Orsted, Statoil to reveal offshore storage potential from early 2018

UK offshore battery projects set to be commissioned by Orsted and Statoil in early 2018 will generate valuable data on the revenue streams and right-sizing of energy storage installations, project directors told New Energy Update.

Related Articles

In June, Orsted-- formerly known as Dong Energy-- announced plans to integrate a 2 MWh ABB battery energy storage solution (BESS) at its operational 90 MW Burbo Bank wind farm in Liverpool Bay, England.

The Burbo Bank project will be the world's first offshore wind farm with storage to provide frequency response services to an electricity grid. The battery is being installed next to the onshore substation and will be used to help the UK National Grid maintain the required grid frequency at around 50 Hz.

Orsted, the world’s leading offshore wind farm developer, currently operates eight wind farm assets in UK waters and has a further four under construction. The Danish company aims to achieve a global installed offshore wind capacity of 11 to 12 GW by 2025.

Battery installation is expected to be completed by the end of 2017, James Sun, Senior Lead Asset Business Developer at Orsted’s Wind Power division, told New Energy Update.

"There will be some time needed to fully install, integrate and then commission the unit for operation sometime in Q1 2018," Sun said. Orsted is following standard compliance procedures to update its connection agreement and is currently discussing with National Grid the exact test requirements prior to commissioning, he said.

Another pioneering wind plus storage project is underway in Scottish waters, where Norwegian oil and gas major Statoil is developing the 1 MWh Batwind pilot storage solution at its 30 MW Hywind Scotland floating wind farm.

The Batwind project is supported by a Memorandum of Understanding (MoU) signed by Statoil, the Scottish Government and Offshore Renewable Energy (ORE) Catapult in March 2016. Under the MoU, Statoil will work alongside Scottish industry and universities to propagate and fund innovation in BESS through a development program managed by ORE Catapult and Scottish Enterprise.

Batwind is expected to be online by Q2 2018 and will provide valuable data on the commercial potential for offshore wind farm developers, Hilde Strom, Batwind Project Manager, Statoil, told New Energy Update.

Monetizing storage

Rapid falls in battery costs, combined with an increasing focus on grid reliability to accommodate rising renewable energy capacity, are opening up new business opportunities for integrated storage projects.

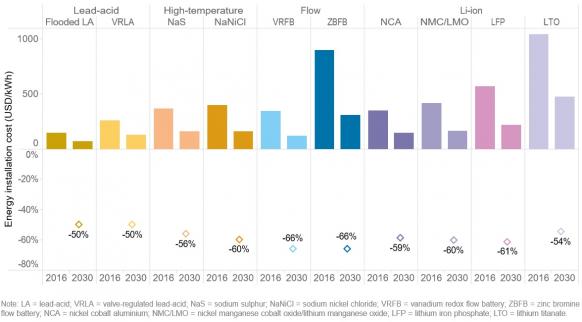

Battery costs could fall by as much as 66% by 2030, according to a recent report by the International Renewable Energy Agency.

Market regulators are gradually implementing frameworks that support wider use of storage technology. In the UK, the government and energy market regulator OFGEM published the ‘Smart Systems and Flexibility Plan,’ aiming to reduce the barriers to energy storage deployment. Key features include the introduction of a new licence for electricity storage and plans to amend the Energy Act 1989 to define storage as a distinct subset of generation.

“The Plan puts electricity storage at the heart of our future energy system,” industry group Electricity Storage Network, said in a statement.

Such regulatory advancements are creating potential business cases for offshore wind with storage, Strom told New Energy Update.

“In markets like the UK and U.S. where storage is becoming a license to operate, where frame conditions are emerging, Statoil will certainly consider battery storage integration to our assets,” she said.

Statoil owns 751 MW of operational offshore wind capacity and has a 50% stake in the 385 MW Arkona project under construction in Germany. In September, the company signed a joint venture partnership with Scottish & Southern Energy (SSE) to develop three 1.2 GW offshore wind projects consented at the UK's Dogger Bank, and the company has major expansion plans in the U.S.

