Shell’s US offshore wind entrance set to cut fixed, floating project costs

Shell’s two East Coast lease wins will allow the oil and gas operator to implement offshore learnings and financing power in the rapidly-expanding U.S. offshore wind market.

Related Articles

In December, Shell marked its entrance into the U.S. offshore wind market by winning two development lease auctions on the East Coast.

On December 14, Mayflower Wind, a 50:50 joint venture by Shell New Energies and EDPR, was awarded a lease to develop offshore wind projects in Massachusetts. The lease area covers 127,388 acres and could host up to 1.6 GW of capacity. Norwegian oil and gas group Equinor also won a lease for a 128,811-acre site and Vineyard Wind was allocated a 132,370-acre lease area.

A week later, Shell New Energies and EDF created a new 50-50 joint venture to develop a lease area in New Jersey waters. The lease area covers 183,353 acres and could host around 2.5 GW of offshore wind capacity, according to the companies.

Shell and its partners will now initiate formal development efforts at the Massachusetts and New Jersey sites and aim to commission the first wind farms in these blocks by the mid-2020s, the companies said.

Shell's move into the U.S. offshore wind sector shows how falling costs and improving policy frameworks are attracting new investors.

Shell is already a partner in the Dutch 680 MW Borssele 3&4 offshore wind project and the group sees offshore wind as its biggest growth opportunity for renewable energy, Shell told New Energy Update.

Larger, higher efficiency turbines will allow offshore wind to deliver power generation at "competitive costs,” a Shell spokesperson said.

Major oil groups like Shell and Equinor are bringing a range of offshore expertise and financial power to offshore wind projects. As the U.S. offshore market matures, these groups are set to significantly impact the cost of fixed bottom projects as well as floating wind technologies.

Europe first

The U.S. offshore wind market will benefit from cost reductions gained in the more mature European market. Higher capacity turbines, economies of scale and installation learnings have sliced costs in Europe and some projects are set to be built without subsidy.

Falling costs in Europe have boosted confidence in the U.S. market and spurred support from policymakers, Chris Hart, Head of U.S. offshore wind at EDF Renewables North America, told New Energy Update.

"Several states, including New Jersey, Massachusetts, New York and Maryland, have adopted new policies or strengthened existing policies to encourage the development of offshore wind energy,” he noted.

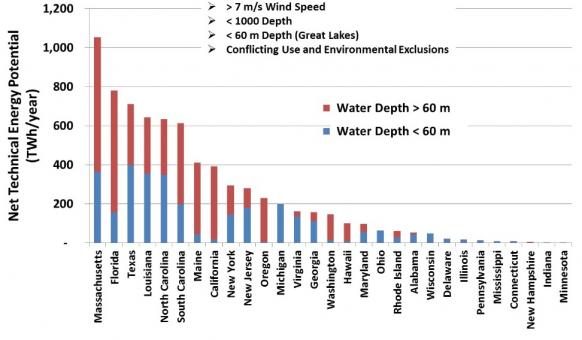

Technical offshore wind capacity by state

(Click image to enlarge)

Source: US Department of Energy (DOE), 2016.

Orsted, the largest offshore wind developer by capacity, recently acquired 100% of U.S. developer Deepwater Wind at a price of $510 million. Orsted will merge Deepwater's 3.3 GW U.S. offshore wind portfolio with its own 5.5 GW of potential projects, creating the largest U.S. offshore wind pipeline of any developer.

In Europe, project efficiency gains, supportive funding markets, and growing demand from corporate customers will continue to support low offshore wind prices.

In November, the UK government set maximum offshore wind prices of 56 pounds/MWh (63.9 euros/MWh, $73.1/MWh) and 53 pounds/MWh for projects to be commissioned in 2023/24 and 2024/25.

The UK price cap includes offshore transmission costs and confirms zero-subsidy or market-comparable prices are being achieved in all of Europe’s main offshore markets.

Subsidy-free offshore wind projects could soon be a reality in U.S. states with relatively-low wholesale prices, such as Massachusetts and New York, leading offshore developers told the 2018 U.S. Offshore Wind conference last June.

