US offshore CEOs call for East Coast supply hubs to beat competition

The U.S. offshore sector must create regional East Coast supply chains and public-private initiatives that accelerate training and port investments to ensure long-term competitiveness, leading developers told the U.S. Offshore Wind 2019 Conference.

Related Articles

New Jersey's decision last week to select Orsted’s giant 1.1 GW Ocean Wind project for its first large-scale facility highlights the rapid growth taking place in the U.S. offshore wind sector.

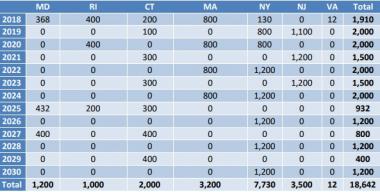

The 800 MW Vineyard Wind 1 and 2 project in Massachusetts will dominate installation activity in 2020-22 but deployment will rapidly spread to other states. By 2023, annual U.S. offshore installations are forecast to hike to 1.8 GW and remain between 1.2 GW and 2.2 GW between 2024 and 2030, according to BloombergNEF (BNEF).

European offshore wind specialists have flocked to the emerging U.S. offshore wind market, partnering with U.S. firms to gain a competitive edge.

European project learnings have sliced prices and boosted demand for U.S. projects. Contracted U.S. offshore wind capacity is forecast to rise to around 4 GW by the end of 2019, the University of Delaware said in a recent report. A further 5.5 GW of new capacity is expected to be procured in 2020-2022, followed by 6.4 GW in 2022-2025, it said.

Forecast US offshore wind contracts by state

(Click image to enlarge)

Source: University of Delaware's Special Initiative on Offshore Wind, March 2019

Growing demand from state authorities and utilities is supporting the development of a U.S. offshore wind supply chain but challenges remain, leading developers told the conference in Boston on June 10.

To become competitive, the U.S. offshore wind sector must take a wider regional approach to supply chain buildout and work with U.S. institutions to create hiring and port infrastructure solutions, developers said.

Hiring challenge

The Vineyard Wind project, co-owned by Avangrid Renewables and Copenhagen Infrastructure Partners represents the U.S.' first large-scale offshore wind project and is made up of two 400 MW units.

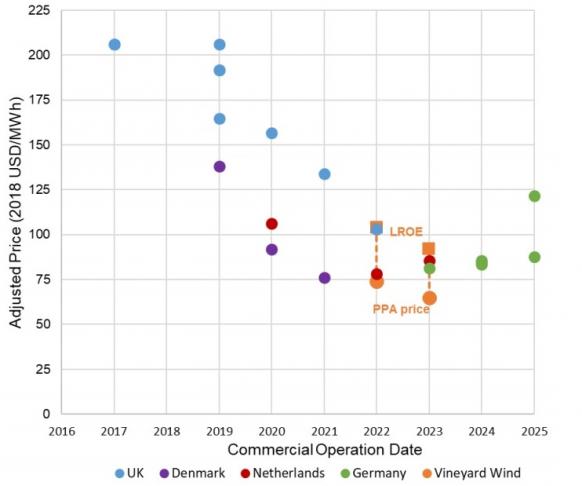

In July 2018, the project partners secured 20-year power purchase agreements (PPAs) with Massachusetts electric distribution companies (EDCs) at starting prices of $74/MWh for unit 1 and $65/MWh for unit 2. Taking into account tax credits and additional revenue streams, the levelized revenue of energy (LROE) for the entire project is estimated at $98/MWh, competitive with some European projects despite the lack of local infrastructure, the U.S. National Renewable Energy Laboratory (NREL) said in a report.

Adjusted prices of Vineyard Wind vs European offshore projects

(Click image to enlarge)

Source: NREL report: The Vineyard Wind Power Purchase Agreement: Insights for Estimating Costs of U.S. Offshore Wind Projects (February 2019)

The Vineyard Wind project will install 9.5 MW MHI Vestas turbines, the largest capacity turbines currently available on the market. Turbine capacities are continuing to rise as developers seek to boost revenue and reduce the levelized cost of energy (LCOE).

MHI Vestas opened its first U.S. office in Boston this month and the company is planning to hire around 40 technical staff in the U.S. ahead of turbine installation in 2021, Philippe Kavafyan, CEO, MHI Vestas, told the conference.

"We are gearing up...The first challenge is to ramp up and bring up to speed with the right training, the technicians we will need to drive the construction phase and the services phase of this project," Kavafyan said.

Training will be conducted at European projects this year, he said.

The strong U.S. labor market is creating hiring challenges and offshore operators will need to work with colleges, unions, and state and federal governments to implement efficient training programs, John Hartnett, CEO of Mayflower Wind, a joint venture by Shell and EDP Renewables, told attendees.

