Turbine suppliers invest in multi-brand services as competition mounts

Wind turbine suppliers are investing in supply chain solutions and combining new technologies with data advantages to win service contracts for third-party turbines, leading suppliers told the Wind Operations Dallas 2019 conference.

Related Articles

As intense price competition squeezes margins, turbine suppliers are targeting a greater share of the growing operations and maintenance (O&M) market.

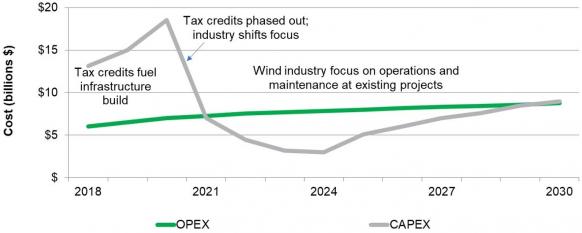

Annual investments in wind operations and maintenance (O&M) in U.S. and Canada will rise from a current level of $5 billion-$6 billion to $7.5 billion by 2021, eclipsing capex spending for the first time, IHS Markit said in a report published in 2018.

O&M providers are using economies of scale, improved spare parts strategies and the latest sensor and data analytics technologies to reduce costs.

Rising turbine capacities are also reducing maintenance costs and widening the range of operational technology. The number of turbine models installed in the U.S. rose from around 100 in 2010 to 146 in 2018.

Original Equipment Manufacturers (OEMs) are now focusing on multi-brand service contracts to increase their share of the O&M market, leading OEM groups told the conference in Dallas on April 16.

OEMs are expanding data and supply chain capabilities and widening training programs to accommodate multiple turbine brands, the groups said.

"Multi-brand is a key focus for our customers," Marco Molina, Americas Services Sales Director at GE Renewable Energy, said.

"We are in the process over the past year of listening, developing and shaping responses to work in that arena," he said.

Maintenance focus

Falling capital costs have increased the importance of wind O&M and boosted competition in the services sector.

Global prices for initial full-service contracts fell from an average $26,400/MW/year in 2016 to $18,100/MW/yr in 2018, according to the BloombergNEF (BNEF) Wind O&M Pricing Index. In some markets, contracts are trading at far lower levels, BNEF data shows.

In the O&M market, OEMs compete against independent service providers (ISPs) and operators' in-house O&M teams.

New speciality O&M suppliers are also emerging, focusing services on certain major components such as gearboxes, generators or blades, Oliver Metcalfe, wind power analyst at BloombergNEF (BNEF), told the Wind O&M EU 2019 conference in February.

The emergence of these firms allows asset managers to sign a lower cost O&M contract and call on the specialist maintenance groups to perform major component work when necessary, Metcalfe noted.

"This means that if you are an asset manager, you can optimize your operations and maintenance strategy according to your desired level of risk," he said.

Forecast North American wind opex vs capex

(Click image to enlarge)

Source: IHS Markit, September 2018.

OEM service providers benefit from growing global databases of learnings from deployed assets. Combined with data analytics, this enables them to maximize gains from preventative and predictive maintenance.

Leading suppliers are also investing in advanced automation and robotics technologies and solutions which remove crane requirements.

New technologies such as thermal imaging blade inspection equipment are providing valuable insights, Denver Bane, Onshore Wind Services Strategy Leader at GE Renewable Energy, told the Dallas conference.

Machine learning can be used to process the images and provide a report to customers within 24 to 48 hours which shows which blades have anomalies and provides recommended remedies, Bane said.

"This technology is incredible...it allows you to inspect blades that are actually running... With that thermal capability we can see subsurface and surface anomalies," he said.

Going forward, GE aims to use advanced sensors and automation to develop prognostics for all failure modes, Bane said.

"In the next one to five years you are going to see turbines coming online with more sensors and capabilities in that regard than ever before and we are going to have better analytics and machine learning to make sense of that data stream," he said.

Supply challenge

OEMs must implement efficient processes to procure third-party turbine parts to minimize downtimes for multi-brand services, Darnell Walker, CEO Services Americas at Siemens Gamesa Renewable Energy, said.

"Supply chain is one of the key issues that we have had to deal with," Darnell said.

Siemens Gamesa currently maintains 900 turbines supplied by other manufacturers, including some U.S. assets. The contracts represent over 1 GW of global installed capacity.

On April 4, Siemens Gamesa signed its first full-scope multi-brand service contract for the 34 MW Lukaszow and 24 MW Modlikowice wind farms in western Poland. The wind farms comprise of 29 Vestas V90 wind turbines which have been operational since 2012.

Siemens Gamesa will provide O&M services for 23 years, guaranteeing the life of the turbines for a total of 30 years.

The technical engineering of third-party turbine components has been less of a challenge than expected, but expansion into new regions requires efficient local sourcing processes, Darnell told the conference.

"The thing that we felt that we have to really get honed in on is locally sourcing parts...[so that] we get those manufactured by local people in the region that we service," he said.

Training up

OEMs are also expanding repair capabilities to reduce downtimes and widen O&M opportunities.

In one example, GE has invested in training and tooling for gearbox repairs at its Wind Energy Learning Center in Niskayuna, NY, Molina said.

"We have a dedicated team- a repairs engineering team. They are partnered with the product line and they are constantly working to develop expanded capabilities in that space," he said.

Going forward, suppliers will need to pursue a diversified approach to services, incorporating hybrid plant technologies as well as multiple wind turbine models, Michael Petersen, Director of Services, Canada & Eastern USA at Siemens Gamesa Renewable Energy, said.

Wind technicians may need to develop competencies in solar and battery systems, he noted.

Hybrid wind, PV and storage plants are on the rise as owners look to maximize returns and mitigate intermittency amid growing wind and solar capacity.

In February, Portland General Electric (PGE) and NextEra Energy Resources agreed to a build 380 MW wind-solar-storage plant in Oregon.

The Wheatridge Renewable Energy Facility will be the largest 'hybrid' renewable plant in the U.S., incorporating 300 MW of wind capacity, 50 MW of PV solar and 30 MW of battery storage. GE Renewable Energy will supply 120 wind turbines to the project.

New technologies should help accelerate the learning process and widen the expertise of technicians.

Augmented reality combined with handheld devices can provide detailed real-time guidance for turbine repairs, accelerating complex tasks and increasing technicians' learning curves, Bane told the conference.

"Instead of taking five to 10 years for a technician to gain the [necessary] experience, we could see technicians productive after one or two years using tools like these," he said.

New Energy Update