As the value of flexible generation rises, this will support a range of income generation models for storage projects, including "in front of the meter" grid balancing services and developer-led behind-the-meter solutions which maximize wholesale market revenues.

First response

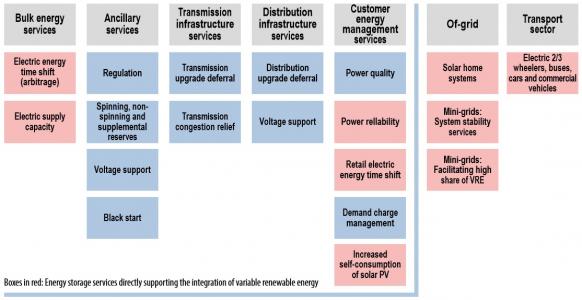

Orsted's Burbo Bank battery installation is a "first step" towards an effective participation of offshore wind in ancillary grid services, Sun said.

The UK’s National Grid has recognised that the current markets for ancillary services such as frequency response, reactive power, and black start were designed for traditional thermal plant in mind, Sun noted.

"[National Grid] has committed to reforming these markets over the coming years to remove barriers to participation by newer technologies such as renewables, and we are actively engaged with this reform process,” he said.

Frequency response will be the main application trialed but Orsted is “open to trialing other use cases as and when the right opportunity arises,” Sun said.

Services offered by electricity storage

(Click image to enlarge)

Source: International Renewable Energy Agency (October 2017)

Statoil’s Batwind project will allow the company to analyze multiple strategies for monetizing energy storage dispatchability and assess when the increased capital expenditure (capex) required to integrate battery storage becomes commercially attractive, Strom said.

Potential business models include the capture of wind overshoots to sell excess generation on the wholesale market at later periods, reduction of balancing costs by self-regulation of power supply, capture of wholesale power price peaks through arbitrage, as well as system services such as frequency regulation, she said.

“We may not be able to test all these value drivers, but this is the aim.”

Market placement

The incentive to co-locate or develop hybrid wind and storage projects will rise as wind subsidies are rolled back and projects are more exposed to wholesale market risks, Oliver Kerr, Associate at Aurora Energy Research, told New Energy Update.

Lower battery costs will be key to wider deployment, Kerr noted. Aurora predicts the installation cost for a 1 MWh battery will fall from 426 pounds per kWh ($564.2/kWh) to 333 pounds/kWh by 2025.

IRENA predicts significant cost reductions across all battery types in the coming decade, as the below chart shows.

Forecast Lithium ion battery costs

(Click image to enlarge)

Source: International Renewable Energy Agency (October 2017)

Under current conditions, batteries with one hour of capacity are often the most investable size for energy arbitrage, Kerr said.

“Operators could deploy longer-duration batteries to soak up more excess power generation, it really depends on how much balancing they plan to do but balancing can be achieved with a relatively small battery,” he said.

Business models must also take into account that turbine innovations have enabled greater flexibility of wind generation without energy storage assets, Kerr noted.

"Today’s turbines can adjust output, so you could actually avoid some imbalance costs and participate in markets like frequency response and the [generation] Capacity Market without co-locating with batteries,” he said.

Stacking value

A 2016 study by the Carbon Trust and Imperial College found that the commercial viability of storage increases when used across multiple services.

UK power market authorities are supporting this approach of layering value propositions, so that operators can monetize the value of their flexibility while technologies improve.

“This means maximizing access to the existing range of markets, alongside new markets or revenue streams and being able to stack value across them wherever appropriate,” the government’s ‘Smart Systems and Flexibility Plan’ said.

This strategy is helping to steer early applications of offshore wind with storage.

For example, Statoil has selected a battery size for Batwind which allows it to test and stack revenue streams without increasing the cost of the battery significantly, Strom said.

“We also aim to learn how to optimize the battery size in relation to the size of the wind farm to have a good business case,” she said.

By Kerry Chamberlain