US wind operations spending to eclipse capex by 2021; US Interior wind prices fall below $20/MWh

Our pick of the latest wind power news you need to know.

Related Articles

North America wind operations spending to eclipse capex by 2021

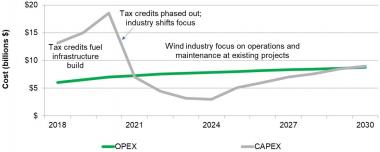

Annual investments in wind operations and maintenance (O&M) in U.S. and Canada will rise to $7.5 billion by 2021, eclipsing capex spending for the first time, IHS Markit said in a new report.

Annual wind O&M spending is forecast to rise from a current level of $5 billion-$6 billion, to over $8.3 billion by 2027, as operators maintain ageing turbines and growing fleets.

The average age of North American wind turbines will rise from seven years in 2018 to 14 years in 2030 according to IHS Markit data.

North American wind opex vs capex

(Click image to enlarge)

Source: IHS Markit, September 2018.

There are more than 50,000 utility scale wind turbines installed in 42 U.S. states and 12 Canadian provinces, representing some 100 GW of power capacity. IHS Markit predicts 70,000 turbines will be installed by 2028, providing over 150 GW of capacity.

The strongest growth in new wind installations will come in the next few years, as developers take advantage of production tax credits (PTCs). Extended in 2016, the 10-year PTC support drops by 20% annually with zero support from 2020. Wind installation growth will decelerate following removal of the credits but opex will continue to grow, IHS Markit said.

“The transition from CAPEX to OPEX is significant, and the wind industry will need to shift its focus away from infrastructure build and toward providing services and minimizing costs at existing projects,” Maxwell Cohen, associate director at IHS Markit and co-author of the report, said.

Operators are continuing to improve maintenance practices and O&M costs are 25% lower for new wind farms installed since 2010, IHS Markit noted.

The IHS Markit study sources data from around 34 GW of North American wind capacity, around a third of the installed asset base. The data includes over 150,000 turbine years of operational history from more than 15 turbine suppliers.

US Interior wind purchase contracts fall below $20/MWh

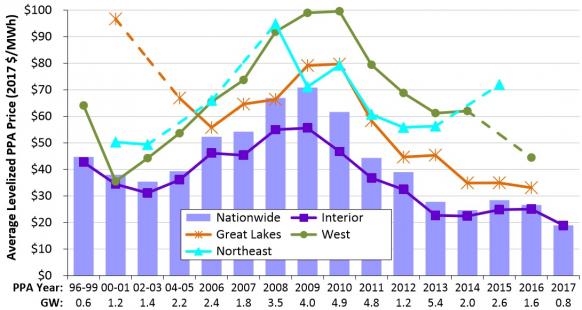

U.S. Interior wind power purchase agreement (PPA) prices fell below $20/MWh in 2017, on average, according to the Department of Energy's latest Wind Technologies Market Report, prepared by the Berkeley Lab.

Utilities have been the largest purchasers of wind power, but corporate contracts are on the rise as costs fall and companies seek to meet renewable energy targets.

PPA prices have largely followed turbine price trends, rising between 2003 and 2009 and falling since then.

Generation-weighted average PPA prices

(Click image to enlarge)

Source: Wind Technologies Market Report

Across the U.S., wind developers have continued to leverage turbine advances to reduce costs.

The US installed 7.0 GW of new wind capacity in 2017 and repowered 2.1 GW of capacity as developers sought to lock in Production Tax Credit (PTC) support.

The average rated (nameplate) capacity of newly installed U.S. wind turbines rose by 8% in 2017 to 2.32 MW, while the average rotor diameter rose by 4% to 113 meters.

A large number of wind projects continue to employ multiple turbine configurations from a single supplier, taking advantage of growing expertise in wake control and overall site optimization, the DOE's report said.

Nearly a quarter of larger wind power projects built in 2016 and 2017 used turbines with multiple hub heights, rotor diameters or capacities, it said.

Future projects will deploy progressively taller turbines with 35% of applications in early 2018 seeking approval for heights over 500 feet, according to data from the Federal Aviation Administration.

In the repowering market, most projects in 2017 involved upgrades to the rotor diameters and major nacelle components to increase production and lifespans. The turbines had been in service for between 9 and 14 years.

"Larger rotors were installed on all of these repowered turbines, with an average increase of 12 meters, while only 10% saw increases in rated capacity," the report said.

Utility-backed fund raises $681 million for advanced energy technologies

Energy Impact Partners (EIP), an investment group backed by global utilities, has raised $681 million to invest in cutting-edge energy technology companies, the company announced September 5.

The new investment capital includes $531 million in capital from its utility-backed Flagship Fund and access to up to $150 million in debt from the U.S. Small Business Administration (SBA) for EIP's credit platform, it said

EIP's utility partners include Southern Company, National Grid, Xcel Energy, Ameren, Great Plains Energy, Fortis, AGL, Avista, MGE Energy Inc., TEPCO, PTT, OGE Energy, TransCanada, and Alliant Energy.

EIP has already invested over $200 million in advanced energy technology companies including Advanced Microgrid Solutions, Arcadia Power, AutoGrid, BHI Energy, Cimcon Lighting, Clevest, Dragos, ecobee, Enchanted Rock, FirstFuel, Greenlots, Mosaic, Opus One Solutions, Powerphase, Sense, Sparkfund, Tendril, and Urbint.

EIP's priority investment sectors have included electric vehicle charging technology, behind-the-meter storage, cyber security and Internet of Things applications.

Mining groups to seek out wind, solar contracts as costs fall: Fitch

Mining companies will increasingly turn to wind and solar power in the coming years, attracted by lower costs and environmental targets, Fitch Solutions said September 7.

Most mining companies continue to rely on fossil fuel-based grid power or off grid diesel units. Falling costs and an increasingly-favourable regulatory environment will see more miners seek out wind and solar contracts, particularly in the Americas where companies can benefit from existing renewables infrastructure and carbon pricing mechanisms, Fitch said.

Falling costs will be the main driver of demand from mining companies. Energy costs currently account for approximately 30% of miners' balance sheet costs, according to some estimates.

"We expect this [%] to increase over the coming years as ore reserves are depleted, forcing companies to adopt more energy-intensive mining methods," Fitch said.

"In an environment where miners will remain committed to keeping costs down, the use of renewables offers significant cost-reduction potential," it said.

Mining installed renewable energy capacity, by type

Source: Fitch, Energy and Mines

Renewables also offer a reliable source of electricity to mining sites, allowing companies to reduce local political and regulatory risks.

"For instance, Zambia's overdependence on hydropower resulted in a tariff dispute between the government and the country's key copper miners last year that led to power outages and production stoppages at Glencore's Mopani Mines, one of the country's largest," Fitch said.

Following the 2015 Paris Climate Change Pact, mining hubs have implemented measures to progressively reduce emissions, incentivizing mining companies to shift towards renewables.

"For instance, in Chile and Canada, the introduction of carbon pricing schemes, at $5/tonne and $10/tonne, respectively, is pushing miners to increasingly consider ways of limiting their carbon exposure as a core strategic objective and attracting interest in renewables investments," Fitch said.

Electric vehicle and consumer electronics companies will become increasingly valuable customers for mining companies and this will further increase the pressure to reduce the environmental impact of mining projects, it said.

In one example, Apple and top aluminium producers Rio Tinto and Alcoa recently announced plans to invest in carbon-free aluminium production through Elysis, a new joint-venture. Together with the Canadian and Quebec governments, the companies will invest C$188 million ($142.7 million) in the new business.

New Energy Update