Trump import tariffs could hike wind costs by 10%; Orsted buys US offshore pioneer Deepwater Wind

Our pick of the latest wind power news you need to know.

Related Articles

US import tariffs could raise wind costs by 10%

U.S. tariffs on steel and Chinese imports could raise wind power costs by up to 10%, Tom Kiernan, CEO of the American Wind Energy Association (AWEA), said at a conference in New York on October 2, Bloomberg reported.

The projections were supported by executives from leading turbine manufacturers Vestas, General Electric and Siemens Gamesa, the report said.

Current U.S. wind activity is being boosted by federal production tax credits (PTCs) which are being scaled down annually.

Some 5.3 GW of new U.S. wind farm projects started construction during the second quarter of 2018, raising total wind construction activity to a record level of 19.0 GW, the American Wind Energy Association (AWEA) said in August. An additional 3.9 GW of new U.S. wind power capacity entered advanced development, bringing the total capacity in this phase to 18.8 GW, AWEA said. In the advanced development phase, projects have achieved a major milestone such as placing a turbine order or procuring a power purchaser.

Import tariffs could disrupt this growth, Scott Stalica, general manager for North America equipment sales at General Electric’s renewable energy unit, told the conference.

“Whether we want to admit it nor not, there’s certainly disruption going on in the market right now,” Stalica said.

“There’s a sense of urgency to get projects built. I expect that things will temper,” he said.

US wind quarterly build, development

(Click image to enlarge)

Source: American Wind Energy Association (AWEA)

The U.S. installed 626 MW wind capacity in the second quarter of 2018, raising total installed wind capacity to over 90 GW.

In January, the U.S. Energy Information Administration (EIA) predicted installed wind capacity will rise by 8.3 GW in 2018 and push annual wind generation above hydroelectric output for the first time. Installed wind capacity is expected to rise by a further 8.0 GW in 2019, EIA said in its Annual Energy Outlook.

Orsted buys US offshore developer Deepwater Wind amid growth surge

Leading global offshore wind developer Orsted has acquired 100% of U.S. offshore wind developer Deepwater Wind from owner D.E. Shaw Group at a price of $510 million, Orsted announced October 8.

Denmark's Orsted is expanding its U.S. operations to capitalize on new growth markets after aggressive expansion in Europe.

Orsted will merge Deepwater Wind's 3.3 GW U.S. offshore wind portfolio with its own 5.5 GW of potential projects, creating the largest U.S. offshore wind pipeline of any developer, it said.

"With this transaction we’re creating the number one offshore wind platform in North America, merging the best of two worlds: Deepwater Wind’s longstanding expertise in originating, developing and permitting offshore wind projects in the U.S., and Orsted’s unparalleled track-record in engineering, constructing, and operating large-scale offshore wind farms," Martin Neubert, CEO of Offshore Wind at Orsted, said.

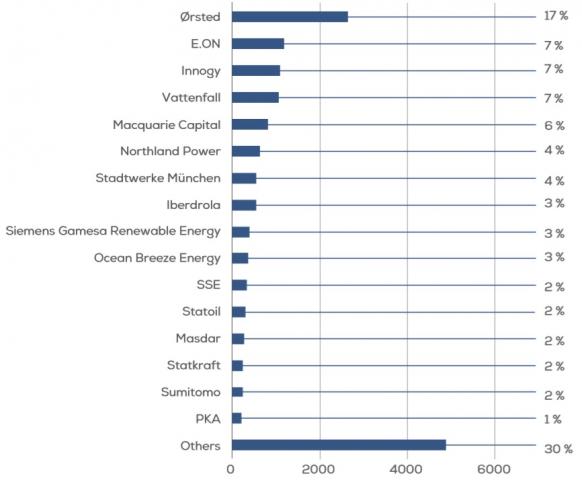

Owners' share of installed offshore capacity (cumulative, end 2017)

(Click image to enlarge)

Source: WindEurope

Deepwater Wind commissioned the U.S.' first commercial offshore wind farm off Rhode Island in December 2016. The 30 MW Block Island project is comprised of five 6 MW turbines manufactured by General Electric (formerly Alstom Wind Power).

Deepwater Wind also has long-term revenue contracts in place or pending finalization for three offshore wind projects in Rhode Island, Connecticut, Maryland and New York for a total capacity of 810 MW. The group is also developing projects in three federal lease areas in Massachusetts and Delaware for a potential capacity of 2.5 GW.

