use scale to optimize spare parts and labor strategies, McNulty said.

Larger projects are also often built in regions with a supportive wind industry, such as in the US Midwest, allowing operators to cluster local resources, he said.

As fleet sizes grow, operators are seeking greater control over spare parts procurement and the pooling of spare parts between operators is also on the rise.

Operators of larger plants and fleets can also gain greater yield from predictive maintenance technologies to increase energy availability and lower the cost per MWh.

The deployment of wind power analytics offers significant economies of scale, John Majewski, Vice President, Asset Management at Invenergy, told New Energy Update in April. Invenergy announced in February it would deploy NarrativeWave analytics across its U.S. wind fleet and assets in Canada and Poland to increase operational efficiency.

"It costs the same amount of money to run it on one turbine as 2,200 turbines. So there is a tremendous return to scale," Majewski said.

Interior engine

Rapid buildout in U.S. Interior regions has significantly reduced installation costs and led to knock-on benefits for O&M practices.

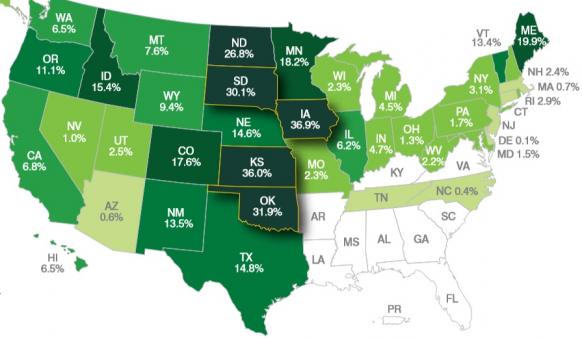

Wind energy share of US power generation in 2017

(Click image to enlarge)

Source: American Wind Energy Association (AWEA)

U.S. Interior wind power purchase agreement (PPA) prices fell below $20/MWh in 2017, on average, according to the Department of Energy's latest Wind Technologies Market Report, prepared by the Berkeley Lab.

Average installation costs in the U.S. interior fell from $2,069/kW in 2010 to to $1,531/kW in 2016. Developers in the U.S. Interior have benefited from more favorable wind resources, large expanses of flat developer-friendly land, and transportation access to growing regional manufacturing hubs, the U.S. Energy Information Administration (EIA) said in a research note in July.

This regional buildout has also hiked O&M efficiency as operators have leveraged local resources and knowledge, IHS Markit data shows.

Average O&M costs in the MISO, SPP, and ERCOT U.S. interior markets are 35% lower than costs in California's CAISO and 15% lower than costs in New York's NYISO, according to IHS Markit’s study.

Again, project size has been a key factor of plummeting costs in the U.S. Interior.

The average size of new installations in MISO, SPP, ERCOT between 2013-2017 was 125 MW, compared with 50 MW in CASIO and 25 MW in NYISO.

The U.S. Interior has become an increasingly important region for the U.S. wind industry, driving forward new construction and operations learnings. This region hosted 90% of new wind projects in 2016, up from 46% in 2010, EIA said in July.

U.S. Interior construction will continue to drive national activity in the coming years and support long-term growth in new installations, McNulty said.

IHS Markit predicts the removal of the federal production tax credit [PTC] by 2020 will prompt a dip in wind capex spending but steadily improving full-life economics will support longer term wind growth in the mid-to late 2020s.

"We think in the long run there will be a recovery in the market...The technology is close to being where it needs to be to be competitive on its own," McNulty said.

"The U.S. Interior shows how O&M costs are not a significant barrier for wind power development once local industries have matured," he said.

New Energy Update