"I can clearly see the potential for being subsidy-free in the U.S. in the next couple of years," Gunnar Groebler, Senior Vice President, Business Area Wind at Vattenfall, a leading European offshore wind developer, said.

Offshore experts

Shell will bring decades of experience in developing and operating large-scale offshore projects to the offshore wind market.

Oil and gas groups boast expertise in health and safety, vessel logistics, installation efficiency and operations and maintenance (O&M) practices.

Oil and gas operators can also draw from long-running supply and service partnerships to increase project efficiency, Jim Lanard, CEO of U.S. offshore wind developer Magellan Wind, told New Energy Update in 2017.

"Oil and Gas has very strong Approved Vendor Lists (AVLs) and established supply-chains, a massive play for big Oil and Gas will be bringing over that supply chain which all offshore wind will benefit from,” he said.

Last summer, Equinor and power group E.ON performed the fastest ever installation of offshore wind turbines for their 360 MW Arkona wind farm project in the German Baltic Sea. Construction was completed within three months, including loading, weather-led downtimes and technical maintenance.

Shell can also draw from its existing onshore U.S. wind business. Shell entered the US onshore wind sector in 2001 and has five operational onshore wind projects in North America and a wholesale energy trading business.

Floating future

Shell is currently focusing its U.S. offshore activities on the north-east coast, but will look at other options going forward, the company told New Energy Update.

Shell and fellow oil and gas group Equinor both see floating wind technology as a major future growth area. Fixed bottom designs are unsuitable for water depths of over 60 meters and some 4 TW of wind capacity lies in these depths, according to industry group WindEurope.

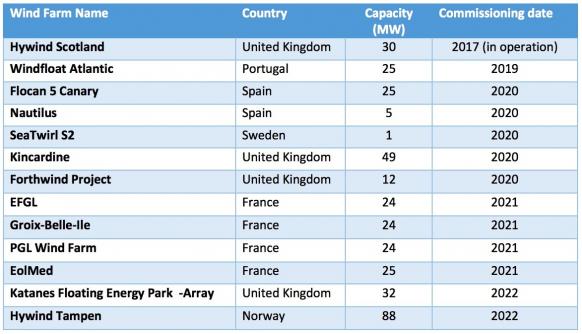

In October 2017, Equinor brought online the world's first commercial-scale floating wind farm in Scottish waters. The 30 MW Hywind Scotland floating wind farm consists of five 6 MW Siemens direct drive turbines deployed in water depths of 95 to 120 meters.

Pre-commercial floating wind projects due online by 2022

(Click image to enlarge)

Source: WindEurope's Floating Offshore Wind Energy: a Policy Blueprint for Europe (October 2018).

EDPR, Shell's partner in Massachusetts, is aiming to build the US's first floating offshore wind farm off the deep water coast of Northern California. EDPR and consortium partners Redwood Coast Energy Authority (RCEA), Principle Power, Aker Solutions, H. T. Harvey & Associates and Herrera Environmental Consultants aim to build a wind farm of capacity 150-200 MW by 2025.

Other West Coast projects include Castle Wind, a joint venture between Trident Winds and German power group EnBW, which has announced plans to build a 1 GW floating wind project in Morro Bay, California.

Floating wind developers are continuing to improve the design and construction methods for floating wind projects. Costs are expected to fall sharply in the coming years and Shell believes its offshore oil experience could make it a leader in the floating wind market, the company told New Energy Update.

Shell, power group Innogy and Stiesdal Offshore Technologies (SOT) recently signed a cooperation agreement to build a demonstration floating wind project using SOT’s modular ‘TetraSpar’ foundation concept.

The three companies aim to install a 3.6 MW Siemens Gamesa Renewable Energy (SGRE) turbine in water depths of 200 m in 2019.

"These are exciting times. The floating offshore wind market is evolving but until now, floating foundations have been stubbornly expensive. This demonstration project will give us a better understanding of how the cost can be driven down," Hans Bunting, Chief Operating Officer Renewables of Innogy, said.

By Neil Ford