"Finding staff for our companies in the front end development and execution phases is extremely challenging-- there is competition within the industry as well as competition across all industries," Hartnett said.

Regional hubs

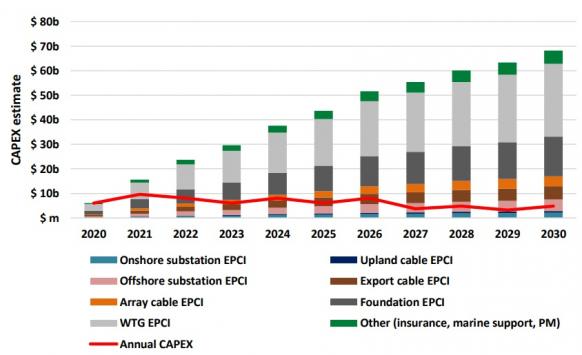

A growing pipeline of large-scale offshore wind projects will support supply chain investments along the U.S. East Coast. The value of the U.S. offshore wind supply chain is forecast to hit $68 billion by 2030, the University of Delaware said in its report.

"The question is what are the first elements," Lars Thaaning Pedersen, CEO of Vineyard Wind, said.

"It could be blades, it could be towers, it could be some of the heavy steel manufacturing which will be well suited to be domesticated here in the U.S.," Pedersen said.

Value of US offshore wind supply chain

(Click image to enlarge)

Source: University of Delaware's Special Initiative on Offshore Wind, March 2019.

The U.S. offshore wind industry will be able to localize content most efficiently through a regional approach to supply, rather than state-by-state requirements, developers and market experts told the conference.

Experience in Asia and Europe has shown that mandating local content requirements can hike project prices, Tom Harries, Senior Associate, Offshore Wind at BNEF, warned.

France and Taiwan imposed strict local content requirements for offshore wind and have produced the most expensive projects, Harries said.

"As soon as Taiwan removed local content requirements, prices halved," he said.

Going forward, the U.S. supply chain could produce turbines specifically designed for local wind conditions, Jason Folsom, U.S. National Sales Director at MHI Vestas, said.

Turbines could be designed to optimize lower wind conditions, reducing costs and increasing output at sites in Southern U.S. regions and the Great Lakes, Folsom said.

"Turbines that we sell today were built for North Sea operating environments...the only way that we are going to make the industry ours in the U.S. is if we take that further," he said.

Port hunt

The U.S. East Coast will require significant investments in port infrastructure in order to minimize offshore wind project costs, developers told the conference.

"Port infrastructure is one of the key challenges for this industry and for the states to solve," Pedersen said.

Last October, Vineyard Wind signed an 18-month lease at a new port facility in Bedford, Massachusetts to perform turbine staging from 2020.

The installation of 20 GW of U.S. offshore wind capacity by 2030 would require 10 such facilities, Pedersen noted.

"Either we have to develop quite a few of those or we have to develop much larger facilities," he said.

To ensure long-term competitiveness, U.S. East Coast developers will need one or two regional ports that can efficiently serve offshore wind projects, Christer af Geijerstam, President, Equinor Wind U.S., said.

"What we are really looking for is large areas, good bearing capacities, no bridges and deep draughts... It's hard to find places that tick all those boxes," Geijerstam said.

Port improvements will require collaborative investment measures between public and private groups, to minimize the impact on project pricing, he said.

EPC shift

The pricing on the Vineyard wind project sets a bullish benchmark for U.S. offshore wind and the project will be closely watched by the market.

Developers in the U.S. must adapt to local market conditions, such as the Jones act, which requires freight shipped within U.S. waters to be transported only by vessels built, owned and operated by U.S. citizens.

Vineyard Wind has adapted its Engineering, Procurement and Construction (EPC) procurement according to U.S. market needs, implementing a hybrid procurement model which combines aspects of a multi-contract arrangement with full wrap, Morten Hjortkjaer, Head of Supply Chain Management, Procurement and Contract Management, Vineyard Wind, told the conference.

"We had a lot of engagement with the market, with the industry players, especially around how we solve the Jones act, how we get the equipment out there," Hjortkjaer said.

"We started out having control of the logistics ourselves, but in some areas we have decided to wrap that into an EPC," he said.

The current limitations of the U.S. supply chain is set to impact contract pricing on the first wave of offshore wind projects.

Vineyard Wind took into account some "additional elements" when budgeting for the EPC, Hjortkjaer said.

"There is a difference between building a project in Europe where there have been many projects built over the last many years, where the factories are there... the people are there," he said.

Despite this, the Vineyard Wind PPA price was lower than many analysts expected and local supply chain buildout could see the U.S. offshore wind market match the world-leading prices set by Europe.

New Energy Update