Orsted’s 5.5 GW U.S. offshore wind portfolio includes development rights for up to 2 GW in Massachusetts and 3.5 GW in New Jersey. Orsted also has exclusive rights with Dominion Energy to discuss the potential development of up to 2 GW of offshore wind capacity in Virginia and will construct two 6 MW wind turbine positions for phase one of Dominion Energy’s Coastal Virginia Offshore Wind Project.

“Deepwater Wind has done a fantastic job as a first-mover in U.S. offshore wind, and I look forward to joining and integrating the two US organizations," Thomas Brostrom, CEO of Orsted U.S. Offshore Wind and President of Orsted North America, said.

"We have exciting times ahead of us delivering large-scale clean energy projects to households and businesses along the Eastern Seaboard. Orsted will maintain a strong presence in Massachusetts and Rhode Island and will, of course honor the local commitments associated with Deepwater Wind’s projects along the East Coast,“ Brostrom said.

In August, Orsted agreed to buy 100% of U.S. onshore wind farm developer Lincoln Clean Energy (LCE) to gain a foothold in the onshore wind market. LCE’s portfolio comprises of 513 MW of recently commissioned wind capacity, 300 MW under construction, and a 1.5 GW development pipeline.

“We see this as a very valuable addition to building a long-term platform for growth in the U.S. market, across technologies,” Henrik Poulsen, CEO of Orsted," reportedly told journalists.

Osted has also established an office in Austin, Texas to develop battery storage and solar projects.

In Asia, Orsted was recently awarded two offshore wind projects in Taiwan's first offshore wind tender for a total capacity of 900 MW. The Danish group also has exclusivity rights over a potential further 1.5 GW of offshore capacity in Taiwan.

Port investments could cut offshore wind capex by 5.3%: industry group

Investments of 0.5-1 billion euros ($0.6-1.1 billion) in new European port infrastructure could cut total offshore capex costs by up to 5.5 billion euros, or 5.3%, by 2030, according to the WindEurope Ports Platform association. The figures are based on 30 GW of new offshore wind capacity by 2030.

In order to support growth, investments of up to 1 billion euros are required to build new infrastructure and upgrade, redesign and adapt existing facilities, WindEurope said in a statement.

These investments would integrate specialized vessels to speed up installation and help build out operations and maintenance (O&M) hubs, it said.

"New port facilities are also needed to facilitate operations for the annual decommissioning of 750 MW of capacity and annually recycling more than 600 turbines that have reached end of life between now and 2030," WindEurope said.

Limitations of Europe's port infrastructure and insufficient vessel capacity could inflate the cost of floating offshore wind projects, a new study commissioned for the UK's Carbon Trust said last month.

Only a few ports in Scotland, Norway and Spain are currently suitable for the development and operation of floating offshore wind farms, the study by LOC Renewables, WavEC and Cathie Associates, said.

Quayside construction of large-scale floating wind farms requires ports to have large areas for component set down and production lines, and an area for wet storage of assembled units, the report said.

Without a plan to develop a network of equipped ports, floating offshore projects could suffer higher costs and longer project lead times, it warned.

“Ports are continuously deploying new innovations. They adapt their infrastructure to cater for ever larger components, multifunctional vessels and an increased number of activities," Wim Stubbe, business development manager at Belgium's Port of Oostende and chair of the WindEurope Ports Platform, said in a statement.

"The WindEurope Ports Platform provides an opportunity to exchange best practices...We need to work together to prepare for future markets such as the decommissioning of offshore wind farms," Stubbe said.

European Union urged to fast-track floating wind support

The European Union (EU) should coordinate national schedules for floating offshore wind deployment to optimize supply chain buildout, provide funding instruments for low-cost financing and support research and development (R&D), industry group WindEurope said in a policy statement published October 3.

Floating offshore wind costs could reach 80 to 100 euros per MWh ($91.8-114.8/MWh) for projects reaching final investment decision (FID) between 2023 and 2025, WindEurope said in a new policy report. By 2030, costs could fall to 40 to 60 euros/MWh, it said.

"European companies are the pioneers as they lead three quarters of the 50 plus floating offshore wind projects at different stages of development worldwide today," WindEurope said.

"Europe should capitalize its first mover advantage. Floating offshore wind needs urgent action from the EU and Member States to maximize the local economic benefits of a nascent supply chain," it said.

New Energy Update