US steel tariffs could raise wind power costs by 5%; GE launches world’s largest offshore turbine

Our pick of the latest wind power news you need to know.

Related Articles

US steel imports could raise wind, solar project costs by up to 5%

New tariffs on U.S. steel imports could increase the levelized cost of energy (LCOE) of new U.S. renewable plants by up to 5% and dent growth, according to a research note published by GTM Research, MAKE Consulting and Wood Mackenzie on March 12.

"Section 232" tariffs on imported raw and semi-finished steel and aluminium, approved by President Trump March 1, impose a 25% penalty on steel imports and 10% levy on aluminium imports.

"As steel and aluminium are found in critical wind, solar and energy storage components, cost increases will likely trickle into the renewables value chain," the consultancies said.

"The resulting price increase in commodities could potentially result in a 3% to 5% increase in the levelized cost of energy for U.S. renewable power plants, leading to slightly lowered forecasts for project deployments or slightly lowered project returns," the groups said.

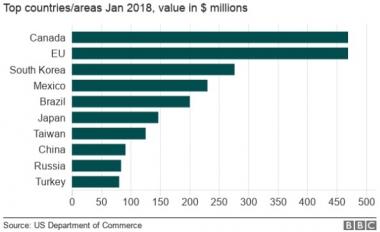

Main steel suppliers to US

(Click image to enlarge)

Exclusions on finished goods and notable geographic exemptions for Mexico and Canada may blunt the overall project cost impact, the consultancies said.

GE launches world's largest turbine in offshore market push

GE Renewable Energy has launched a 12 MW offshore wind turbine, representing the largest capacity turbine in the market to date.

The Haliade-X will be delivered to projects from 2021 and GE will invest $400 million in engineering, testing and supply chain development over the next three to five years, GE said March 1.

The launch of the new turbine comes as offshore developers continue to seek economies of scale and series to drive down costs. Larger, higher efficiency turbines and growing installation experience have had a dramatic impact on offshore wind costs, producing record-low tender prices across Europe.

Europe installed a record 3.1 GW of new offshore wind capacity in 2017 and the average capacity of newly-installed turbines was 5.9 GW, up by 23% year-on-year, industry group Windeurope said February 6.

Last year, Orsted became the first offshore wind farm developer to install 8 MW turbines and the Danish company has predicted turbines of capacity 13 to 15 MW will be on the market by 2024.

GE's Haliade-X has an estimated capacity factor of 63%, which the company says is five to seven percentage points above the current industry benchmark.

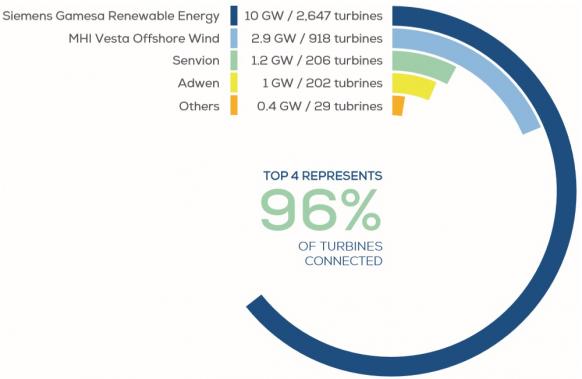

The launch of the Haliade-X shows GE intends to gain a larger foothold in the offshore wind market, where it has fallen behind other leading suppliers.

Offshore: Turbine suppliers' share of installed capacity

Cumulative, end 2017

(Click image to enlarge)

Source: WindEurope (February 2018).

"The Haliade-X shows GE's commitment to the offshore wind segment and will set a new benchmark for cost of electricity, thus driving more offshore growth," Jerome Pecresse, President and CEO of GE Renewable Energy, said.

GE aims to supply its first demonstration Haliade-X nacelle in 2019 and ship the first commercial units in 2021.

RWE to acquire E.ON renewables assets to become green power leader

Germany's E.ON and RWE announced February 12 an asset swap deal which will see E.ON take a controlling stake in Innogy and RWE acquire E.ON's renewable energy business.

E.ON currently operates around 5.3 GW of renewable generation capacity and has a strong presence in Europe and U.S.

E.ON will acquire RWE’s 76.8% stake in Innogy, allowing E.ON to focus on intelligent networks and customer solutions to become "an innovative force behind the energy transition in Europe," the companies said.

RWE's acquisition of E.ON.'s renewable energy assets will make it Europe's third-largest renewable energy company and the second-largest wind power group.

"This opens up attractive growth prospects, with a concrete project pipeline in Europe and the U.S.," the firms said.

RWE will also receive minority stakes held by E.ON’s subsidiary PreussenElektra in the RWE-operated power plants Emsland and Gundremmingen, as well as Innogy’s gas storage assets and its participation in the Austrian energy utility Kelag.

"RWE will become a broadly diversified power producer optimally complementing a large portfolio of renewables assets with its conventional energy generation and linking the two with its existing trading platform," it said.

The transaction will also see RWE take a 16.7% stake in E.ON.

E.ON expects annual synergies of between 600 and 800 million euros by 2022 and predicts the deal will lead to up to 5,000 jobs losses from the 70,000 jobs currently at E.ON group.

At the same time, E.ON expects to create "thousands of new jobs" in the coming decade, it said.

"This strategic exchange of businesses will create two highly focused companies that will shape a better future for Europe’s energy landscape. Each company will have a stronger entrepreneurial core," Johannes Teyssen, CEO of E.ON, said.

"The new E.ON will be able to intensify its efforts towards climate protection, for example through the faster roll-out of charging networks for e-mobility or the advancement and extension of smart grids in Europe. In turn, our renewables platform will become part of a stronger joint entity within RWE,” Teyssen said.

"The expansion of CO2-free electricity generation will increasingly evolve from a regulated sector to a normal competitive market," Rolf Martin Schmitz, CEO of RWE, said.

"Significant size is crucial for success in this future-orientated business," he said.

The voluntary public takeover offer period for the deal is expected to start in May 2018 and the transaction is expected to close by the end of 2019.

Until the transaction completes, E.ON, RWE and Innogy will remain separate businesses and competitors.

New Energy Update